GBP/USD: The uphill battle for the GBP is becoming stronger with increasing UK restrictions [Video]

The GBPUSD is sitting on some pretty heavy support on top of its 100 and 200 daily moving average. The uphill battle for the GBP is becoming stronger with increasing UK restrictions to slow down COVID-19. The USD is helping GBPUSD falls as it is also finding strength from a combination of general risk aversion and position trimming into quarter end.

With rising COVID-19 cases, job losses expected at the end of the furlough scheme, negative rates gently hinted at by the Bank of England, and potential Brexit calamity expect sellers on the GBPUSD pair. Read More...

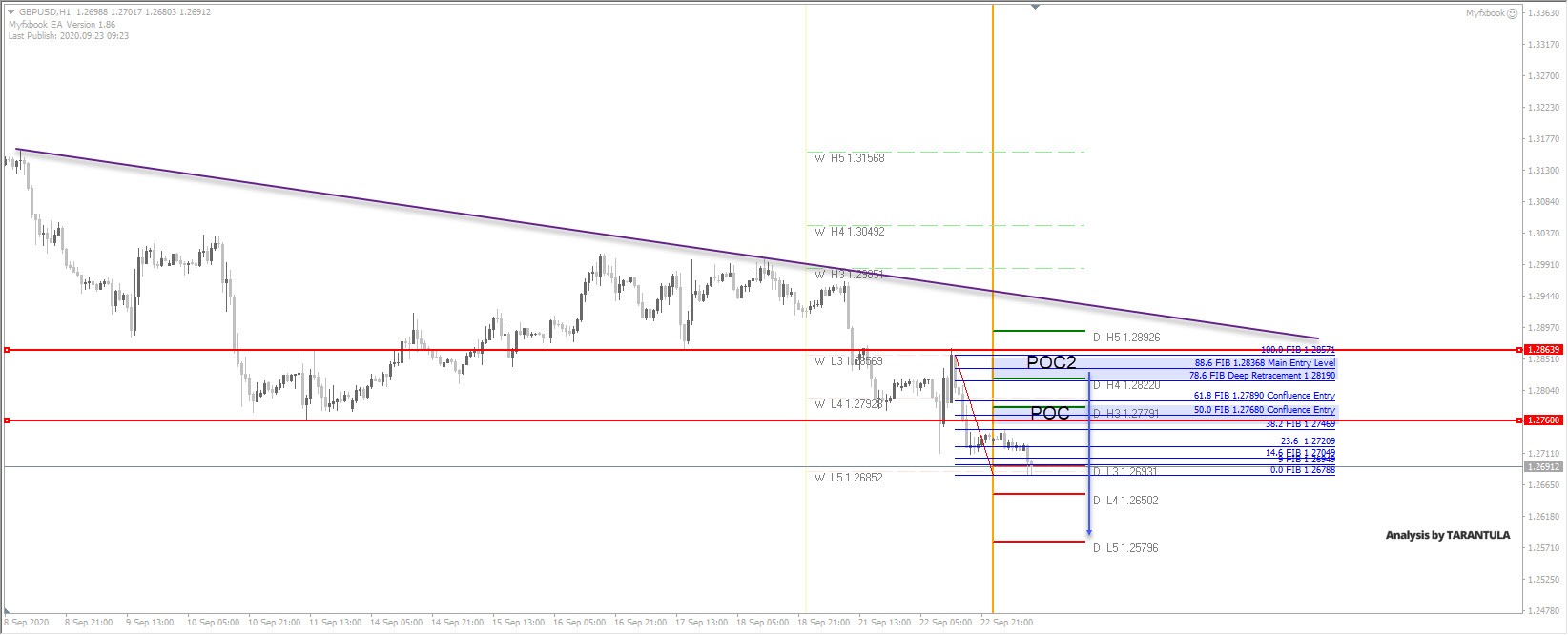

GBP/USD new lows are smiling to seller

The GBP/USD is clearly bearish. At this point the price stands at the W H5 so we might see a rally which sellers might use for selling at a better price.

There are 2 POC zones where we could see new wave of selling. The first POC 1.2760-90 is additionally supported by the order block (red line). In the case of a deeper retracement up watch for 1.2820-60. Reversal patterns in the zone could also show sellers and we should see a further drop towards 1.2780, 1.2685 and 1.2650. Below 1.2650, 1.2579 is the target. Selling the rallies continues. Read More...

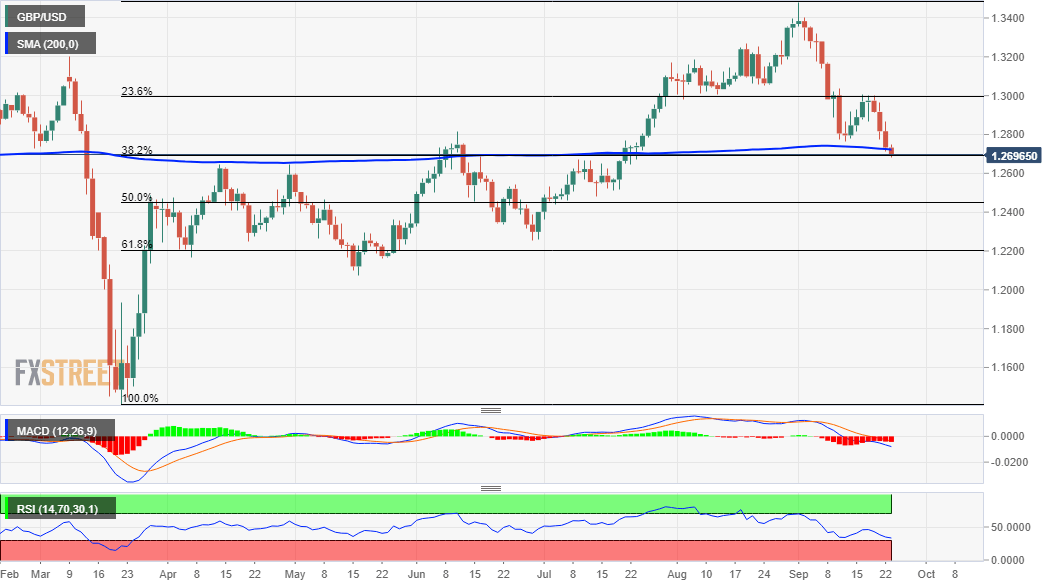

GBP/USD Analysis: Break below 200-DMA paves the way for further near-term weakness

The GBP/USD pair had some good two-way price moves on Tuesday and was influenced by a combination of diverging forces. Following an early slide to the 1.2700 neighbourhood, the pair caught some intraday traction and rallied over 150 pips after the BoE Governor Andrew Bailey downplayed expectations that the central bank could soon cut interest rates below zero. At an online talk hosted by the British Chambers of Commerce, Bailey said that the mention of negative rates doesn't imply anything about the possibility of using it. He also noted that the experience of negative rates elsewhere was mixed, and the effectiveness depends on the structure of the banking system and the timing of the move.

The British pound got an additional from positive Brexit-related headlines. EU source reportedly said that Brexit talks have been going a bit better than expected and that there is a 'window of opportunity'. The UK PM spokesman confirmed the EU Chief Brexit Negotiator Michel Barnier's visit tomorrow for informal talks. The spokesman further stressed that the UK will continue to work hard on securing a Brexit deal. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.