Pound Sterling falls back as BoE rate cut hopes deepen

- The Pound Sterling retreats on higher BoE rate cut projections.

- BoE Bailey says he doesn’t see market expectations for two or three rate cuts as unreasonable.

- This week, the US Dollar’s moves will be driven by the core PCE price index data.

The Pound Sterling (GBP) faces pressure near 1.2650 against the US Dollar in Tuesday’s early American session as the latter rebounds. The GBP/USD pair exhibits falls as investors expect that the Bank of England (BoE) will be more dovish this year than previously anticipated, driven by lower-than-anticipated inflation data in January and February

The BoE said last week in its monetary policy statement that the central bank is not at a point where interest rates can be reduced. However, policymakers didn’t rule out the market’s view of two or three rate cuts this year. Two BoE policymakers, Catherine Mann and Jonathan Haskel – who voted for rate hikes in February – dropped their hawkish calls on interest rates in the March meeting. This has boosted confidence among investors that inflation in the United Kingdom is moving in the right direction.

Meanwhile, BoE Catherine Mann said in a statement released in Tuesday's European session that she changed her vote on rates due to consumers disciplining firms' pricing, the changing dynamic in labor markets, and the financial market curve. Mann added, "Discretionary services inflation has softened in the last couple of months." Mann further added that market is pricing in too many cuts in interest rates.

This week, the market sentiment will drive the Pound Sterling’s next move as the UK economic calendar is light. Investors will keenly focus on the United States core Personal Consumption Expenditure Price Index (PCE) data for February, which will be published on Good Friday. The annual Core PCE is forecasted to have grown at a steady pace of 2.8%.

Daily digest market movers: Pound Sterling falls as US Dollar bounces back

- The Pound Sterling faces resistance near 1.2650 against the US Dollar. The US Dollar Index (DXY), which tracks the US Dollar’s value against six major currencies, finds support near 104.16. The USD Index recovers even though expectations for the Federal Reserve (Fed) reducing interest rates in the June policy meeting increase as policymakers still have faith that has inflation is easing.

- The Fed remains confident that underlying price pressures are easing. However, hot US inflation in January and February suggested that the path toward achieving price stability could be bumpier than expected. Higher rentals and service inflation have fed the stubborn US Consumer Price Index (CPI). About rent inflation, Fed Governor Lisa Cook said on Monday, "Although housing-services inflation remains quite high, the current low rate of increase on new rental leases suggests that it will continue to fall."

- Meanwhile, the downside bias remains unabated as the Bank of England seems to adopt a slightly dovish tone on interest rates. In the recent monetary policy meeting, no policymakers voted for a rate hike for the first time since September 2021. BoE policymaker Catherine Mann was expected to vote for a rate hike. This has increased market expectations for a rate cut in the June meeting.

- BoE Governor Andrew Bailey said in an interview with the Financial Times last week that market expectations for rate cuts this year are not unreasonable and delivered an optimistic tone on the economic prospects. Regarding the inflation outlook, Bailey said, "We are not seeing a lot of sticky persistence."

- This week, trading volume could remain low due to Good Friday. Also, the United Kingdom's economic calendar has nothing much to offer. However, the US core PCE Inflation data for February will be in focus.

