GBP/USD Forecast: Football not coming home, restrictions not going so fast, sterling could suffer

Football is not coming home, it is going to Rome – England's dreams of winning the Euro 2020 football tournament have been shattered after an exhausting final in which Italy won. British traders have woken up tired, but forex never sleeps and sterling is on the move – to the downside.

"Freedom Day" may be less free than earlier anticipated. While the UK is set to lift a substantial set of restrictions on July 19, the persistent spread of COVID-19 cases has prompted ministers to suggest that wearing masks indoors and other rules will stay intact. Hints of a slower return to normal mean a weaker recovery. Read more...

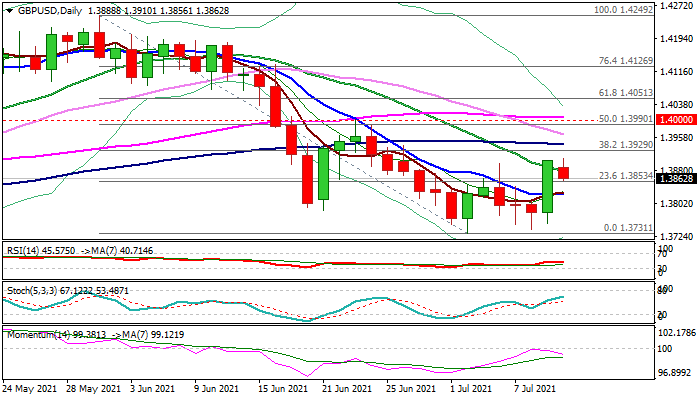

GBP/USD analysis: Finds resistance near 1.3900

During the early hours of this week's trading, the GBP/USD currency exchange rate bounced off the resistance of a zone that surround the 1.3900 level. By the middle of Monday's trading, the rate was expected to look for support near the 1.3850 level.

Near the 1.3850 level, the rate could find support in the weekly simple pivot point at 1.3853 and the last week's significant zone near 1.3840. If these levels would be passed, the pair could reach the combined support of the 55, 100 and 200-hour simple moving averages near 1.3820. Read more...

GBP/USD outlook: Bulls are taking a breather after strong rally on Friday

Cable is consolidating under a new two-week high (1.3904), posted after Friday’s 0.9% rally, as sterling accelerated higher on fresh risk mode, inspired by global equity gains. Pound’s sentiment improves on expectations that the government would remove nearly all coronavirus restrictions on July 19, while weaker dollar adds to a positive near-term outlook.

Fresh bulls need to clear important barriers at 1.3929/59 (Fibo 38.2% of 1.4249/1.3731 fall/daily cloud base) to generate a stronger reversal signal, which would require a break of the key 1.40 resistance zone for confirmation. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds gains near 0.7000 amid PBOC's status-quo, Gold price surge

AUD/USD is clinging to mild gains near 0.7000 early Monday. The pair benefits from a risk-on market profile, China's steady policy rates and surging Gold and Copper prices. Focus now remains on Fedspeak for fresh impetus.

Gold eyes $2,450 and Fedspeak for a sustained uptrend

Gold price is off a new lifetime high at $2,441 but looks to extend Friday’s upswing at the start of the week on Monday. The US Dollar is struggling alongside the US Treasury bond yields, as risk sentiment remains in a sweeter spot on China’s stimulus measures.

EUR/USD grinds higher toward 1.0900, Fedspeak eyed

EUR/USD is edging higher toward 1.0900 early Monday, helped by a better market mood. The pair also draws support from softer US Dollar and US Treasury bond yields, awaiting Fedspeak amid light European trading.

Week Ahead: Ethereum and DeFi to come under spotlight this week Premium

Bitcoin’s attempt at a comeback has stirred the pot, causing altcoins to become volatile again. With the US Securities and Exchange Commission set to make its decision on Ethereum ETFs this week, some sectors of altcoins might see higher liquidity and volatility than others.

Will they/won’t they cut rates as commodity prices in focus

What a difference a couple of days make. One day stock markets are making record highs and banking on rate cuts, the next stocks are giving back gains and rate cut expectations are being pared back.