Oil turns red with IEA and OPEC not seeing eye-to-eye

- WTI Oil sideways in a broader range trade with Aramco scrubbing production boost.

- Oil traders are still positioned for more upside potential with bullish option market positioning.

- The US Dollar Index steady below 103.00, with data-driven week ahead while Fed enters blackout period.

Oil prices falling in the red with a Risk Off tone in the US session taking it over, while earlier Saudi Arabia’s Aramco has postponed plans to boost its production from 12 to 13 million barrels per day by 2027. Still, the news only moves the price by a touch because the actual production was never close at these levels, and thus is not being taken away from markets. All in all, nothing changed much and this puts the Crude in a bit of a range between $75 and $80.

The US Dollar is entering a week in which it will move from one data point to the next. The glue or guidance that markets normally get from US Federal Reserve members’ speeches will not be taking place this week as the Fed has entered its blackout period ahead of the rate decision and Chairman Jerome Powell’s speech next week. Expect thus a very whipsaw week for the US Dollar, facing scenarios such as when one data point contradicts the next, or an accelerated move in one direction when all data falls in line with one bias.

Crude Oil (WTI) trades at $77.10 per barrel, and Brent Oil trades at $81.42 per barrel at the time of writing.

Oil news and market movers: Rolling over the floor

- The amount of Crude Oil held in ships and containers worldwide, shrunk the last seven days by 8.1% against previous week. This means some substantial buying has occured recently.

- The International Energy Agency (IEA) and OPEC are not seeing eye-to-eye on the Oil outlook with the IEA seeing more downside demand while OPEC rather sees demand remaining quite steady depsite the projected slowdown in the world economy.

- The situation in Gaza remains in a stalemate with no ceasefire deal reached over the weekend. With Ramadam having started, the people in Gaza remain in search of food and basic supplies.

- Saudi Aramco has halted its plans to boost its oil-production capacity. The reasoning behind it is the robust non-OPEC supply growth in recent months, which could create a severe supply glut in the market.

- Furthermore, Saudi Aramco is set to boost its dividend payments as elevated benchmark Oil prices are boosting revenue and cash flow for the company.

- An Oil tanker in India has hit a crude import terminal at Sikka port. The timing of possible delays in Crude deliveries is still unclear.

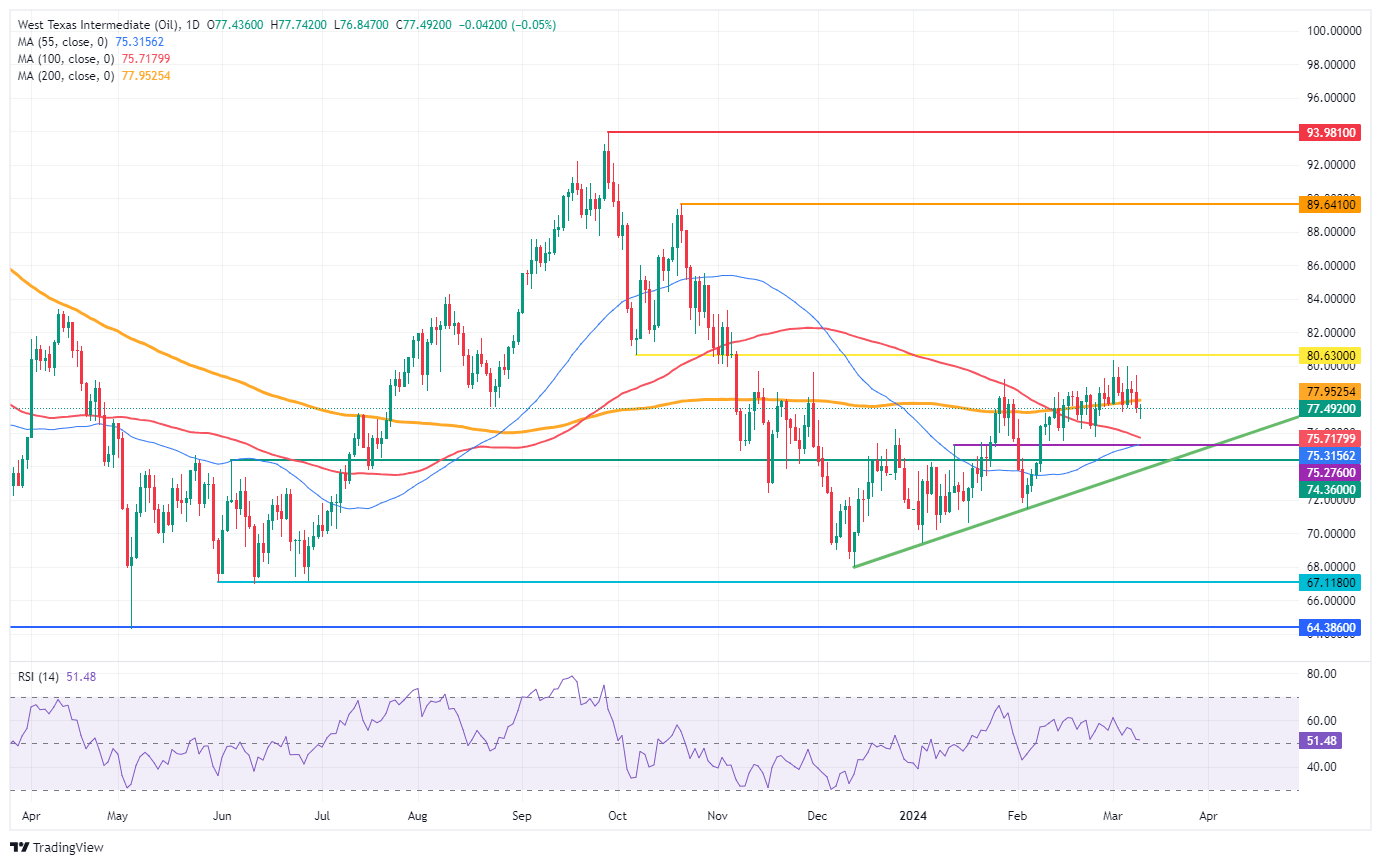

Oil Technical Analysis: respect for levels

Oil prices are starting to give shape to a bandwidth between $75 and $80 as a healthy equilibrium between buyers and sellers appears to be in place. The fact that Saudi Aramco did not go ahead with its production boost shows that it sees no urgency to do so, although these plans are ready in a drawer to be pulled out one day. With the US Dollar tilted to more weakness, more upside in Oil could still be on the horizon.

Oil bulls still clearly see more upside potential. The break above $80 though does not seem to be taking place that quickly, and $86 is appearing as the next cap. Further up, $86.90 follows suit before targeting $89.64 and $93.98 as top levels.

On the downside, the 100-day and the 55-day Simple Moving Averages (SMA) are near $75.71 and $75.31, respectively. Add the pivotal level near $75.27, and it looks like the downside is very limited and well-equipped to resist the selling pressure.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.