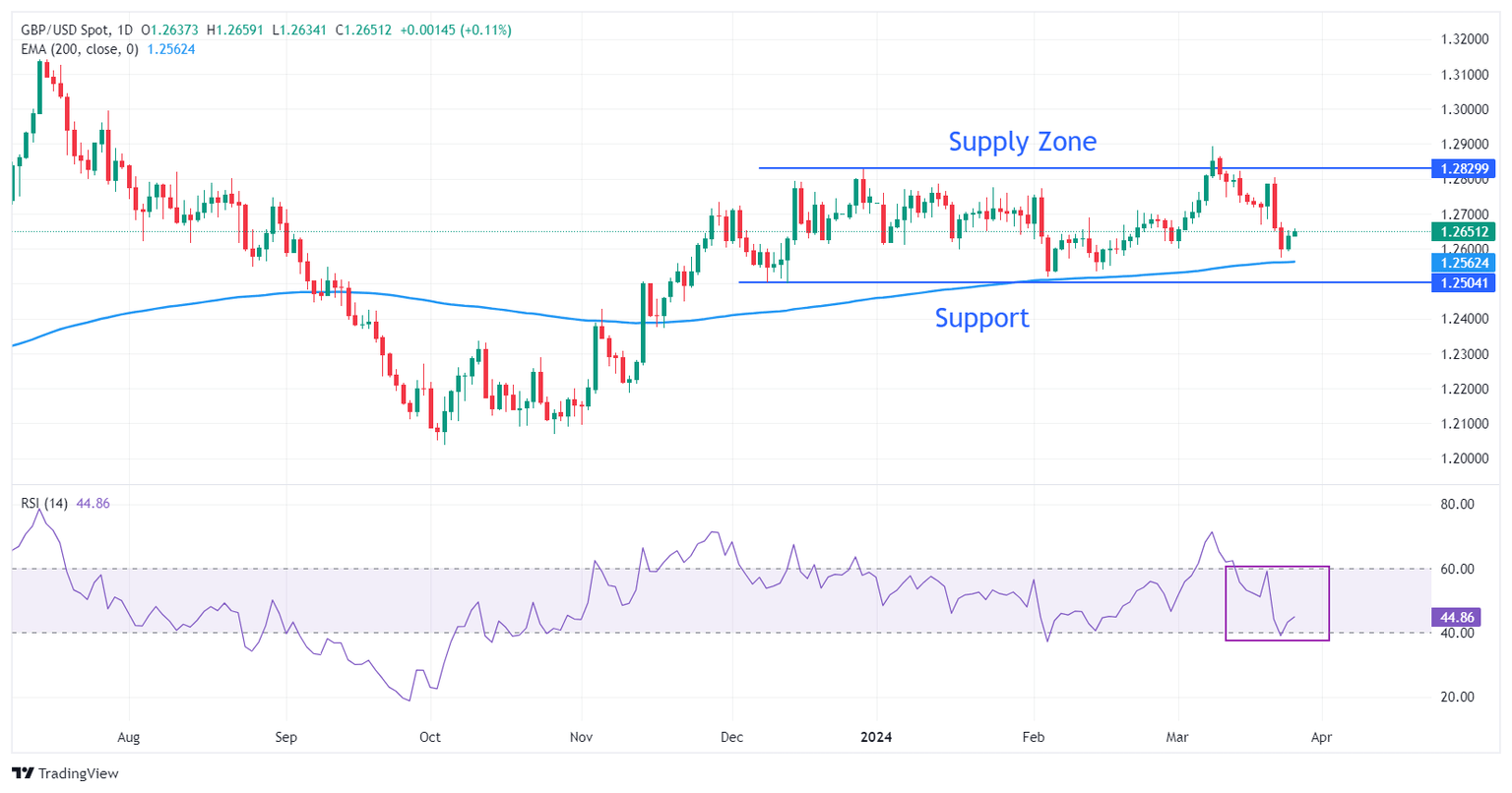

Technical Analysis: Pound Sterling struggles to sustain above 1.2600

The Pound Sterling faces pressure while sustaining above the crucial support of 1.2600. The GBP/USD pair has been trading broadly sideways in a wider range between 1.2500 and 1.2900 for almost the last four months. The 200-day Exponential Moving Average (EMA) at 1.2558 will be a major cushion for the Pound Sterling bulls.

The 14-period Relative Strength Index (RSI) saw a pullback move after dipping to 40.00. A bearish momentum would trigger if the RSI dips below this level.

BoE FAQs

What does the Bank of England do and how does it impact the Pound?

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

How does the Bank of England’s monetary policy influence Sterling?

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

What is Quantitative Easing (QE) and how does it affect the Pound?

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

What is Quantitative tightening (QT) and how does it affect the Pound Sterling?

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.