Pound Sterling Price News and Forecast: GBP gains on higher UK CPI, Retail Sales

Pound Sterling gains on higher UK CPI, Retail Sales and flash PMI data awaited

The Pound Sterling (GBP) trades higher against its major currency peers, except antipodeans, during the European trading session on Thursday. The British currency gains as the United Kingdom (UK) Consumer Price Index (CPI) rose more than expected in December.

The data released on Wednesday showed that the headline inflation accelerated to 3.4% year-on-year (YoY) compared to estimates of 3.3% and the November reading of 3.2%. Read more...

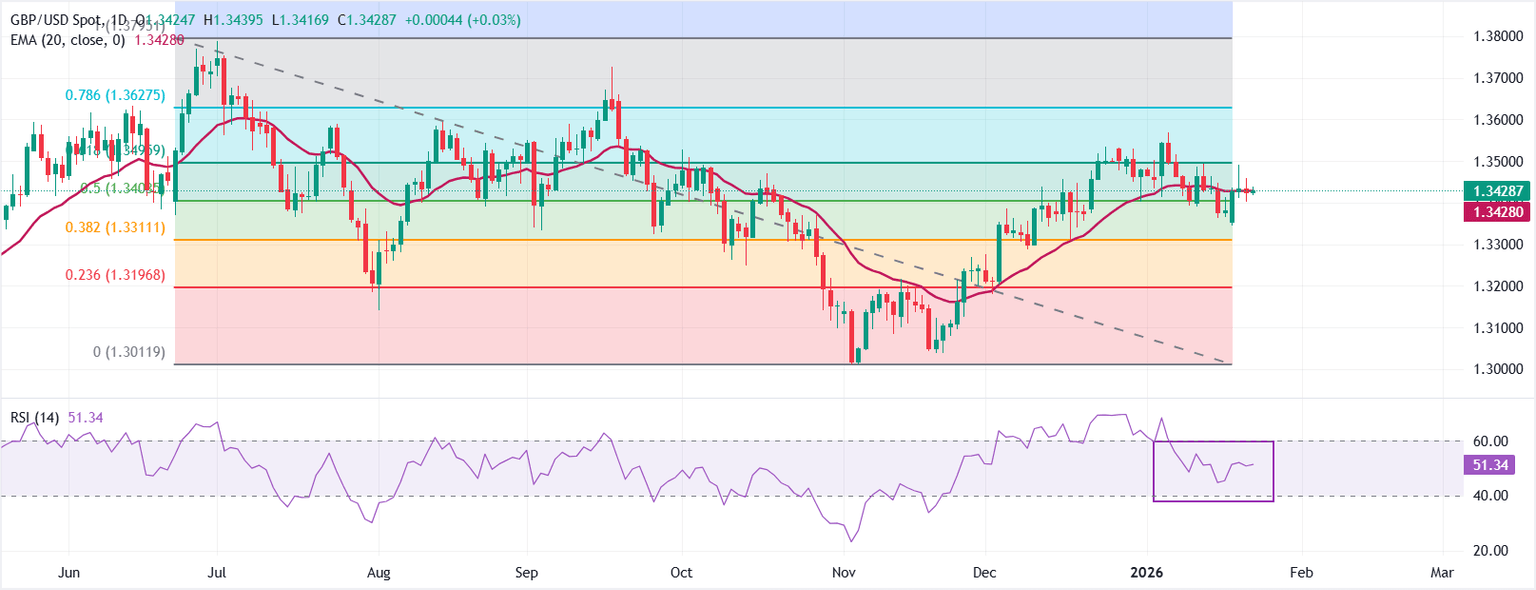

GBP/USD: Likely to range-trade between 1.3400 and 1.3460 – UOB Group

Pound Sterling (GBP) is likely to range-trade between 1.3400 and 1.3460. In the longer run, the near-term bias is tilted to the upside, but GBP may not break above 1.3505, UOB Group's FX analysts Quek Ser Leang and Lee Sue Ann note.

24-HOUR VIEW: "Yesterday, we expected GBP to 'range-trade between 1.3420 and 1.3470'. GBP subsequently traded in a lower range of 1.3402/1.3458, closing largely unchanged at 1.3433 (-0.08%). There has been no shift in either downward or upward momentum, and we continue to expect range-trading today, most likely between 1.3400 and 1.3460." Read more...

Author

FXStreet Team

FXStreet