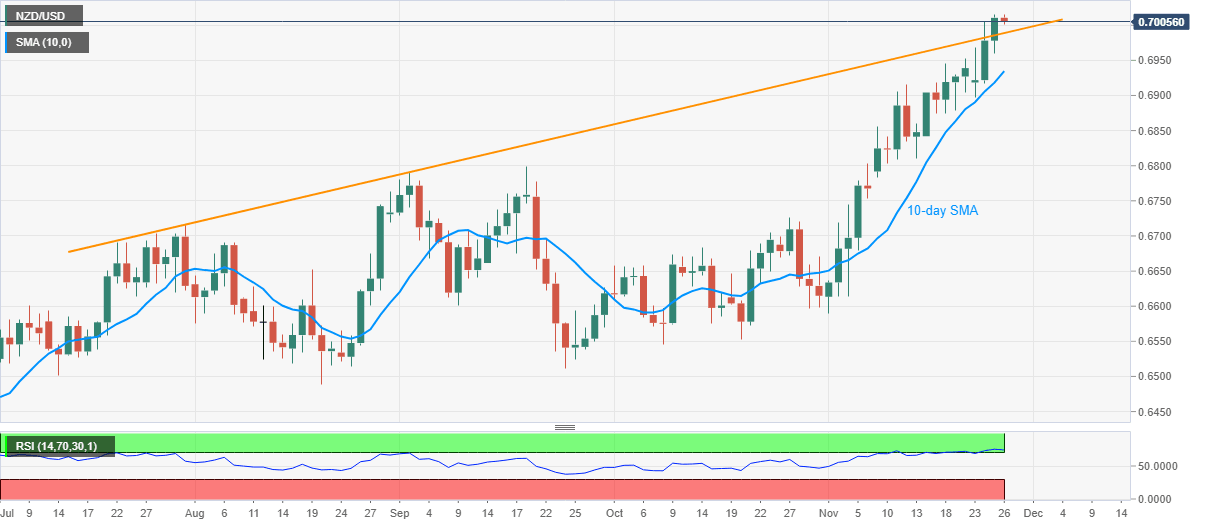

NZD/USD Price Analysis: Eases from multi-day top above 0.7000, eyes four-month-old support

- NZD/USD struggles to rise past-0.7000 after stepping back from June 2018 top.

- Overbought RSI conditions also challenge the upside momentum.

- 10-day SMA adds to the downside filter below the previous resistance line.

NZD/USD wobbles inside nearly 15-pips area, currently down 0.05% intraday around 0.7007, so far during early Thursday. In doing so, the kiwi bulls mark a halt after challenging the 2.5-year high the previous day.

With the overbought RSI favoring further weakness in NZD/USD prices, sellers will eye fresh entries below an ascending trend line from late-July, currently around 0.6985. In doing so, a 10-day SMA level of 0.6934 will be on their radars.

However, December 2018 low and high marked in early 2019, respectively around 0.6970 and 0.6945/40, offer a bumpy road to the south.

Alternatively, a fresh high beyond 0.7016 will aim for the mid-2018 peak surrounding 0.7060/65.

During the quote’s further advances past-0.7065, the 0.7100 round-figure and March 2018 low close to 0.7150 will be the key to watch.

NZD/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.