Pound Sterling steadies while US Dollar rises on persistent price pressures

- The Pound Sterling holds gains near 1.2500 even though the US Dollar recovers sharply.

- BoE Governor Andrew Bailey expects a sharp drop in April’s inflation.

- US GDP grew at a slower pace of 1.6% in the first quarter this year.

The Pound Sterling (GBP) aims to hold strength near the psychological resistance of 1.2500 against the US Dollar (USD) in Thursday’s early American session. The GBP/USD struggles as the US Dollar rebounds sharply after the United States Q1 Gross Domestic Product (GDP) report showed that inflation accelerated sharply. The preliminary GDP Price Index rose sharply by 3.1% from the prior reading of 1.7%. This has prompted expectations that the Federal Reserve (Fed) will keep interest rates restrictive for a longer period.

Meanwhile, the US economy grew at a slower pace of 1.6% from expectations of 2.5% and the former reading of 3.4%. This has deepened concerns over the US economic outlook.

On the United Kingdom front, Investors’ confidence in the UK economy's outlook improved after the preliminary PMI report from S&P Global/CIPS for April showed that new business volumes increased across the private sector as a whole. The agency also reported that the rate of growth of overall activity was the strongest since May 2023. However, the expansion was centred on the service sector, as manufacturers saw a moderate downturn in order books.

Despite the recent upturn, downside risks to the Pound Sterling remain high as investors expect the Bank of England (BoE) will pivot to interest-rate cuts before the Federal Reserve (Fed) does so. Last week, BoE Governor Andrew Bailey said: “I expect next month's inflation number will show quite a strong drop.” Bailey added that Oil prices haven't leaped as much as expected and that the effect of the Middle-East conflict “is less than feared.”

Daily digest market movers: Pound Sterling struggles to hold gains as US Dollar rises

- The Pound Sterling hovers near the psychological resistance of 1.2500 against the US Dollar. A sharp recovery in the US Dollar has built slight pressure on the GBP/USD pair. The US Dollar moves higher as the higher GDP Price Index has offset the impact of weak GDP growth and a poor preliminary US PMI report that raised doubts over the strong economic outlook of the economy. Meanwhile, similar data for the UK presented a recovery in overall private-sector activity fueled by the Services sector.

- The US PMI report showed on Tuesday that surprisingly both the Manufacturing and Services PMI were down from the prior readings. The Manufacturing PMI even fell below the 50.0 threshold, signalling a contraction. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said: “The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April. Further pace may be lost in the coming months, as April saw inflows of new business fall for the first time in six months and firms’ future output expectations slipped to a five-month low amid heightened concern about the outlook.

- Despite uncertainty over the US economic outlook, speculation that the Federal Reserve will begin lowering interest rates after the September meeting remains firm. Going forward, investors will focus on the core Personal Consumption Expenditure Price Index (PCE) data for March.

- For more clarity over Fed’s rate-cut timing, investors will wait for the core PCE inflation data for March, to be published on Friday. The underlying inflation data is estimated to have grown steadily by 0.3% on month, with annual figures softening to 2.6% from the 2.8% recorded in February.

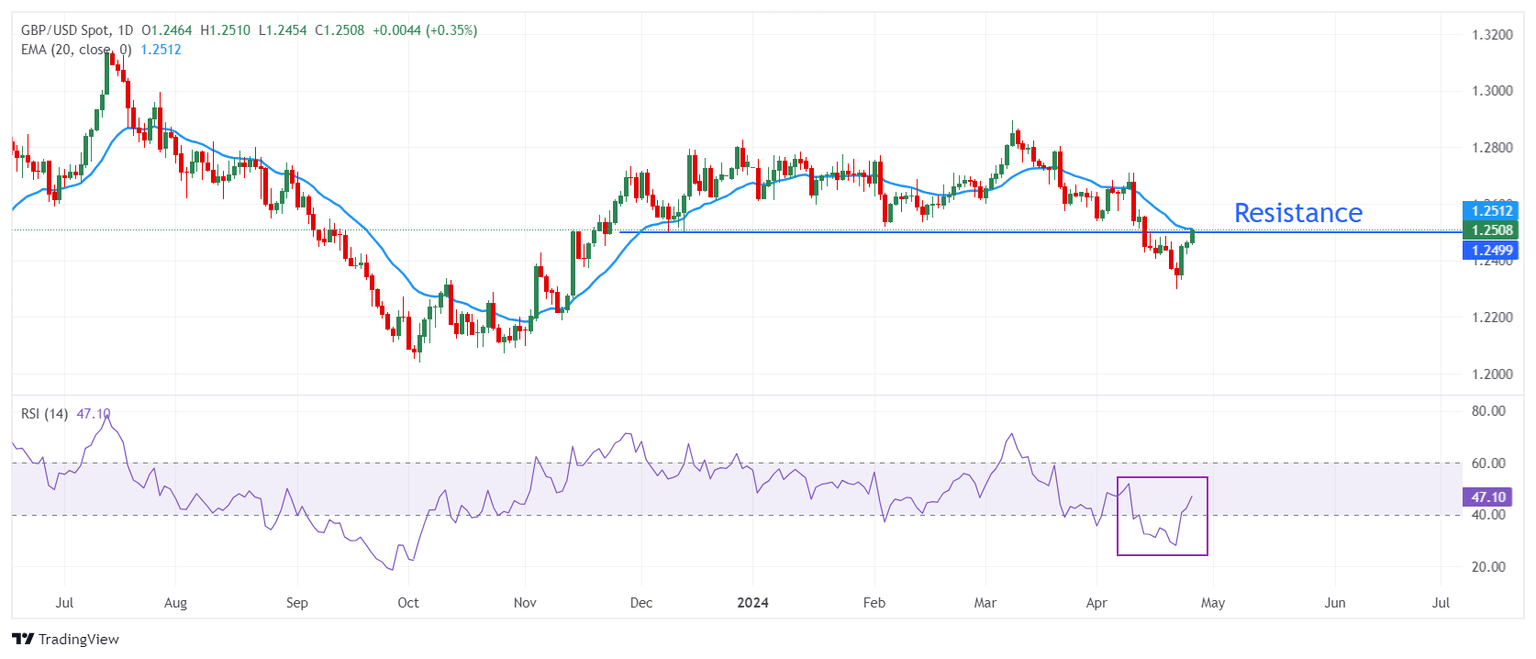

Technical Analysis: Pound Sterling trades close to 1.2500

The Pound Sterling extends its recovery to the crucial resistance of 1.2500 against the US Dollar. The GBP/USD pair moves sharply higher after finding strong buying interest near a five-month low of around 1.2300. The near-term outlook of the Cable is still bearish as the 20-day Exponential Moving Average (EMA) at 1.2509 is declining.

The 14-period Relative Strength Index (RSI) rebounds above 40.00, suggesting that a bearish momentum has concluded for now. However, the bearish bias remains intact.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.