GBP/USD analysis: Respects channel

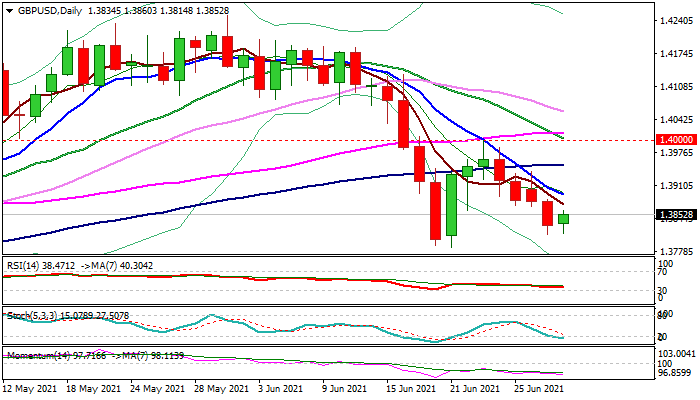

The GBP/USD passed the support of the 1.3860 level and declined to the support of the lower trend line of the channel down pattern. The trend line provided the pair with enough support for a recovery to the 1.3860 level.

The 1.3860 marks managed to provide enough resistance for the pair to decline. By the middle of Wednesday's trading, the GBP/USD had reached the 1.3820 marks, which appeared to be providing support. If the rate recovers from the 1.3820 level, it would eventually face the resistance of the 1.3860 marks and the 55-hour simple moving average, which would approach from above. Read more...

GBP/USD outlook: Bears take a breather ahead of strong supports at 1.3800 zone

Cable bounced on Wednesday after retesting 1.3814 (one-week low posted on Tuesday), as traders took some profits from a four-day drop. Near-term bears face headwinds from strong bids at 1.3800 zones (1.13814 (Today/Tue lows / 1.3791/86 – lows of June 18/21) but the overall picture remains bearish on daily chart.

Limited correction is seen likely before bears re-take control, as negative momentum continues to rise and daily moving averages are in bearish configuration. Falling 10DMA offers solid resistance at 1.3891, ahead of 100DMA / daily cloud base (1.3950) which should cap upticks and protect 1.40 breakpoint (psychological barrier, reinforced by falling 20DMA / recent recovery spike high). Read more...

GBP/USD Forecast: Sterling scores, pound suffers its own goals (and dollar strength)

It has been a brilliant night for Sterling – Footballer Raheem Sterling, not the currency. England beat Germany 2:0 in a high-stakes match, thrilling Brits that were glued to their TV sets. However, pound sterling bulls glued to their screens could find little solace in the pair's performance.

The British currency has been suffering from several worries. First, the rapid spread of the Delta coronavirus variant is weighing on sentiment. While the UK will likely ease restrictions on July 19 as planned, concerns about a harsh winter are rising. That dampens the prospects for the economy moving forward. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats to 1.0750 area as USD recovers

EUR/USD stays under modest bearish pressure and trades slightly below 1.0750 in the European session on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD drops below 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold stays near $2,310 as US yields edge higher

Following a quiet Asian session, Gold retreated slightly to the $2,310 area. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.