Pound Sterling gains as UK inflation rises more than expected

- The Pound Sterling trades subduedly against the US Dollar amid easing US-EU disputes.

- Trump drops plans for US military action on Greenland and tariff threats against EU nations.

- Investors await US PCE inflation, flash US-UK S&P Global PMIs, and the UK Retail Sales data.

The Pound Sterling (GBP) trades higher against its major currency peers, except antipodeans, during the European trading session on Thursday. The British currency gains as the United Kingdom (UK) Consumer Price Index (CPI) rose more than expected in December.

The data released on Wednesday showed that the headline inflation accelerated to 3.4% year-on-year (YoY) compared to estimates of 3.3% and the November reading of 3.2%.

However, the impact of higher UK inflation seems to be limited on Bank of England (BoE) dovish expectations as the pace of price increases is expected to slow sharply in the coming months, with last year’s rises in utility costs and other government-controlled tariffs falling out of the annual comparison, Reuters reported.

Economists at the National Institute of Economic and Social Research (NIESR) think tank have stated that the Bank of England (BoE) “will not be worried by these numbers”, and they predict “one interest rate cut in the first half of this year”.Going forward, investors will focus on the UK Retail Sales data for December and the preliminary S&P Global Purchasing Managers’ Index (PMI) for January, which will be released on Friday.

The data is expected to show that Retail Sales, a key measure of consumer spending, contracted steadily by 0.1% month-on-month (MoM). This would be the third straight decline in the consumer spending measure.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | -0.16% | 0.21% | -0.05% | -0.60% | -0.38% | -0.25% | |

| EUR | 0.06% | -0.11% | 0.26% | 0.00% | -0.55% | -0.32% | -0.19% | |

| GBP | 0.16% | 0.11% | 0.38% | 0.12% | -0.45% | -0.22% | -0.09% | |

| JPY | -0.21% | -0.26% | -0.38% | -0.25% | -0.79% | -0.59% | -0.44% | |

| CAD | 0.05% | -0.00% | -0.12% | 0.25% | -0.55% | -0.33% | -0.19% | |

| AUD | 0.60% | 0.55% | 0.45% | 0.79% | 0.55% | 0.24% | 0.35% | |

| NZD | 0.38% | 0.32% | 0.22% | 0.59% | 0.33% | -0.24% | 0.13% | |

| CHF | 0.25% | 0.19% | 0.09% | 0.44% | 0.19% | -0.35% | -0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily Digest Market Movers: Trump rolls back 10% tariffs imposed on several EU members

- The Pound Sterling rises slightly to near 1.3450 against the US Dollar (USD) during European trading hours. The GBP/USD pair gains as the US Dollar ticks lower, but still holds Wednesday's gains driven by receding geopolitical and trade tensions between the United States (US) and the European Union (EU).

- As of writing, the US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, edges down to near 98.75.

- Tensions between two of the world’s largest economies eased after US President Donald Trump took back his decision of imposing 10% tariffs on several EU members and the United Kingdom (UK), and dropped his plans of US military action on Greenland after a meeting with the Secretary General of the North Atlantic Treaty Organization (NATO), Mark Rutte.

- US President Trump also announced that both Washington and NATO have reached a framework of a “future deal with respect to Greenland, and in fact, the entire Arctic Region”.

- Disputes between the US and the EU over Greenland’s entitlement had propelled risk-off market sentiment, weighed on the US Dollar and US assets, as investors became worried about long-term relations between two of the world’s largest economies. The event also led to an improvement in the appeal of European assets.

- In the US, investors will focus on the US Personal Consumption Expenditure Price Index (PCE) data for October and November, which will be published at 15:00 GMT. The data will slightly influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook. Currently, traders are confident that the Fed will keep interest rates steady in the range of 3.50%-3.75% in the policy meeting later this month, according to the CME FedWatch tool.

