Quarterly earnings outlook: Apple (AAPL Stock) and Visa (V Stock)

Visa Q3 earnings report

Visa, third-quarter earnings report is due on July 27, 2021. Considering the previous quarterly report, this guide will forecast the company’s second- quarter earnings report.

Visa released its second fiscal quarter earnings on April 27, 2021. For the three months ended March 31, Visa earned $3.0 billion, or $1.38 per share, nearly comparable to the year-ago quarter’s $3.1 billion, or $1.38 per share. Adjusted earnings per share of $1.38 were reported after adjustments, beating the consensus forecast of $1.27 per share.

The company’s revenue for the quarter dipped 2% to $5.73 billion, but it was still higher than the $5.56 billion expected by analysts. Despite the revenue reduction, payments volume climbed by 11% in the quarter, while total processed transactions increased by 8%.

In the fiscal second half, GAAP operating costs were $2.1 billion, up 11% from the previous year’s results, which included a special item relating to increased indirect taxes in the current year and acquisition-related depreciation of purchased intangible assets and receivables in both years.

Excluding these operational expenditure categories, non-GAAP operating expenses grew 3% over the prior year, principally due to an increase in personnel expenses, which was offset in part by savings in general and administrative, marketing, and professional fees.

GAAP non-operating income was $47 million in the fiscal second quarter, including net equity investment gains of $156 million. Non-GAAP non- operating expense was $109 million, excluding this category.

“The COVID-19 pandemic has turned the world upside down in the last year,” said CEO Alfred F. Kelly, “but we believe we are seeing the beginning of the end, and the recovery is well begun in a number of significant areas around the world.”

The company stated in its Q2 report that it is difficult to predict the Company’s yearly results realistically due to the ongoing impact of COVID-19 and the extreme uncertainty in the global economy, so it is not giving a fiscal full-year 2021 outlook at this time.

While Covid-19-related travel restrictions continue in place, as more people are vaccinated, these restrictions are expected to be relaxed in the coming quarters, benefiting foreign transaction revenues.

Furthermore, consumer spending has improved in recent quarters and is expected to continue to improve as the economy improves. Visa’s revenue is expected to reach $1.38 billion in the third quarter of 2021 as a result of this.

Visa stock analysis

Visa Inc.’s stock has been performing well in recent quarters. Because of the growth of 5G networks, the Dow Jones company is making advances in digital payments. It has also recovered from a sell-off that occurred in March.

Technically, the Relative Strength Index (RSI) is in the neutral level, while previously, it has been in the overbought zone.

The previous high at $250.10 serves as a resistance level, and it is above the 9-day moving average. If this level is breached, we can see a further surge of the V. The volume is in the middle level, indicating that there isn’t much support in the market.

Apple Q3 earnings report

Apple Inc., third-quarter earnings report is due on July 27, 2021. Considering the previous quarterly report, this guide will forecast the company’s third-quarter earnings report.

Apple Inc. posted earnings for the second quarter of the fiscal year 2021 that easily outperformed consensus projections. Apple recorded a double-digit increase in all of its product categories in the second quarter, with its most important product line, the iPhone, and growing 65.5 percent year over year. Its Mac and iPad sales performed better, with laptops increasing 70.1 percent and iPad sales increasing nearly 79 percent yearly.

Services revenue of $16.9 billion was 7.6 percent higher than the projection of $15.7 billion. This figure was a new high for the corporation in any quarter, and it was 26.6 percent greater than the same period last year.

Apple relies heavily on service income for two reasons. The first difference is that service revenue is predictable and consistent, whereas product revenue is subject to the retail industry’s highly seasonal tendencies. Second, Apple’s services business has a far larger gross profit margin than its sales volume.

This was Apple’s second consecutive quarter of double-digit year-over-year increase across all product categories.

CFO Luca Maestri stated that he expects double-digit sales growth in the third fiscal quarter of 2021 but warned that Apple is hampered by global semiconductor scarcity.

Apple CEO Tim Cook stated that the company is experiencing an increase in first-time Mac buyers. Year over year, Mac sales increased by 70%, while iPad sales increased by 79%. Meanwhile, paid memberships to all Apple services are 660 million, an increase of 40 million from Q1 FY 2021.

Analysts predict the company to report its greatest quarterly profits per share and revenue growth in several years in Q3 2021.

This is because Apple is surviving the turmoil of the COVID-19 pandemic better than most companies, as millions of people seek refuge and work from home, boosting demand for Apple gadgets and services significantly.

While the business reported widely disparate quarterly results in fiscal 2020, experts now predict Apple to produce the highest revenue and profitability growth in at least five years in fiscal 2021.

Investors will also watch Apple’s services income, which is a critical, high- margin industry and a significant component of Apple’s revenue diversification strategy. Analysts anticipate that services revenue will expand quicker in the third quarter than it did the previous year.

Apple stock analysis

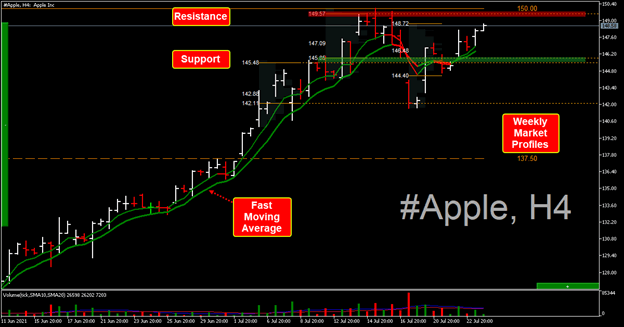

In recent quarters, Apple’s stock performance has paralleled the company’s overall solid earnings reporting. As a result, Apple’s stock has recently risen. In addition, it has recovered from a sell-off that happened following the release of its March-quarter earnings report.

Technically, the Relative Strength Index (RSI) is in overbought and has been for several sessions.

The previous high at $150.14 serves as a resistance level because it coincides neatly with the 9-day moving average. If this level is breached, we could witness a reversal back to $137-135. The volume has dropped from $145 to $137, indicating that there isn’t much support in the market.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.