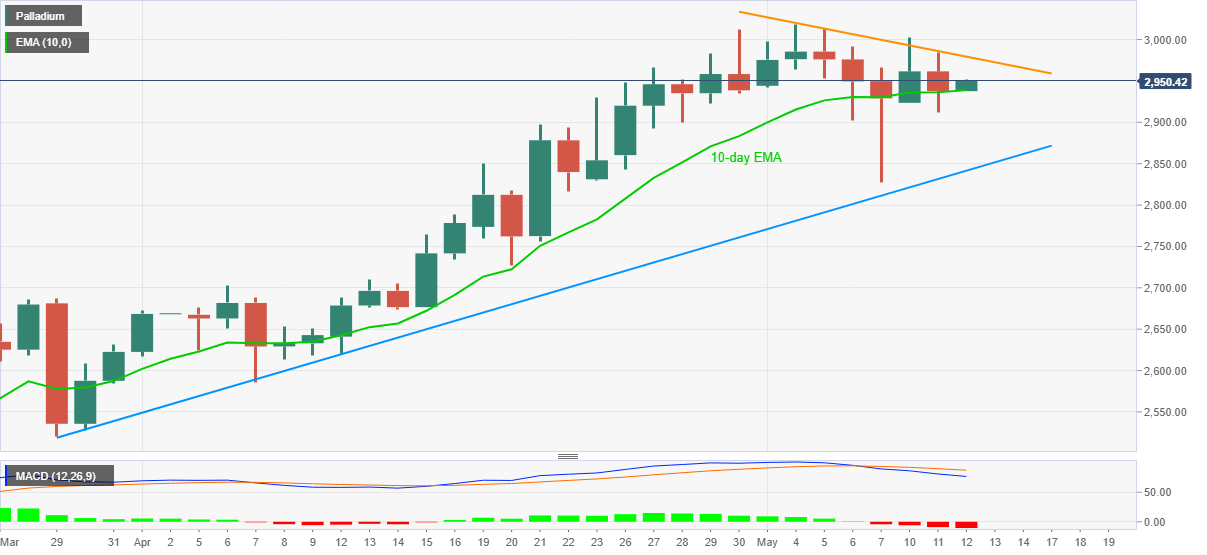

Palladium Price Analysis: 10-day EMA defends XPD/USD bulls around mid-$2,900s

- Palladium bucks the commodity basket’s latest trend, probes intraday high of late.

- Buyers aim for weekly resistance line on bounce off immediate EMA support.

- Bearish MACD could test the bulls afterward, six-week-old support line adds to the downside filters.

Palladium (XPD/USD) picks up bids around $2,950, up 0.44% intraday, as European traders brace for Wednesday’s trading bell. In doing so, the commodity highlights 10-day EMA as near-term strong support even as the monthly resistance line tests the buyers amid bearish MACD.

Hence, the latest corrective pullback from the 10-day EMA level of $2,938 propels the bright metal towards the stated trend line resistance, around $2,980 by the press time.

However, any further upside will have a bumpy road as the $3,000 threshold and the recent top, also the all-time, near $3,020 should cap the run-up.

Meanwhile, a downside break of $2,938 could catch a breather around late April tops near $2,900 ahead of highlighting an ascending support line from March 29, close to $2,841.

Overall, Palladium stays in the upward trajectory but bulls need a strong push and may look to the US CPI figures for a clear direction.

Palladium daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.