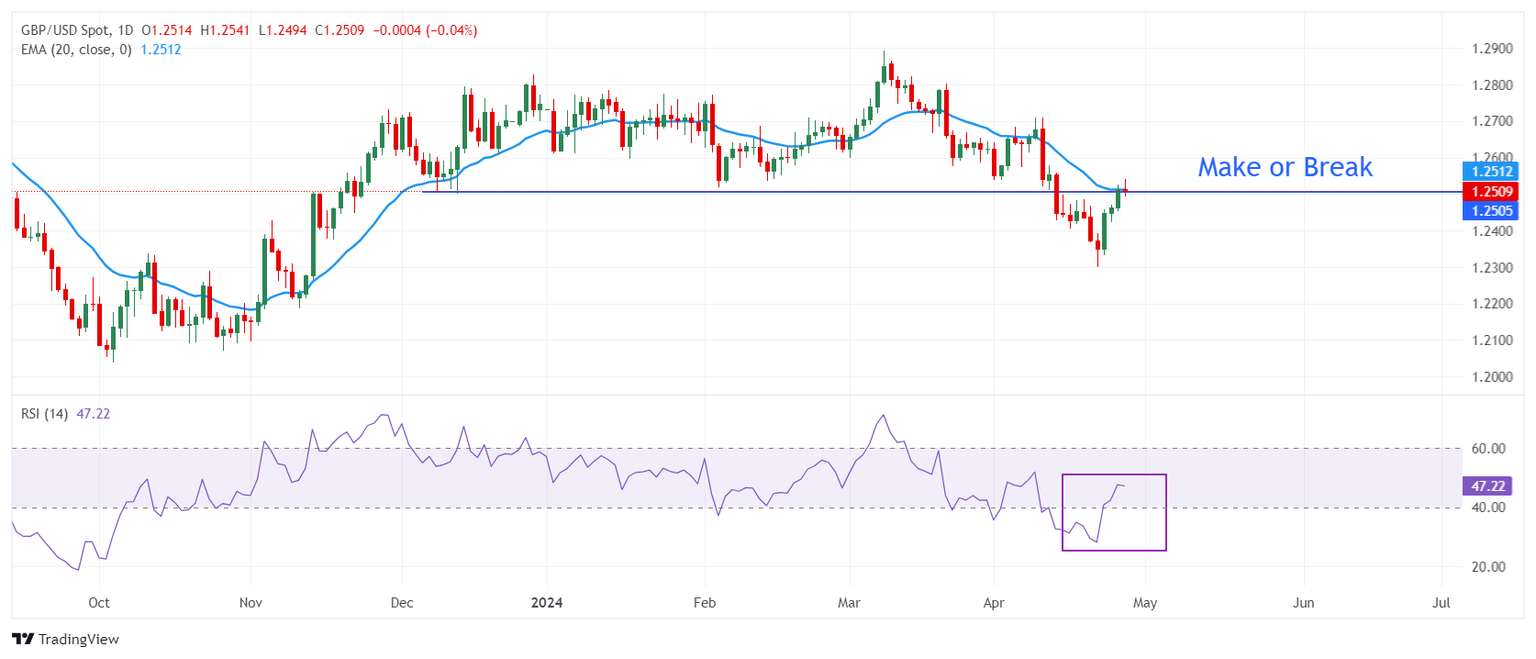

GBP/USD Price Analysis: Tumbles below 1.2500 as bears cut bulls hopes short

During the mid-North American session, the Pound Sterling retreats and registers losses against the

US Dollar, slumping below 1.2500. Data from the United States showed that inflation is picking up, which would deter

Fed intentions from cutting interest

rates. The

GBP/USD trades at 1.2481, down 027%.

Read More...

Pound sterling drops as US Dollar rebounds due to hot US core PCE Inflation

The Pound Sterling (GBP) faces selling pressure near 1.2500 against the US Dollar (USD) in Friday’s early American session. The

GBP/USD pair drops as firm expectations that the Bank of England (BoE) will start reducing interest

rates from the June meeting. BoE policymakers see inflation receding sharply in upcoming months but still refrain from providing a concrete time frame for interest-rate cuts. In the press conference after the last

monetary policy meeting, BoE Governor Andrew Bailey said market expectations for two or three rate cuts this year are not “unreasonable”.

Read More...

GBP/USD trades on a softer note below 1.2530 ahead of US PCE data

The

GBP/USD pair trades on a weaker note around 1.2502 during the early Asian trading hours on Friday. The modest rebound of the

US Dollar (USD) weighs on the major pair despite weaker US GDP growth numbers. The US Personal Consumption Expenditures (PCE) Price Index data on Friday will be in the spotlight.

Read More...