Pound Sterling rises to 1.2750 on soft US Dollar and uncertainty over BoE rate cuts

The Pound Sterling (GBP) rises to near 1.2750 against the US Dollar (USD) in Monday’s London trading session. The GBP/USD pair remains firm as bets supporting the Bank of England (BoE) reducing interest rates from the June meeting have diminished due to a slower-than-expected decline in the United Kingdom’s (UK) consumer inflation for April.

Economists forecasted that the UK headline inflation would fall to 2.1% year-over-year in April but slowed to 2.3% from the previous reading of 3.2%. Also, a nominal decline in the UK service inflation deepens fears of inflation remaining persistent for a longer period. The UK service inflation slowed slightly to 5.9% from the prior reading of 6.0%. UK’s sticky service inflation has remained a major barrier to price pressures returning to the objective rate of 2%. Read more...

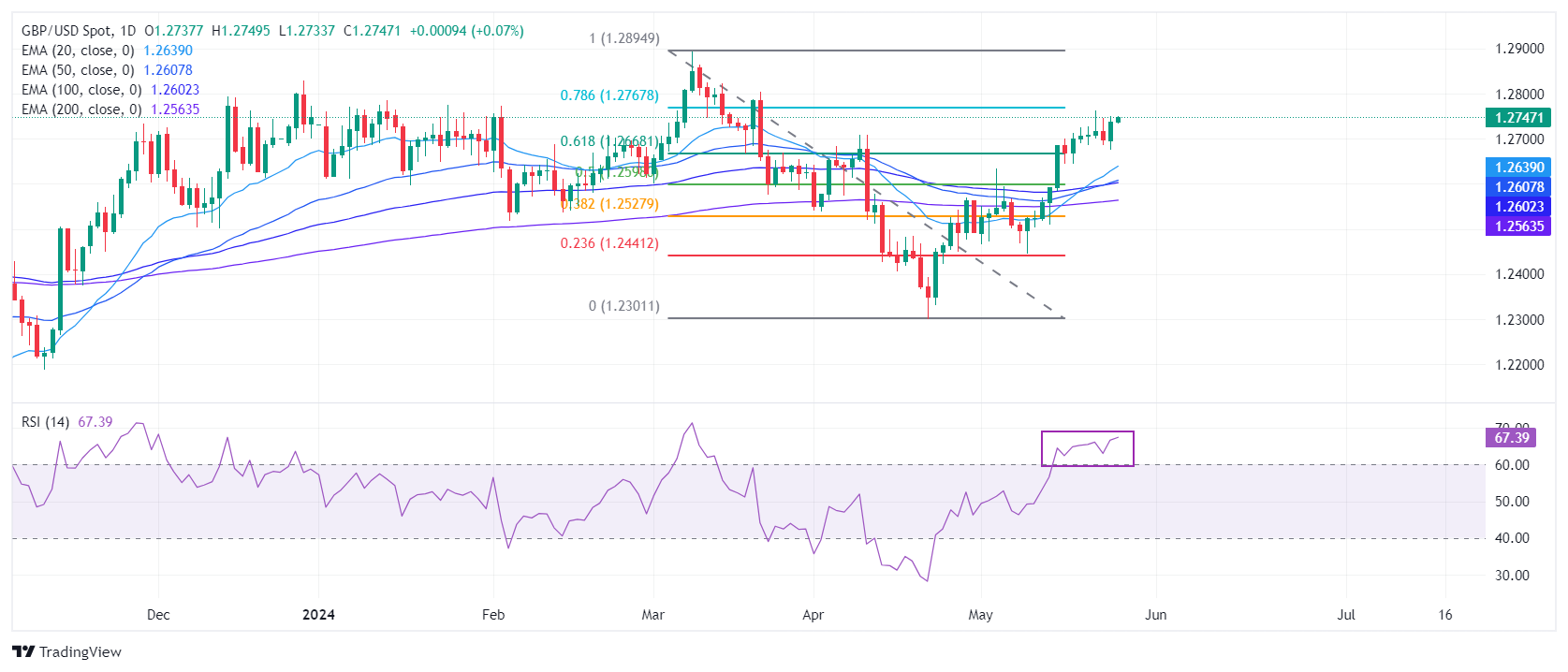

GBP/USD Forecast: Pound Sterling stays bullish to start the week

GBP/USD stays in a consolidation phase near 1.2750 in the European session on Monday after closing the previous week marginally higher. The pair's near-term technical picture suggests that the bullish bias remains intact but 1.2760 could be a tough resistance to crack.

The US Dollar (USD) benefited from upbeat macroeconomic data releases in the previous week but GBP/USD managed to hold its ground as the strong inflation data from the UK revived expectations about a delay in the Bank of England's (BoE) policy pivot. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to modest recovery gains above 1.0700

EUR/USD clings to small recovery gains above 1.0700 on Monday following the previous week's slide. European political uncertainty continues to undermine the Euro and cap the pair's upside, while the US Dollar consolidates recent gains amid a tepid market mood.

GBP/USD remains pressured below 1.2700 amid cautious mood

GBP/USD stays on the back foot and trades below 1.2700 in the second half of the day on Monday. The hawkish Fed expectations and a softer risk tone keep the US Dollar afloat, exerting downward pressure on the pair. Fedspeak remains next in focus.

Gold under pressure, flirting with $2,310

Gold struggles to build on Friday's gains and trades in the red below $2,320 on Monday. The benchmark 10-year US Treasury bond yield rebound above 4.25% following last week's slide, making it difficult for XAU/USD to gain traction.

XRP stuck below $0.50 as Ripple CLO says SEC has abandoned demand for $2 billion fine

XRP struggles to make a comeback above sticky resistance at $0.50 on Monday as traders continue to assess the legal skirmishes between blockchain firm Ripple and the US Securities and Exchange Commission (SEC).

Five fundamentals for the week: French opinion polls, US Retail Sales and Bank of England eyed Premium

Politics is back, with elections in France rocking markets. US Retail Sales and flash PMIs will provide insights into America's slowdown. The Bank of England announces its decision after all-important CPI data.