Top crypto gainers Canton, MYX Finance, Pump.fun rise as the market steadies

- Canton approaches $0.15 on Thursday after an 18% rise the previous day.

- MYX Finance nears a breakout of its upper consolidation range at $6, following a 16% jump on Wednesday.

- Pump.fun holds above the 50-day EMA with Wednesday’s 10% gains, bouncing off the broken resistance trendline.

Canton (CC), MYX Finance (MYX), and Pump.fun (PUMP) are leading the recovery over the last 24 hours as the broader cryptocurrency market takes a breather after sharp losses. Technically, the recovering altcoins are closing toward key resistances as selling pressure eases.

The recovery aligns with the cooling of the US-EU trade war, following the announcement of a framework agreement after a discussion between US President Donald Trump and NATO Secretary General, Mark Rutte, on Wednesday. This agreement involves discussions on Arctic security and the $175 billion Golden Dome missile defense system in exchange for scrapping the tariffs.

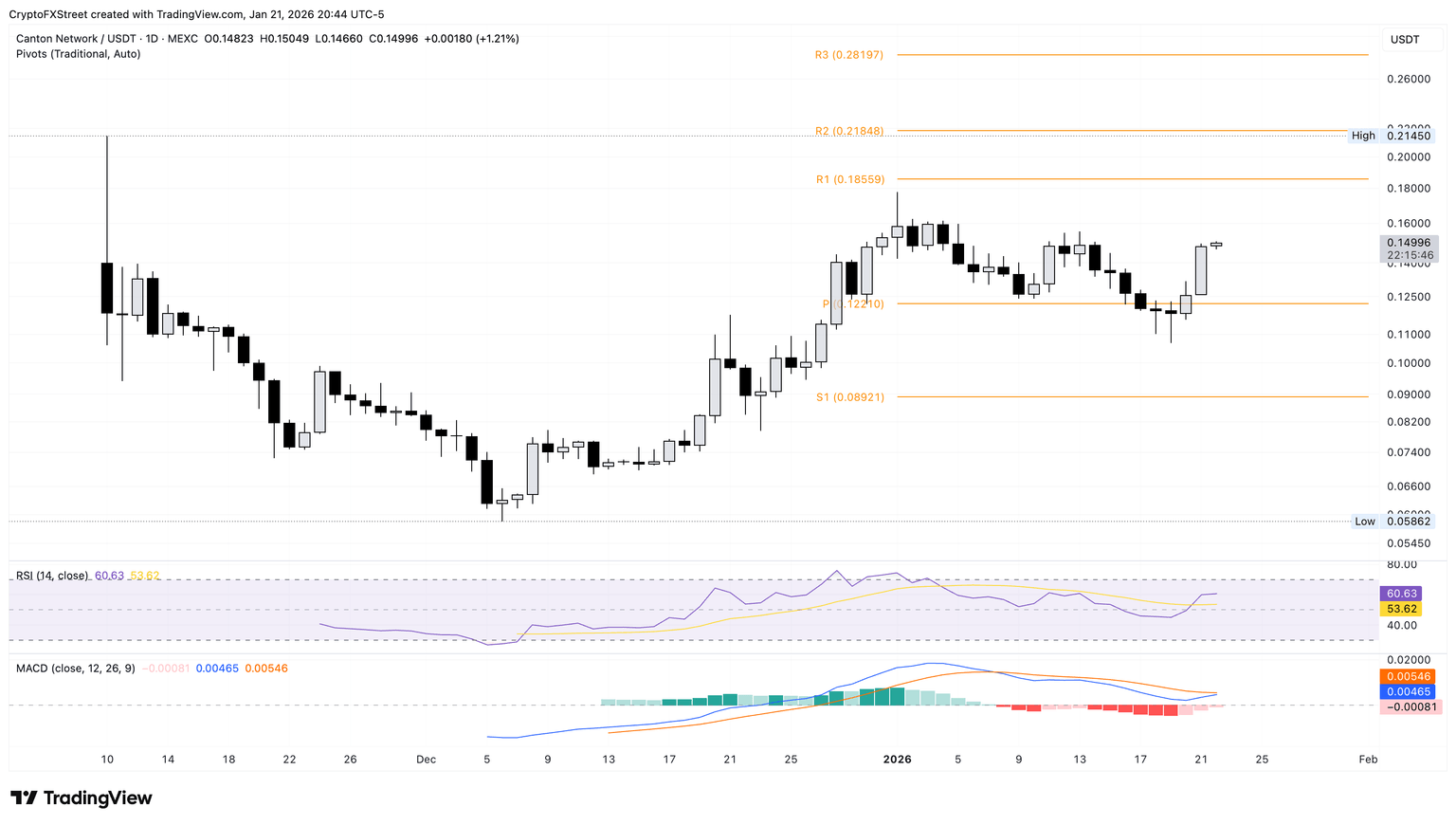

Canton’s rebound could fuel a steady upward trend

Canton Network’s configurable privacy controls make it one of the favorite institutional layer-1 adoptions, including the tokenization of the Depository Trust Company (DTC)-custodied assets and JP Morgan integrating its JPM coin for settlement. At the time of writing, Canton trades close to $0.15 on Thursday, after the 18% jump on the previous day.

