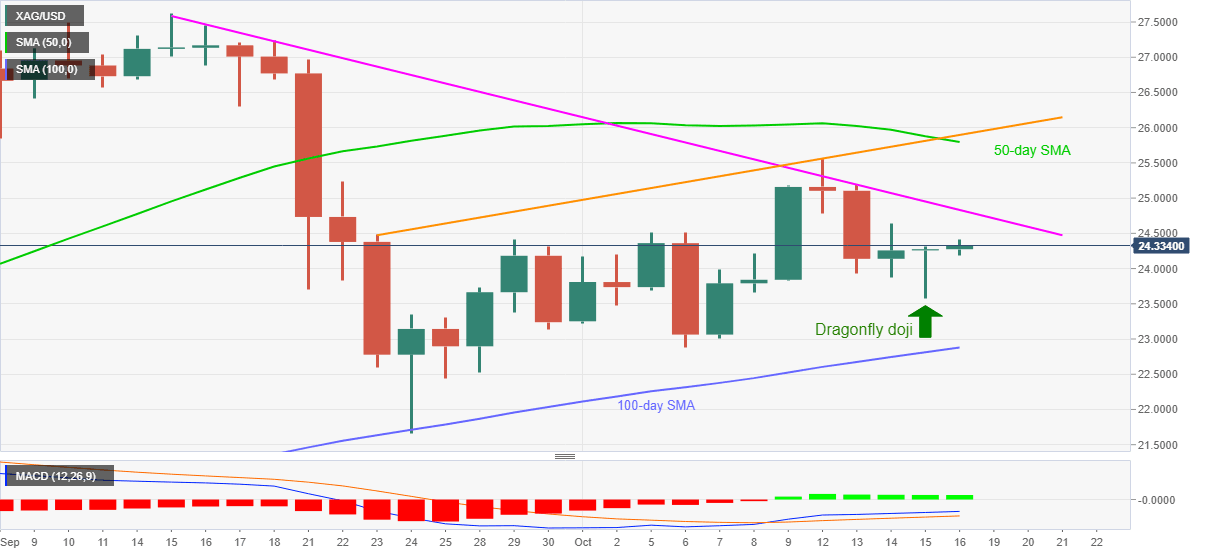

Silver Price Analysis: Mildly bid above $24.00 after Thursday’s Dragonfly doji

- Silver probes intraday high of $24.41 after posting a bullish candlestick on D1 the previous day.

- Sustained trading below 1.5-month-old falling trend line favors the sellers.

- 50-day SMA and a three-week-old rising line add to the upside barrier.

Silver prices keep recovery moves, portrayed during Thursday’s US session, while rising from $24.33 to $24.34 during Friday’s Asian trading.

In doing so, the white metal respects the Dagonfly Doji, bullish candlestick, formation on the daily (D1) chart for the previous day while also cheering bullish MACD. On the contrary, the bears can be hopeful while watching a downward sloping trend line from September 01.

As a result, silver sellers can only likely to retake controls if successfully breaking the $24.00 round-figure ahead of visiting the confluence of 100-day SMA and the monthly low near $22.85/90.

Additionally, the $23.60 and the $23.00 may act as buffers during the fall that can attack the September month’s low of $21.65 on the downside break of $22.85 support.

On the flip side, a six-week-old resistance line near $24.65 offers immediate resistance to the bullion buyers before directing them to the monthly high of $25.56.

However, no further advances can be expected beyond $25.56 unless the quote manages to cross the 50-day SMA level of $25.80, followed by a successful clearance of an ascending trend line from September 23, at $25.90.

Silver daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.