Silver Price Analysis: Sellers attack 12-day-old support line

- Silver prices stay depressed near the key support line.

- Bearish MACD favor sellers eyeing break of immediate support, 100-bar SMA adds to the downside filters.

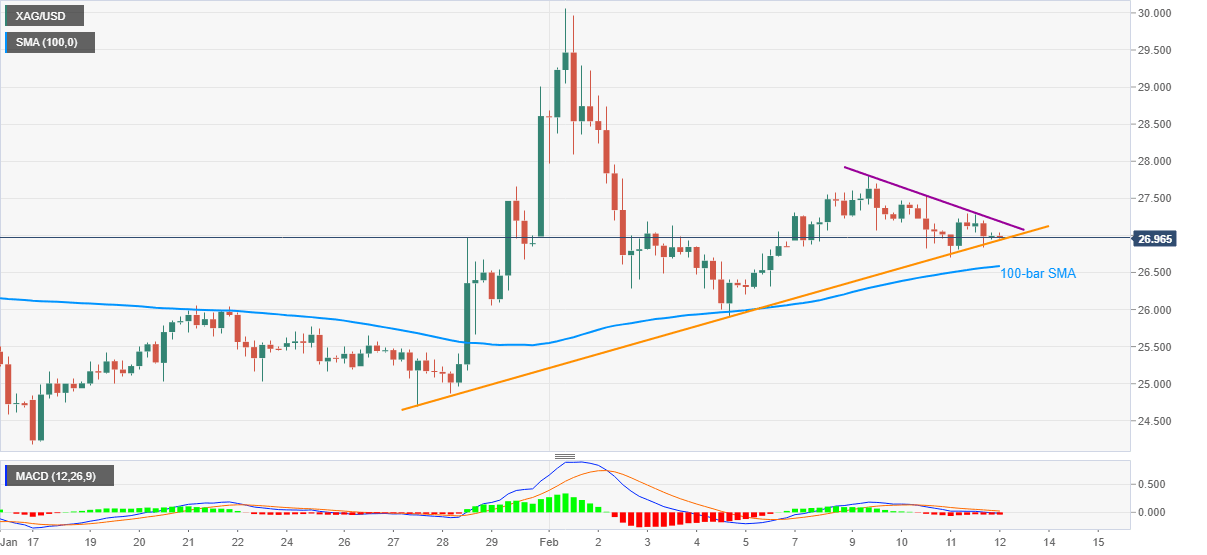

Silver sellers flirt with the $27.00 during Friday’s Asian session. The white metal has been pressured since Wednesday, as portrayed by an immediate falling trend line.

However, an upward sloping trend line from January 27, currently around $26.95, probes the metal bears.

Considering the bearish MACD and repeated failures to cross the nearby resistance line, silver is likely to break below the immediate support line. Though, a 100-bar SMA level of $26.58 may test the bullion bears afterward.

In a case where the white metal’s selling continues past-$26.58, February 04 low near $25.90 and the late January lows near $24.70 can return to the charts.

Meanwhile, an upside clearance of the adjacent resistance line, at $27.20 now, could trigger a fresh run-up targeting the weekly top surrounding $27.80.

Although silver buyers are likely to struggle below the $28.00, a break of which might not hesitate to refresh the monthly peak of $30.06.

Silver four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.