Silver bears taking up the baton towards a 50% mean reversion target

- The white metal under pressure on Monday despite the drop in the greenback and weakness in US stocks.

- DXY ended lower by nearly 0.6% in a slide from 91.7460 to a fresh six-week low of 91.0340.

DXY breached a significant daily support structure, despite a firmer bid in US yields.

Despite the equity weakness, the US 10-year yield rose 2.8bps to 1.608%.

However, improved risk sentiment last week as shown by the rally in global stocks to record highs has continued to weigh on both the greenback

Precious metals were unable to collect investor’s interest and XAG/USD was closing down some 0.5%. The gold to silver ratio also rallied over 0.2%.

However, there was a good move in industrial metals, so silver could find itself playing catch up in the forthcoming sessions.

Both copper and iron ore rallied on the day and the commodity complex, in general, was better bid despite markets being on the defensive in the main.

Copper was hitting a seven-week high amid prospects of strong demand.

''Recent robust economic data in China and the US has boosted optimism that demand will continue to recover following the pandemic-induced slowdown last year. The market has also been buoyed by the infrastructure spending program US President Biden is looking to implement,'' analysts at ANZ Bank explained.

Also worth noting, the MSCI's emerging market currency index hit its highest level in a month. Top emerging markets tend to have positive correlations to commodities and the price of silver.

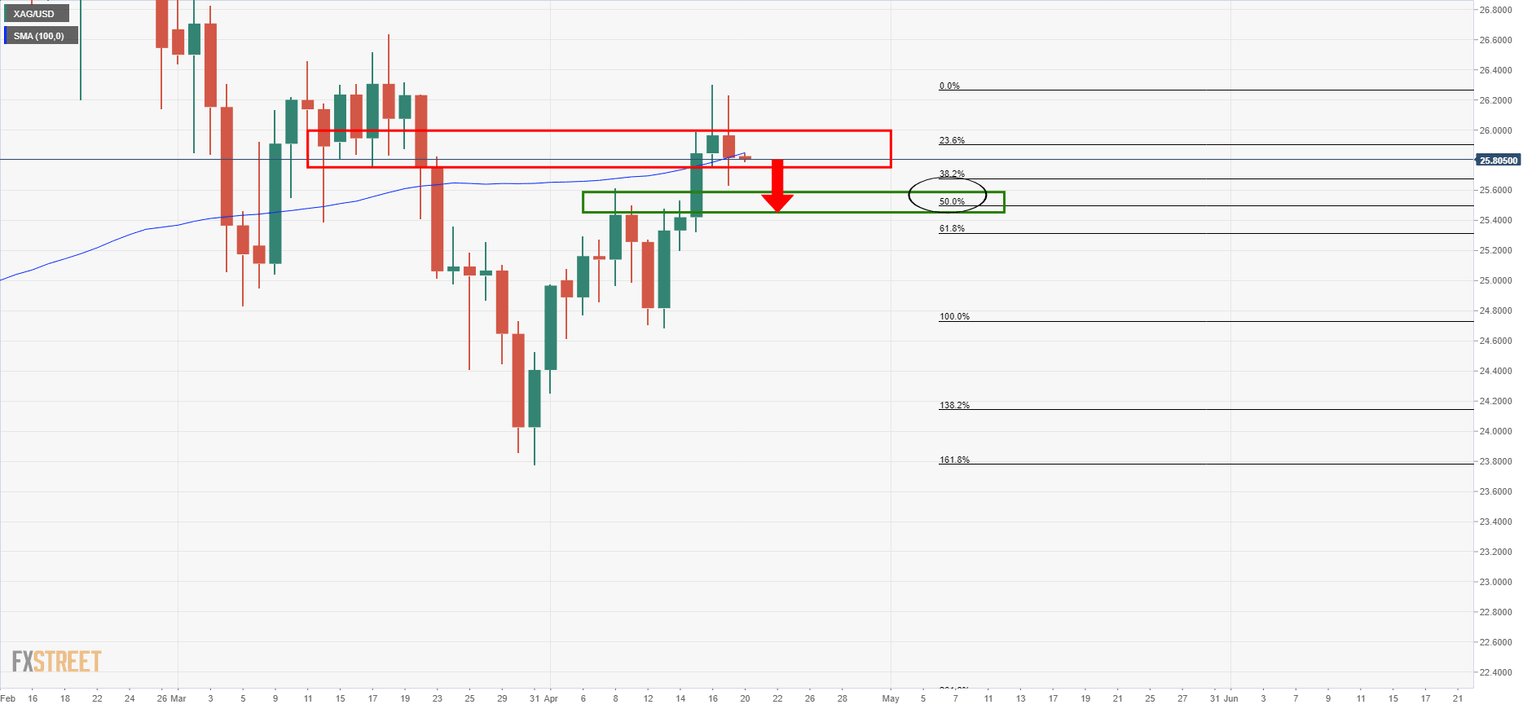

Silver technical analysis

Silver prices have stalled at daily resistance and in the day’s move to the downside, it has subsequently formed a new 4-hour resistance at 25.91.

Supply would be anticipated to reemerge there and result in a deeper bearish retracement towards the early April highs and a confluence with the 50% mean reversion level of the latest bullish daily impulse at 25.50.

Daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.