NZD/USD Price Analysis: Bears maintain control, upwards correction signals emerge

- The daily RSI reveals a negative trend for NZD/USD, suggesting prevalent selling pressure.

- As the RSI stands near oversold conditions, the daily chart hints at a potential consolidation in the next sessions.

- Indicators on the hourly chart corroborate the selling bias, while subtly highlighting signs of imminent recovery.

The NZD/USD pair is currently trading at around 0.5903, suggesting a stronghold of the sellers in the market. The pair's tendency to trade below the short-term Simple Moving Averages (SMAs) indicates a short-term bearish outlook. However, with the oversold conditions looming, a possible reversal may not be too far off.

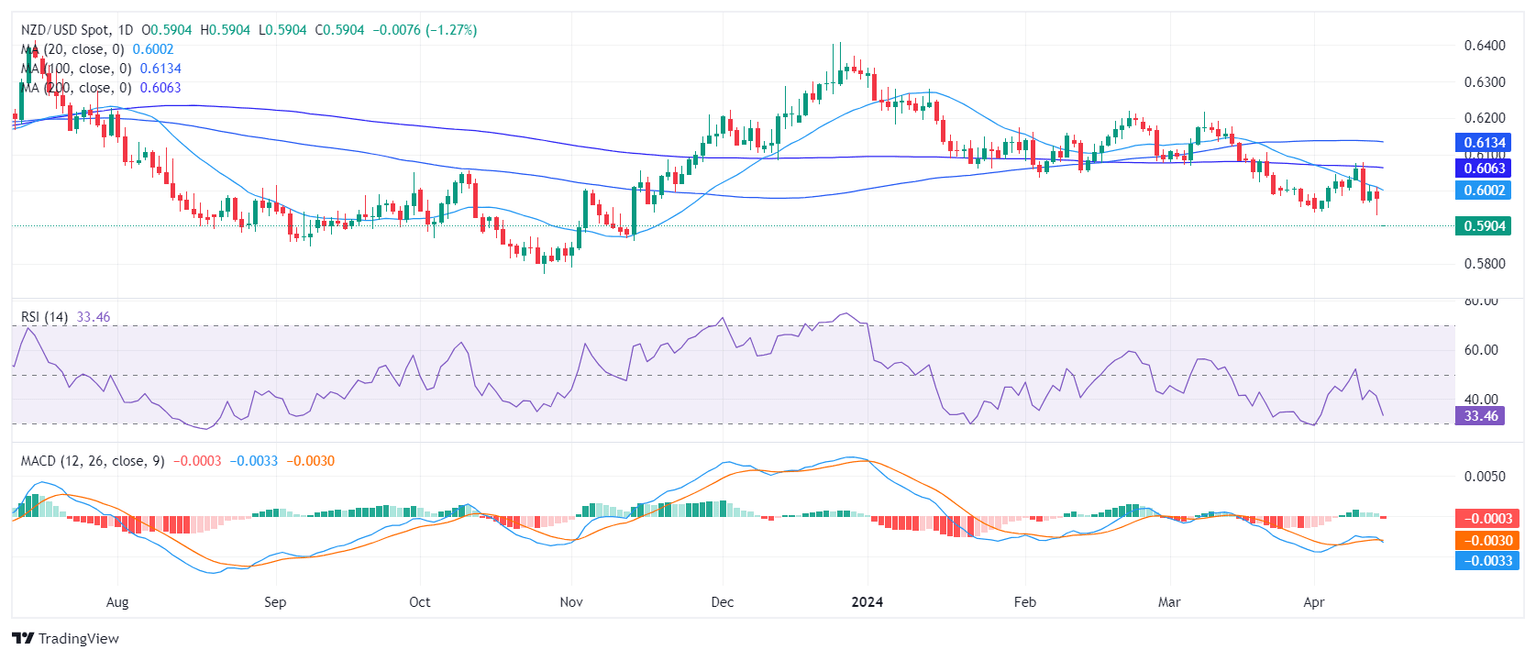

On the daily chart, the Relative Strength Index (RSI) readings have remained under a negative trend with the RSI sitting at 35, indicating a nearing oversold condition. This suggests that sellers have dominated the market in recent sessions. The negative momentum is also represented by the fresh red bar of the Moving Average Convergence Divergence (MACD), suggesting a current bearish bias. However, the nearing oversold condition signals the possibility of a trend reversal.