The rebound in CC this week accounts for roughly 25% in gains so far, with bulls eyeing the R1 Pivot Point at $0.1859.

Technical indicators on the daily chart suggest a reduction in selling pressure as the Relative Strength Index (RSI) at 60 reverses higher from the halfway line toward the overbought zone and the Moving Average Convergence Divergence (MACD) approaches the signal line for a potential bullish crossover.

On the downside, a pullback in CC could target the base formed near $0.12 this week, followed by the $0.10 psychological mark.

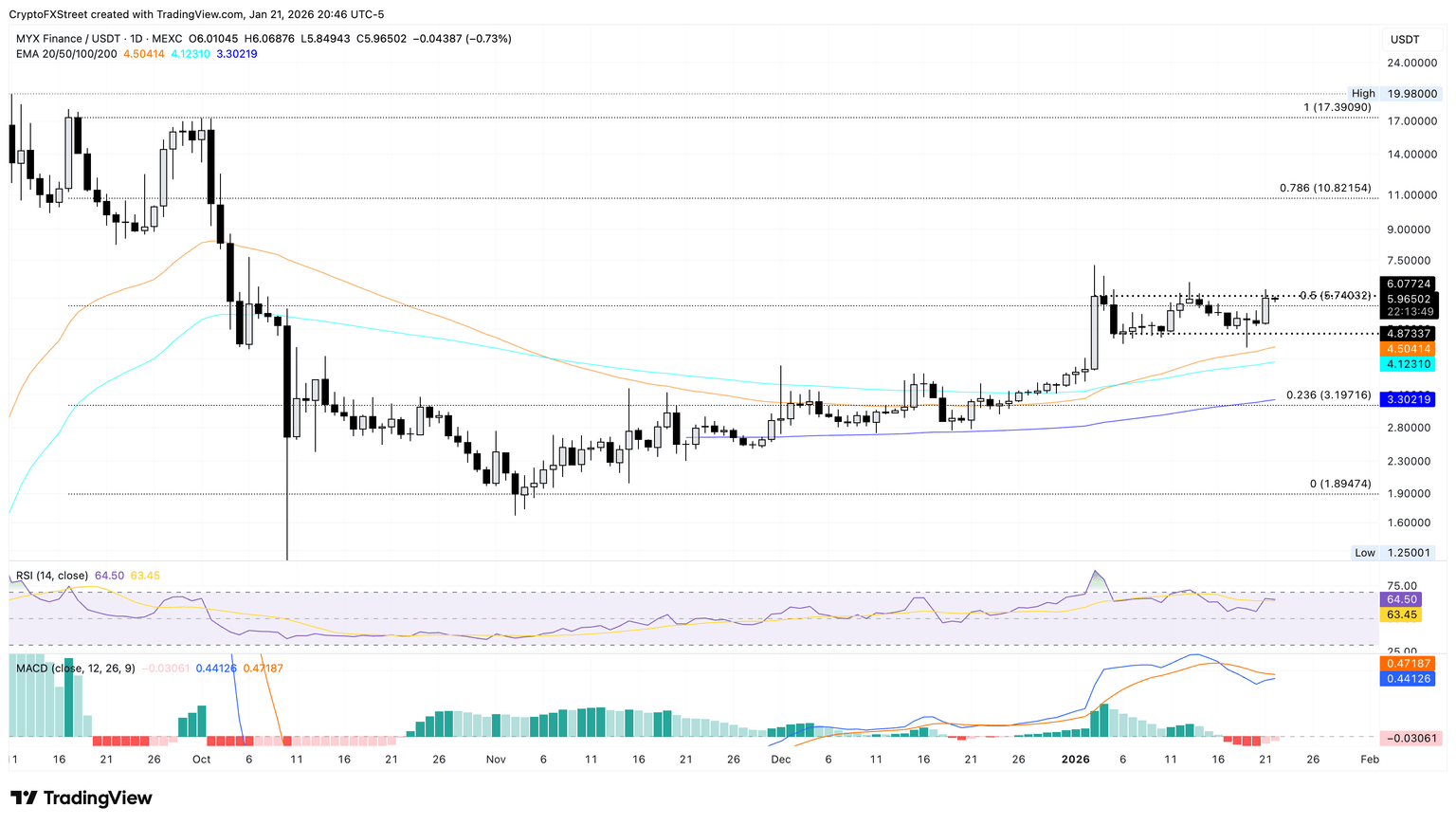

MYX Finance gains traction amid hopes of a range breakout rally

MYX Finance is extending its sideways trend within a consolidation range between $4.87 and $6.07 on the daily chart. At the time of writing, MYX trades above $6, teasing a breakout of the $6.07 ceiling.

