Pound Sterling Price News and Forecast: GBP/USD – Brexit, virus strain sterling

GBP/USD Outlook: Bears trying to seize control amid Brexit/Covid woes, US CPI in focus

The GBP/USD pair struggled to capitalize on its intraday positive move and witnessed a dramatic turnaround on Wednesday in the wake of fresh Brexit jitters. The pair gained some traction after the Bank of England Chief Economist, Andy Haldane warned about rising inflationary pressures and added that the central bank might need to turn off the tap of its huge monetary stimulus. Bulls, however, struggle to capitalize on the move and failed ahead of the 1.4200 mark amid concerns about souring UK-EU relations. Read more...

GBP/USD Forecast: Brexit, virus strain sterling, critical support breached, US data eyed

The highest number of COVID-19 cases since February – the Delta virus variant is spreading fast, making the UK's last reopening stage less and less likely. While Britain is a world leader in vaccination, this strain first identified in India is finding its way to those not fully immunized. The highly anticipated "Freedom Day" will likely be postponed from June 21 to early July.

Economic damage from the delayed return to normal is joined by threats of quota tariffs from the EU. Brussels and London remain at loggerheads over the implementation of the Northern Irish protocol and tensions are mounting. Maroš Šefčovič, the EU´s Brexit point-person, said that his patience is running thin. Read more...

Technical analysis: Will the GBP/USD retreat continue?

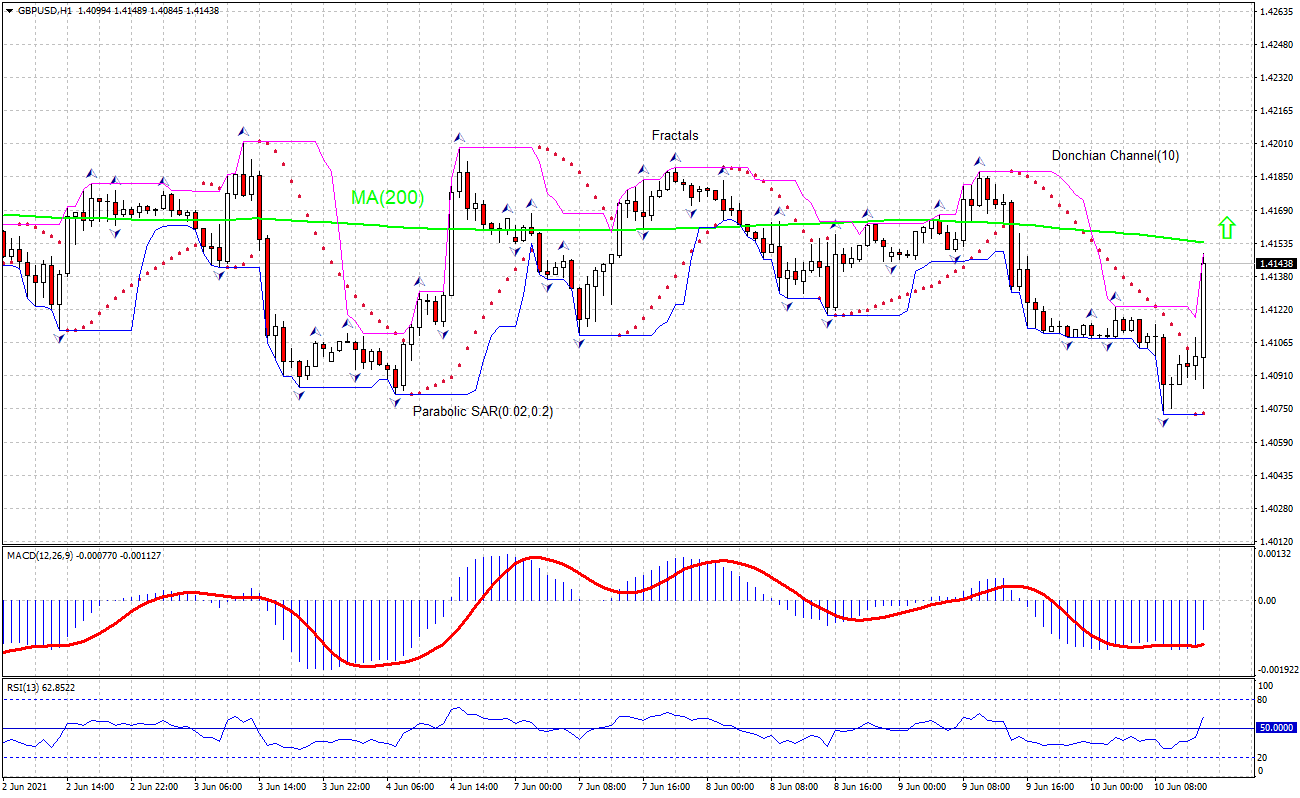

The GBPUSD technical analysis of the price chart on a 1-hour timeframe shows GBPUSD: H1 is rebounding to test the 200-period moving average MA(200) which is declining. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 1.4154. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1.4072. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. Read more...

Author

FXStreet Team

FXStreet