Pound Sterling recovers losses against US Dollar as US inflation slows expectedly

- The Pound Sterling exhibits sluggishness against its major peers on softer than anticipated UK inflation for July.

- Easing UK price pressures give more chances for subsequent interest-rate cuts by the BoE.

- A mild slowdown in the US inflation in July has boosted US Dollar's recovery.

The Pound Sterling (GBP) recovers its intraday losses to a two-week high at 1.2870 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair rebounds as the US Dollar (USD) falls after the United States Consumer Price Index (CPI) report showed that price pressures declined expectedly in July. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hovers near a fresh weekly low around 102.30.

The US CPI report showed that annual headline and core inflation, which excludes volatile food and energy prices, decelerated by one-tenth to 2.9% and 3.2%, respectively, from June readings. The month-on-month headline and core CPI rose by 0.2%, as expected. The inflation data confirms that price pressures remain on the path that leads to the Federal Reserve's (Fed) target of 2%. This has also boosted Fed interest rate-cut prospects.

According to the CME FedWatch tool, 30-day Federal Funds Futures pricing data shows that an interest rate cut announcement in September appears to be a done deal, while traders split over the size of the reduction.

Daily digest market movers: Pound Sterling remains on backfoot as soft UK inflation prompts BoE rate-cut prospects

- The Pound Sterling faces a sharp sell-off against its major peers, except the New Zealand Dollar (NZD) and the Japanese Yen (JPY), in Wednesday’s London session. The British currency weakens as the United Kingdom (UK) Office for National Statistics (ONS) has reported a softer-than-expected CPI report for July, which has boosted expectations of sequential interest-rate cuts by the Bank of England (BoE).

- Annual headline CPI rose by 2.2%, less than estimates of 2.3% but accelerating after returning to banks’ target of 2% both in May and June. In its forecasts, the BoE had already warned that the headline inflation could increase again after returning to 2%. Compared with the previous month, the CPI fell by 0.2%.

- The core CPI, which excludes volatile items such as food, energy, alcohol, and tobacco, decelerated at a faster-than-expected pace to 3.3% compared with the 3.4% expected and June’s figure of 3.5%. A sharp decline in core inflation was prompted by slower growth of service inflation, which has remained a major driving force to sticky price pressures in the UK economy. Inflation in the service sector declined to 5.2% from the former release of 5.7%.

- Price pressures in the service sector are majorly driven by high wage growth, which also fell to its lowest in two years in the three months ending June. The Employment report showed on Tuesday that Average Earnings Excluding Bonuses rose at a slower pace of 5.4% from 5.7% in the quarter ending May. A sheer decline in service inflation due to slower wage growth is expected to be a big relief for BoE policymakers, who have been worried that wage pressures couldn't be controlled in the near term.

- On Monday, BoE's Monetary Policy Committee (MPC) member Catherine Mann warned about inflation remaining persistent. “Goods and services prices were set to rise again, and wage pressures in the economy could take years to dissipate,” Mann said.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | -0.40% | -0.08% | 0.11% | -0.12% | -0.15% | 0.93% | -0.37% | |

| EUR | 0.40% | 0.31% | 0.50% | 0.26% | 0.26% | 1.32% | 0.00% | |

| USD | 0.08% | -0.31% | 0.19% | -0.03% | -0.10% | 1.03% | -0.31% | |

| JPY | -0.11% | -0.50% | -0.19% | -0.21% | -0.25% | 0.82% | -0.45% | |

| CAD | 0.12% | -0.26% | 0.03% | 0.21% | -0.04% | 1.04% | -0.24% | |

| AUD | 0.15% | -0.26% | 0.10% | 0.25% | 0.04% | 1.05% | -0.24% | |

| NZD | -0.93% | -1.32% | -1.03% | -0.82% | -1.04% | -1.05% | -1.27% | |

| CHF | 0.37% | -0.00% | 0.31% | 0.45% | 0.24% | 0.24% | 1.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