If the altcoin clears this level, it would open the door to the 78.6% Fibonacci retracement at $10.82, measured between the closing prices of September 17 and November 3 at $17.39 and $1.89, respectively.

Similar to Canton, the MACD indicator signals a potential bullish crossover while RSI rises to 64, inching closer to the overbought zone.

On the flip side, the rising 50-day Exponential Moving Average (EMA) at $4.50 could serve as immediate support.

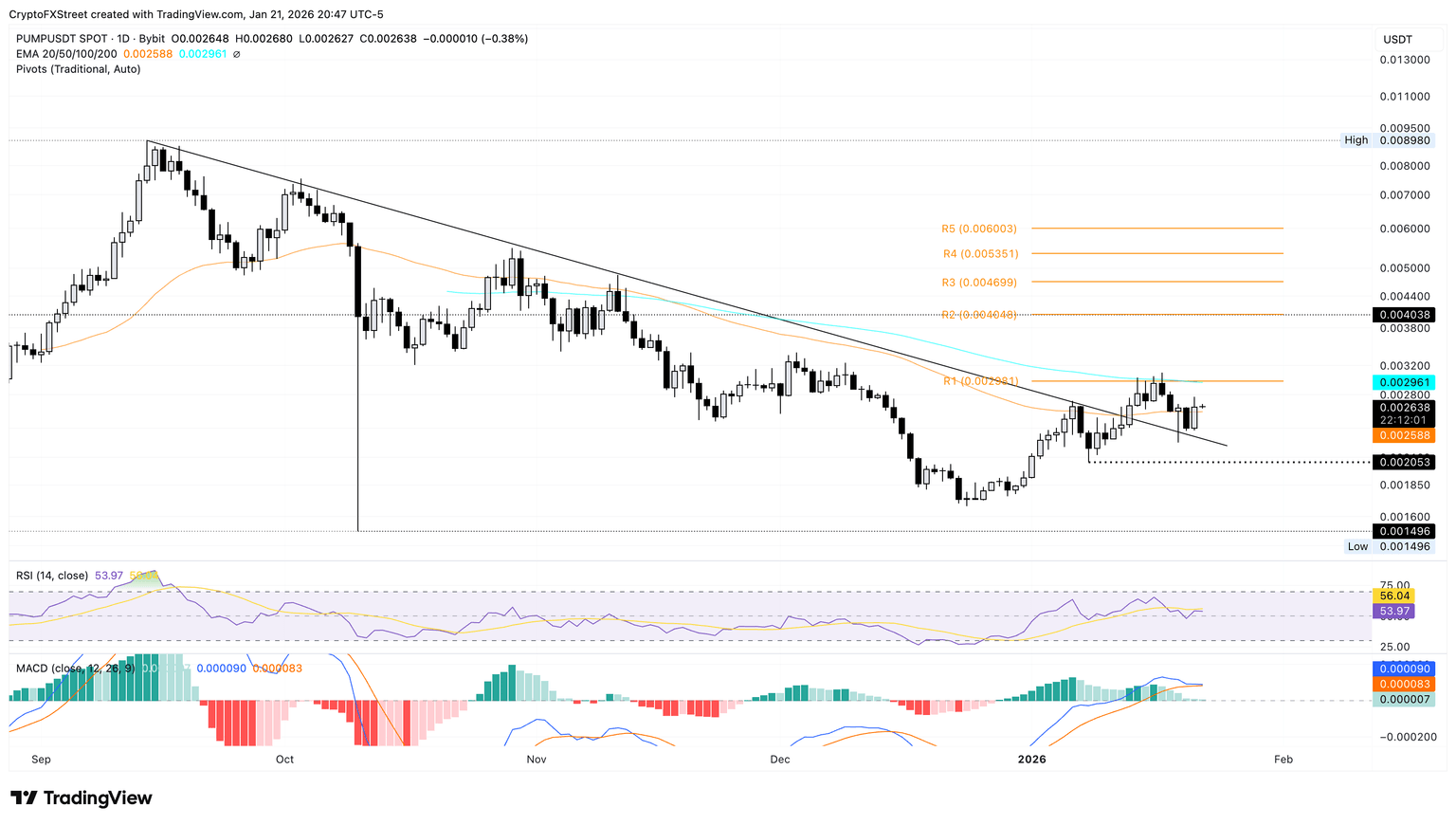

Pump.fun’s recovery above the 50-day EMA remains at a crossroads

Pump.fun trades above the 50-day EMA at $0.0025 at press time on Thursday, following a 10% rebound on Wednesday. The Solana-based launchpad token targets the 100-day EMA and the R1 Pivot Point, coinciding near $0.0029 if the recovery run gains traction.

The MACD remains above the signal line, delaying a bearish crossover, as short-term relief gives buyers a chance to regain momentum. The RSI at 53 hovers above the halfway line, indicating a bullish tilt in a broadly neutral trend.

However, a potential reversal in PUMP could extend the decline toward the $0.0020 round figure.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.