Pound Sterling Price News and Forecast: GBP/USD approaches 1.4200 as US dollar accelerates the decline

GBP/USD Price Analysis: 1.4250 remains a tough nut to crack for the bulls

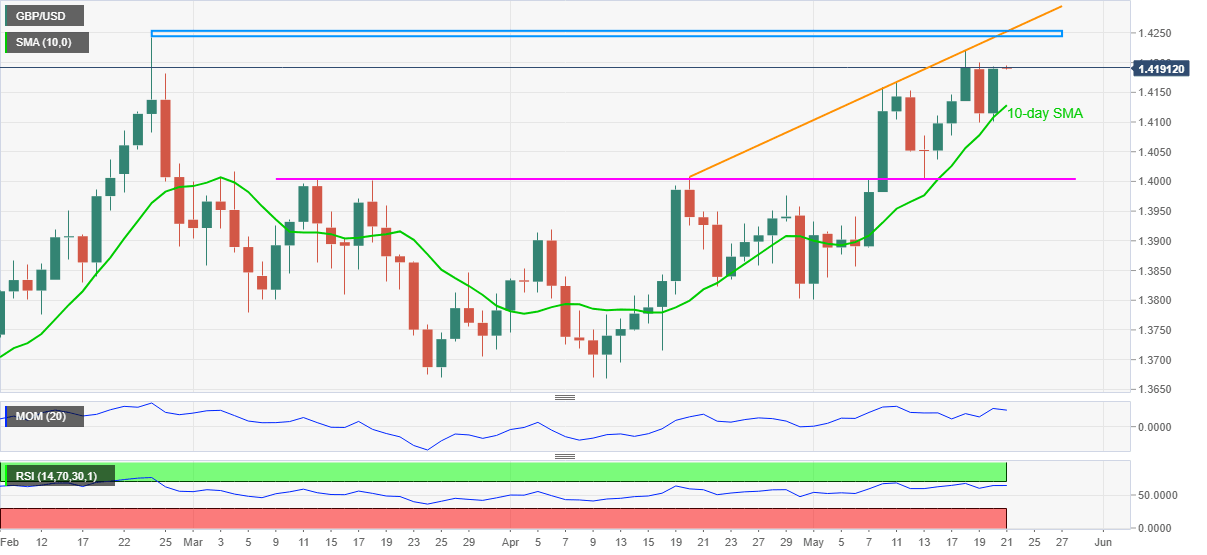

GBP/USD stays on the front foot around 1.4190 after the previous day’s heavy run-up during Friday’s initial Asian session. In doing so, the cable justifies its bounce from 10-day SMA to aim for the key hurdle around mid-1.4200. However, oscillators are likely testing the pair’s further upside.

During the run-up to 1.4250 resistance confluence, comprising an ascending trend line from April 20 and February’s high, the 1.4200 threshold and monthly peak near 1.4220 offer intermediate halts.

GBP/USD approaches 1.4200 as US dollar accelerates the decline

The GBP/USD rose further and climbed to 1.4182, reaching a fresh daily low. Cable is erasing Wednesday’s losses and is approaching the 1.4200 supported by a decline of the US dollar across the board and risk appetite.

Equity prices in Wall Street reach fresh highs. The Dow Jones rises by 0.81% and the Nasdaq by 1.72%. The improvement in risk appetite weighed on the US dollar. The DXY fell to 89.78, and it remains near the low, down 0.42% for the day, looking at May’s lows.

Author

FXStreet Team

FXStreet