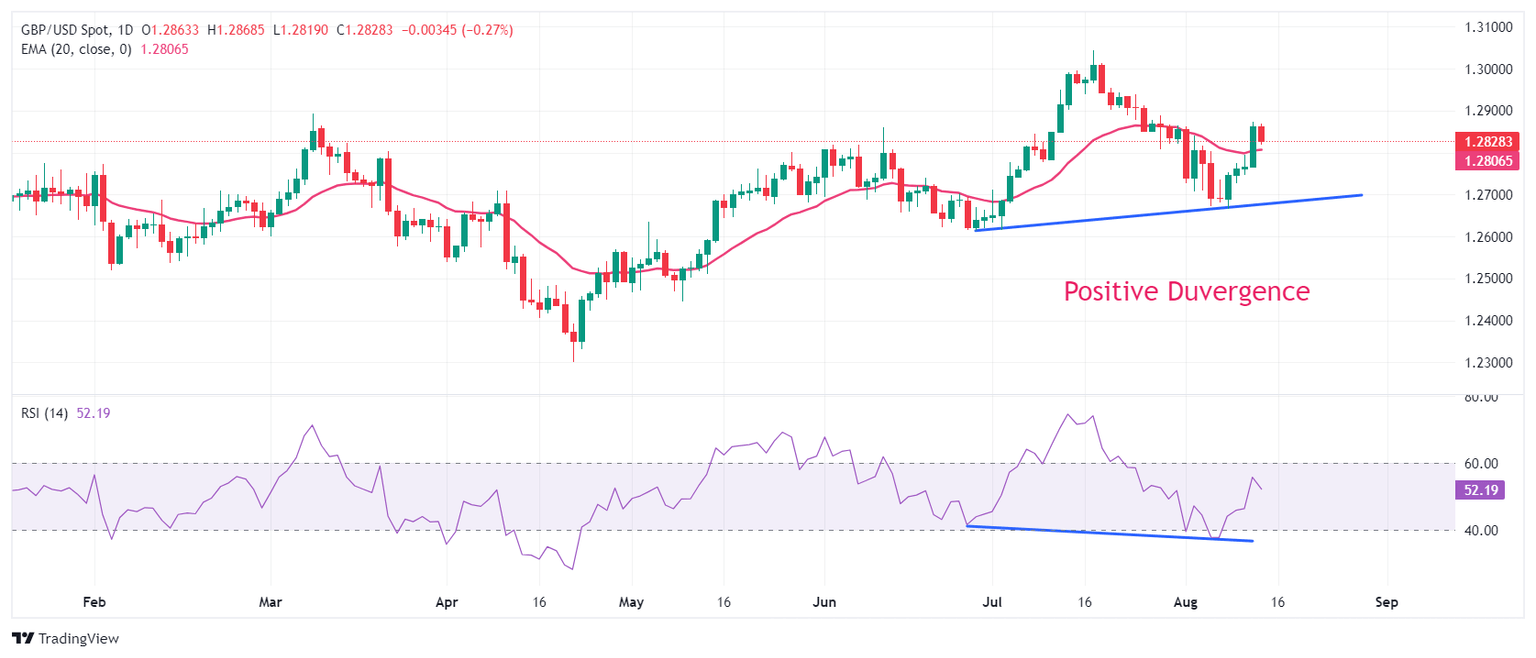

Technical Analysis: Pound Sterling holds key 20-day EMA

The Pound Sterling slides to near 1.2820 against the US Dollar after posting a fresh two-week high at 1.2870. The near-term appeal of the GBP/USD pair is still firm as it holds the 20-day Exponential Moving Average (EMA), which trades around 1.2800.

Earlier, the Cable showed a sharp recovery from a six-week low of 1.2665 after a positive divergence formation on a daily time frame, in which the pair continues to build higher lows while the momentum oscillator makes lower lows. This generally results in a resumption of the uptrend, but it should be confirmed with more indicators.

The 14-day Relative Strength Index (RSI) recovers after finding a cushion near 40.00, exhibiting signs of buying interest at lower levels.

On the upside, August 2 high at 1.2840 and the round-level resistance of 1.2900 will act as major resistances for the Pound Sterling. Alternatively, the recovery move could falter if the asset breaks below August 8 low at 1.2665. This would expose the asset to June 27 low at 1.2613, followed by April 29 high at 1.2570.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Aug 14, 2024 12:30

Frequency: Monthly

Actual: 3.2%

Consensus: 3.2%

Previous: 3.3%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.