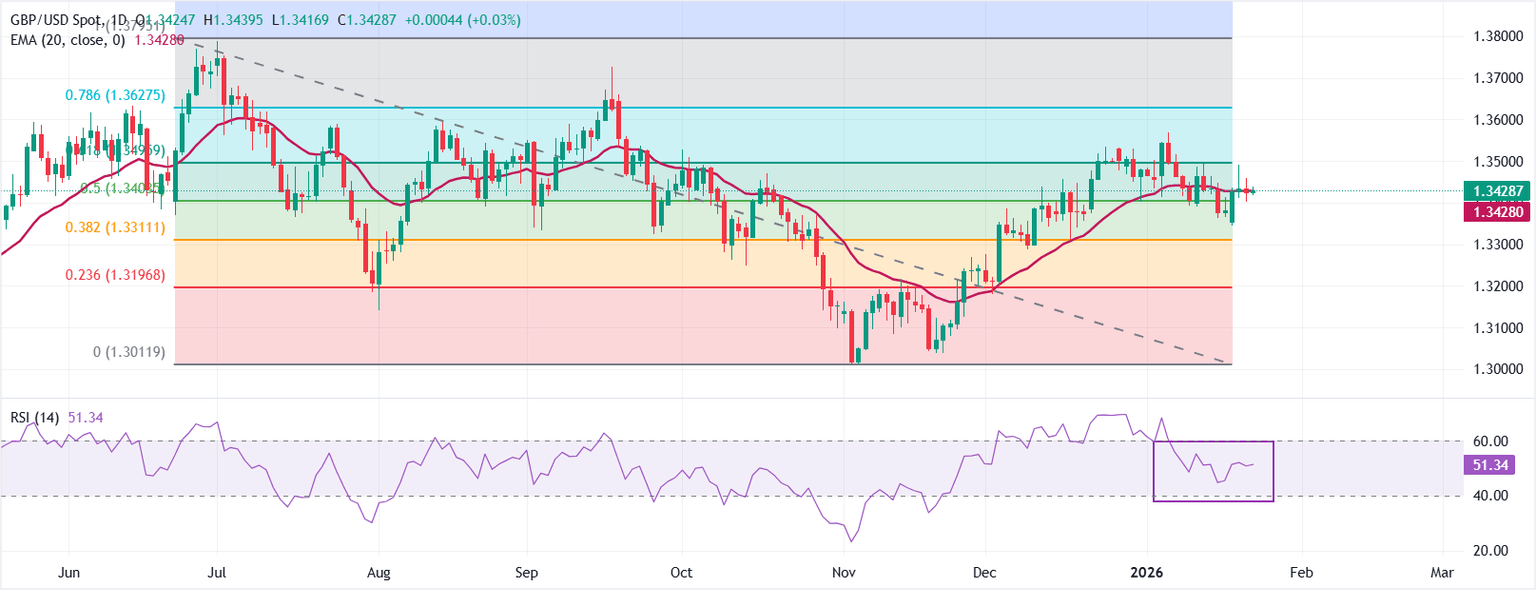

Technical Analysis: GBP/USD holds 50% Fibonacci retracement at 1.3404

GBP/USD trades flat near 1.3430 at the time of writing. The 20-day Exponential Moving Average (EMA) has flattened after a steady climb, signaling consolidation around the short-term mean.

The 14-day Relative Strength Index (RSI) at 51 (neutral) hints at indecision among traders, with no clear direction in the price action as the pair consolidates.

Measured from the 1.3795 high to the 1.3012 low, the 50% Fibonacci retracement at 1.3404 acts as immediate support, while the 61.8% Fibonacci retracement at 1.3496 caps rebounds. A break above 1.3496 would indicate that the pair is regaining strength.

(The technical analysis of this story was written with the help of an AI tool.)

Economic Indicator

Consumer Price Index (YoY)

The United Kingdom (UK) Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. It is the inflation measure used in the government’s target. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Last release: Wed Jan 21, 2026 07:00

Frequency: Monthly

Actual: 3.4%

Consensus: 3.3%

Previous: 3.2%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.