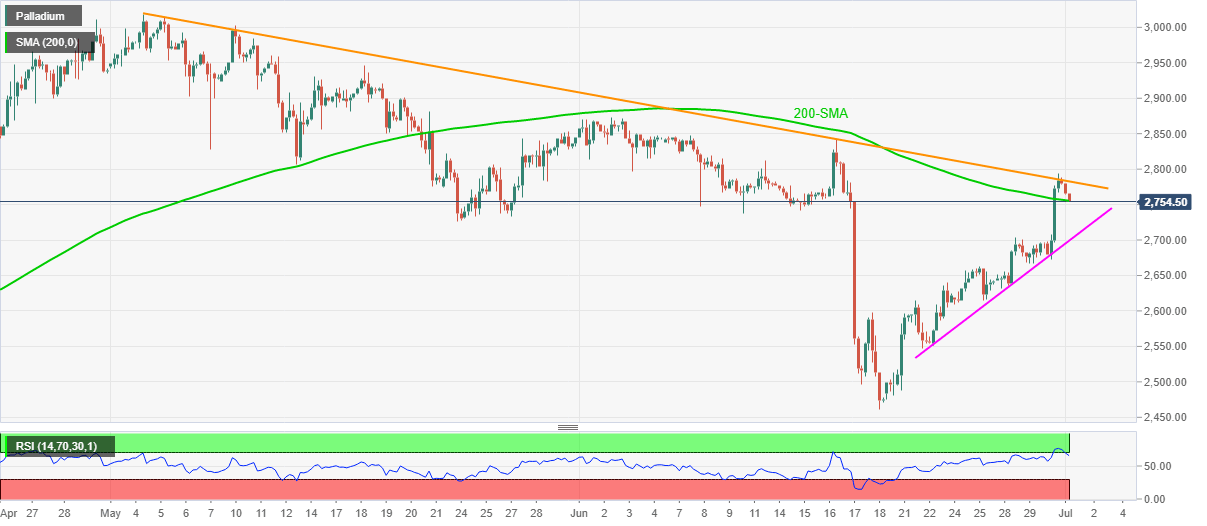

Palladium Price Analysis: 200-SMA tests XPD/USD sellers around mid-$2,700s

- Palladium pulls back from two-month-old resistance line amid overbought RSI.

- May’s low adds to the downside filter ahead of weekly support line.

- Bulls can aim for June’s top on the trend line breakout.

Palladium (XPD/USD) stays on the back foot, down 1.0% around $2,755, as European traders prepare for Thursday’s bell. The commodity took a U-turn from a downward sloping trend line from early May the previous day, backed by the overbought RSI conditions. The following declines, however, battle the 200-SMA to keep the sellers hopeful.

Given the RSI line suggesting further losses below the $2,755 immediate support, May’s monthly bottom surrounding $2,726 is likely to return to the chart.

Though, any further weakness will be checked by a downward sloping trend line from June 23, near the $2,700 threshold.

Meanwhile, an upside clearance of the $2,782 hurdle, comprising the stated resistance line, will initially aim for the $2,800 round figure before attacking the mid-June peak of $2,841.

In a case where the XPD/USD bulls remain dominant past $2,841, the previous month’s high of $2,872 will be on their radar.

To sum up, palladium prices are likely to consolidate further, amid overbought RSI, but the bears may not be welcomed until the quote stays above the short-term support line.

Palladium: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.