Pound Sterling remains upbeat after Hunt's budget statement

- The Pound Sterling holds strength amid UK Spring Budget announcement.

- Measures outlined in the UK Budget could significantly impact the inflation outlook.

- Fed Powell didn't provide timing for rate cuts in his prepared remarks.

The Pound Sterling (GBP) remains upbeat in Wednesday’s late European session amid the release of the United Kingdom’s 2024 budget statement. Chancellor of the Exchequer Jeremy Hunt said that the Office for Business Responsibality (OBR) has raised Gross Domestic Product (GDP) growth forecasts for 2024. The UK's economys is expected to grow by 0.9% from 0.8% forecasted in November. The Convervative Party said it focuses on reducing budget deficit to 1.2% in 2028-29.

As expected the Conservative Party has announced a two-percentage-point cut to National Insurance Contributions (NICs), which should save the average earner around 450 pounds this year. Combined with last year’s cut, total savings for workers would be 900 pounds.

In the United States, Federal Reserve (Fed) Chair Jerome Powell has reiterated that he is still not convinced that inflation will come down to 2%. Fed Powell said rate cuts are likely at some point this year.

Daily digest market movers: Pound Sterling exhibits strength amid Hunt's budget statement

- The Pound Sterling exhibits strength as fiscal stimulus announced by Chancellor of the Exchequer Jeremy Hunt could keep the United Kingdom's inflation outlook sticky. Hunt has announced a two-percentage-point cut to NICs as expected, which will result in an additional saving of 450 pounds for an average salaried worker in 2024.

- Jeremy Hunt said that the OBR has raised GDP forecasts for 2024 and 2025. The UK economy is forecasted to grow by 0.9% and 1.9% in 2024 and 2025, respectively. The Conservative Party expect that defence spending will rise to 2.5% of GDP. Meanwhile, capital gains tax on property sales will be lowered to 24% from 28%. The administration will extend freeze duty on fuel and alcohol.

- A sticky inflation outlook would allow the Bank of England (BoE) to maintain a hawkish rhetoric for a longer period as UK’s consumer price inflation is already highest in comparison with other Group of Seven economies.

- From the viewpoint of BoE policymakers the pace which labor cost and service inflation are declining is double that the pace required for inflation to sustainably come dow to the desired target of 2%. The Pound Sterling tends to attract higher liquidity inflows when the BoE hold interest rates restrictive for a longer period.

- On the economic data front, S&P Global/CIPS reported Tuesday that the Services PMI came in lower than expected, dropping to 53.8 from the prior reading of 54.3. The performance was downbeat; however, the index was higher than every month in the second half of 2023. The agency said, “Another solid expansion of business activity across the service sector in February adds to signs that the UK economy has turned a corner after entering a technical recession during the second half of 2023.”

- The US Dollar weakens as the United States ADP Employment data fails to match expectations. Private payrolls were 140K in Februar, lower than expectations of 150K.

- Meanwhile, in his prepared statements, Federal Reserve (Fed) Chair Jerome Powell lacks conviction that inflation will return to 2%. Powell sees rate cuts in sometime this year, carefully assess incoming data, evolving outlook, balance of risks. Powell added that risks to achieving dual mandate are moving into better balance.

