Pound Sterling slumps amid uncertainty ahead of BoE’s policy decision

- The Pound Sterling dips slightly below 1.2500 due to multiple headwinds.

- Investors expect UK interest rates to remain steady at 5.25% with less-hawkish BoE’s guidance on interest rates.

- Fed’s Kashkari supports keeping interest rates steady for the entire year.

The Pound Sterling (GBP) slips below the psychological support of 1.2500 against the US Dollar (USD) in Wednesday’s early New York session. The GBP/USD pair faces a sell-off due to multiple headwinds, such a sharp recovery in the US Dollar and uncertainty ahead of the Bank of England’s (BoE) interest rate decision, which will be announced on Thursday.

Interest rates in the United Kingdom are expected to remain steady at 5.25% for the sixth time in a row. However, the BoE could turn slightly dovish on the interest rate outlook as policymakers are confident that the headline inflation could have returned to the desired rate of 2% in April, according to comments from BoE Governor Andrew Bailey in the annual Spring Meeting hosted by the International Monetary Fund (IMF) last month.

Financial markets anticipate that the BoE will start reducing interest rates from the June meeting. Traders price in 53 basis points (bps) of easing this year, implying at least two quarter-point cuts, having previously fully priced only one rate cut after inflation data last month showed prices slowed by less than expected in March, Reuters reported. The expectations for the same strengthened after Andrew Bailey said in the last monetary policy meeting that speculation for two or three rate cuts this year is reasonable.

Daily digest market movers: Pound Sterling extends its downside while US Dollar recovers

- The Pound Sterling extends its correction slightly below the psychological support of 1.2500 against the US Dollar. The appeal for risk-perceived assets weakens after hawkish guidance on United States interest rates by Minneapolis Federal Reserve (Fed) Bank President Neel Kashkari on Tuesday.

- Kashkari cited concerns over stalling progress in disinflation due to housing market strength and warned that interest rates need to remain where they are possibly for the entire year. For a rate cut, Kashkari emphasized that he wants to see multiple positive inflation readings, which could build confidence that inflation is on course to return to the desired rate of 2%. He added that weakness in the job market could also justify a rate cut.

- Kashkari’s hawkish interest rate outlook has improved the appeal for the US Dollar, with the US Dollar Index (DXY)—which tracks the Greenback’s value against six major currencies—extending its upside to 105.50. The USD Index recovers the majority of losses linked with weak US Nonfarm Payrolls (NFP) and ISM Services PMI data for April.

- The speculation that the Fed will reduce interest rates from their current levels in the September meeting remains firm. The CME FedWatch tool shows that traders see two rate cuts this year.

- This week, investors will focus majorly on speeches from Fed policymakers to predict the next move in the US Dollar due to the absence of top-tier US economic data. On Wednesday, Fed Vice Chair Philip Jefferson, President of the Federal Reserve Bank of Boston Susan Collins and Fed Governor Lisa Cook are lined up to provide interest rate guidance.

Technical Analysis: Pound Sterling trades below 1.2500

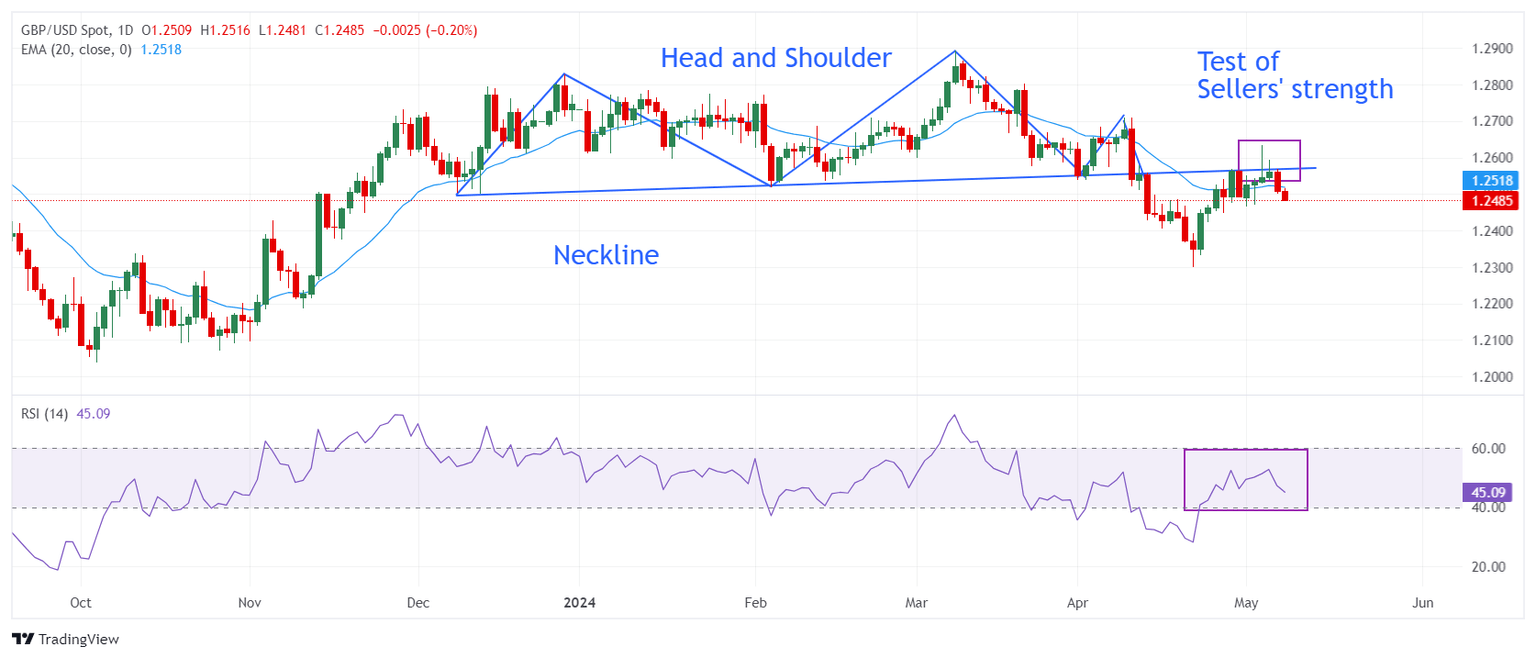

The Pound Sterling falls slightly below the psychological support of 1.2500. The GBP/USD pair is under pressure after facing strong resistance above the neckline of the Head and Shoulder (H&S) chart pattern formed on a daily timeframe. On April 12, the pair suffered an intense sell-off after breaking below the neckline of the H&S pattern plotted from December 8 low around 1.2500.

Investors tend to turn cautious about the near-term outlook as the Cable fails to sustain above the 20-day Exponential Moving Average (EMA), which trades at around 1.2520.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting indecisiveness among market participants.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu May 09, 2024 11:00

Frequency: Irregular

Consensus: 5.25%

Previous: 5.25%

Source: Bank of England

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.