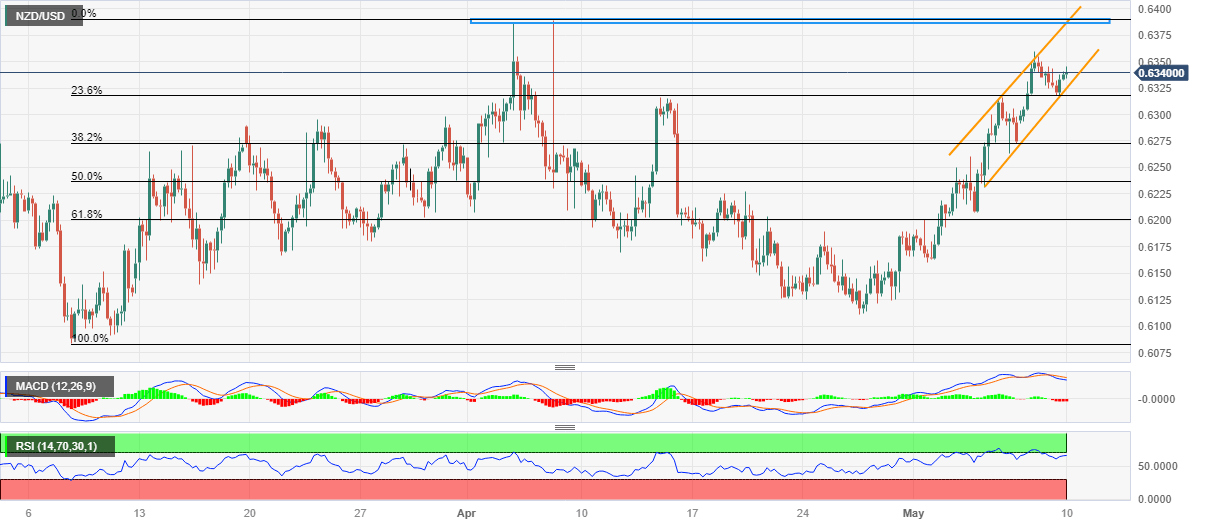

NZD/USD Price Analysis: Edges higher past 0.6300 within weekly bullish channel

- NZD/USD reverses the previous day’s pullback form one-month high inside immediate rising channel.

- Bullish chart formation contrasts with oscillators suggesting pullback in Kiwi prices.

- Bears need to break 0.6300 for re-entry, 0.6385-90 appears a tough nut to crack for buyers.

NZD/USD clings to mild gains around 0.6340 as it seesaws within a weekly ascending trend channel during early Wednesday. In doing so, the Kiwi pair reverses the previous day’s corrective pullback from the one-month high while approaching the short-term key resistance confluence on the US Consumer Price Index (CPI) release day.

It’s worth noting, however, that the bearish MACD signals and nearly overbought RSI (14) hint at the NZD/USD pair’s pullback.

The same highlights the bottom line of an aforementioned bullish channel, close to 0.6325. Also acting as short-term key support is the mid-April swing high near 0.6315 and the 0.6300 round figure.

In a case where the NZD/USD bears keep the reins past 0.6300, the odds of witnessing the pair’s further downside towards the 50% and 61.8% Fibonacci retracement levels of March-April upside, near 0.6235 and 0.6200 in that order, can’t be ruled out.

On the flip side, the latest peak of around 0.6360 precedes the 0.6385-90 resistance confluence, comprising the stated channel’s top line and tops marked in April, to prod the NZD/USD buyers.

Even if the Kiwi pair manages to cross the 0.6390 hurdle, the 0.6400 psychological magnet may act as an extra check for the buyers.

NZD/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.