NZD/USD daily chart

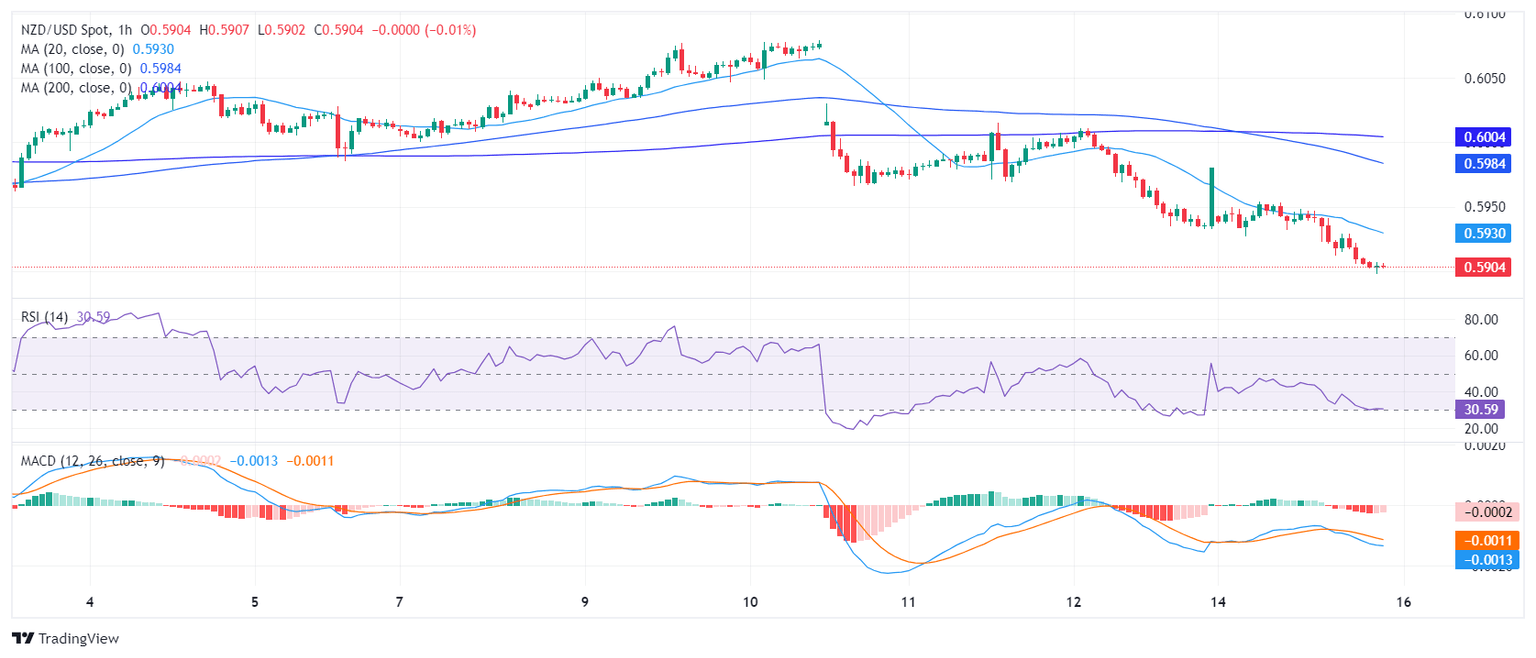

Comparing this to the hourly chart, it is observed that the RSI values are still in the negative range and dangerously near the oversold threshold. The MACD histogram presents a flat red bar, indicating negative momentum, and essentially reaffirms the conclusion drawn from the daily charts, that the market has a prevalent selling bias, but there are signs of potential recovery.

NZD/USD hourly chart

Inspecting the broader outlook, the NZD/USD shows a negative outlook as it sits below its 20,100 and 200-day Simple Moving Average (SMA).

In conclusion, both the daily and the hourly technical outlooks suggest a bearish bias for the NZD/USD pair. However, traders should remain cautious of potential reversals given the nearing oversold condition based on the RSI readings.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.