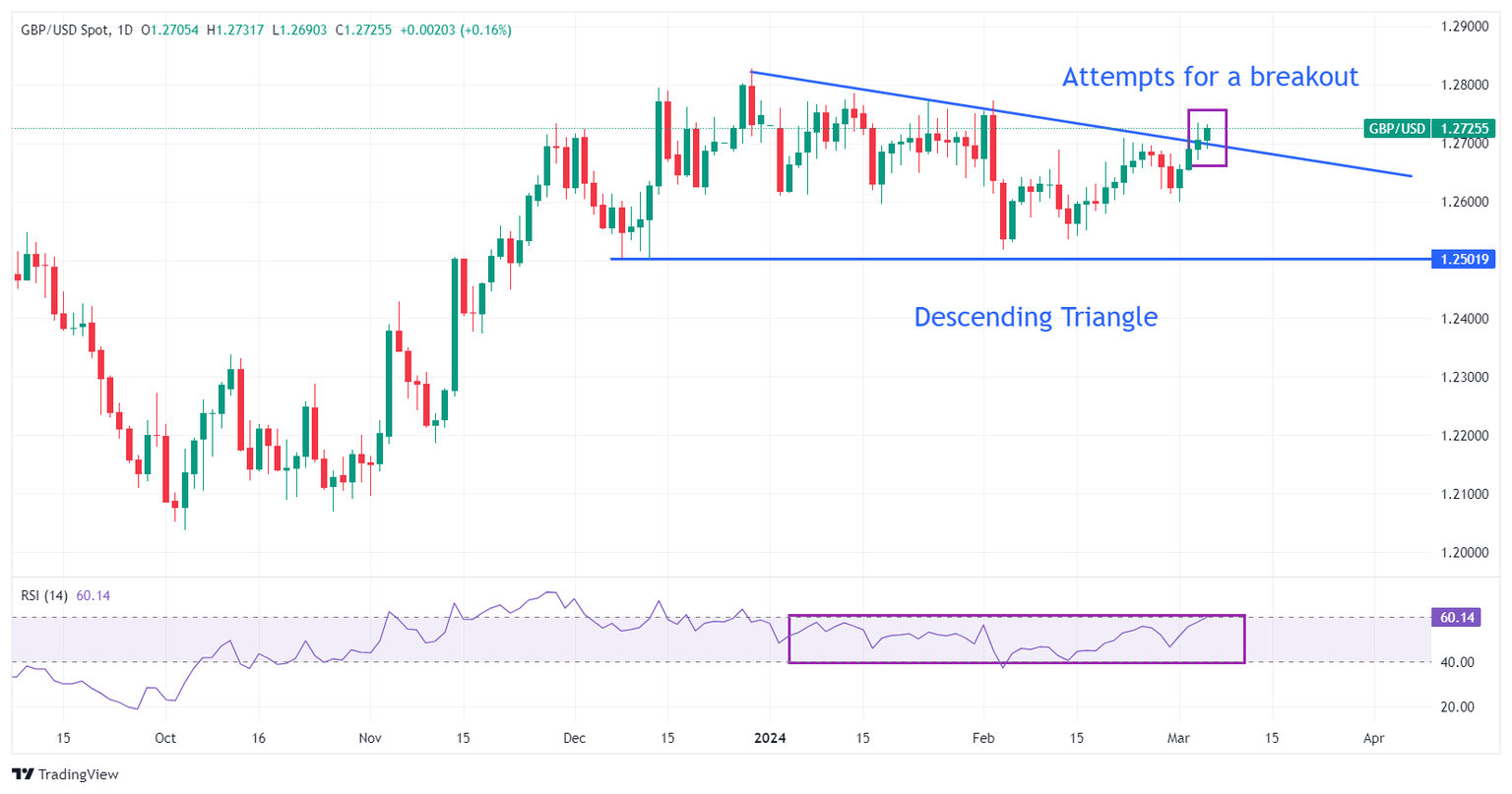

Technical Analysis: Pound Sterling remains above 1.2700

The Pound Sterling has remained confined in a tight range for the last two months. The GBP/USD pair could make a decisive move after the release of the UK’s budget. The pair hovers near the downward-sloping border of the Descending Triangle pattern formed on a daily time frame, placed from December 28 high at 1.2827. A decisive break above the same could result in a sharp upside move. The horizontal support of the aforementioned chart pattern is plotted from December 13 low near 1.2500.

Generally, a Descending Triangle pattern exhibits indecisiveness among market participants but with a nominal downside bias due to lower highs and flat lows.

The 14-period Relative Strength Index (RSI) rises to 60.00. A bullish momentum would trigger if the RSI (14) manages to susatin above the same.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.