GBP/USD Forecast: Brexit, virus strain sterling, critical support breached, US data eyed

- GBP/USD has been on the back foot due to growing Brexit acrimony and virus concerns.

- US inflation figures are set to rock markets.

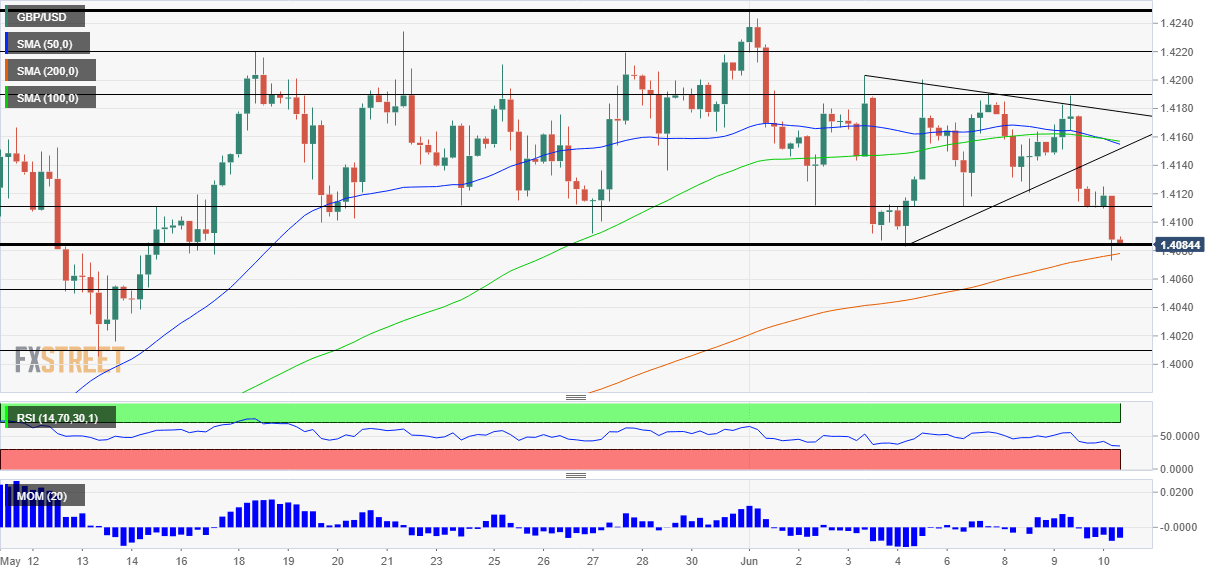

- Thursday's four-hour chart is pointing to further losses.

The highest number of COVID-19 cases since February – the Delta virus variant is spreading fast, making the UK's last reopening stage less and less likely. While Britain is a world leader in vaccination, this strain first identified in India is finding its way to those not fully immunized. The highly anticipated "Freedom Day" will likely be postponed from June 21 to early July.

Economic damage from the delayed return to normal is joined by threats of quota tariffs from the EU. Brussels and London remain at loggerheads over the implementation of the Northern Irish protocol and tensions are mounting. Maroš Šefčovič, the EU´s Brexit point-person, said that his patience is running thin.

Will outside intervention help calm Brexit tensions? US President Joe Biden – who says he is 5/8 Irish – will reportedly pressure UK Prime Minister Boris Johnson to settle the remaining issues, in order to preserve the Good Friday peace agreement in the Emerald Isle. However, the heads of state at the G-7 Summit in London have greater topics to tackle.

Both the virus and Brexit have been weighing on sterling, sending GBP/USD to breach critical support at 1.4080. However, the break is yet to be confirmed and a critical American indicator may trigger a bounce or consolidate the break.

Biden has been focusing on stimulating the US economy after the pandemic, and some accuse him of adding fuel to the fire with too much stimulus. That will come to a test later on Thursday with Consumer Price Index figures for May.

The economic calendar is pointing to an increase of 4.7% YoY and a leap above 5% could boost the dollar on elevated expectations for the Federal Reserve to buy fewer bonds.

However, the greenback already gained ground ahead of the release. That implies a potential "buy the rumor, sell the fact" response that may salvage GBP/USD from fall further down.

US CPI May Preview: Inflation angst is coming

GBP/USD Technical Analysis

Pound/dollar is suffering from fresh downside momentum on the four-hour chart and has lost the 50 and 100 simple moving averages. In its dip under 1.4080, cable also temporarily breached the 200 SMA, but managed to bounce. All in all, bears are gaining ground, but do not have full control.

Below 1.4080, the next levels to watch are 1.4055 and 1.4010, which supported the pair in May.

Some resistance is at 1.4110, which provided support earlier in the week, and then the recent high of 1.4190. Further above, 1.4220 and 1.4250 await the bulls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.