NZD/JPY Price Analysis: Meanders around 85.00 amid a risk-on sentiment

- The NZD/JPY finished Tuesday’s session flat, as the Asian Pacific session is about to begin.

- Reports from Eastern Europe shed some light on a meeting between Putin and Zelensky.

- NZD/JPY Price Forecast: Price action over the last two days suggests consolidation lies ahead.

The NZD/JPY grinds lower on Tuesday, although an improved risk appetite as positive news from Eastern Europe suggests that Russia and Ukraine might be finding some agreements in their postures, which could trigger a cease-fire and find a diplomatic solution to the war. At 85.20. the NZD/JPY does not reflect the aforementioned, as the end of the Japanese fiscal year looms, meaning that the yen strengthened on month-end flows.

Market sentiment improved on Tuesday as reports from the Russia - Ukraine front increased the prospects of a cease-fire between both parties. As reported by a CNN reporter on Twitter, it is possible a reunion between Russian President Vladimir Putin and Ukraine’s President Volodymyr Zelenskyy, as stated by Ukrainian President Advisor Podolyak.

The optimistic tone lifted US equities, which ended in the green, gaining between 097% and 2.55%. The so-called “fear index,” the CBOE Volatility Index (VIX), dropped below 20, sits at 18.90, down 3.72%, reflecting confidence in investors.

In the FX space, the low yielder EUR and safe-haven peers benefitted, particularly the Japanese yen.

Aside from this, in the overnight session for North American traders, the NZD/JPY seesawed in the 85.30-80 range. However, late in the European session, it dropped below the 85.00 mark, reaching a daily low at 84.27, recovering later as the New York session ended, reclaiming the 85.00.

NZD/JPY Price Forecast: Technical outlook

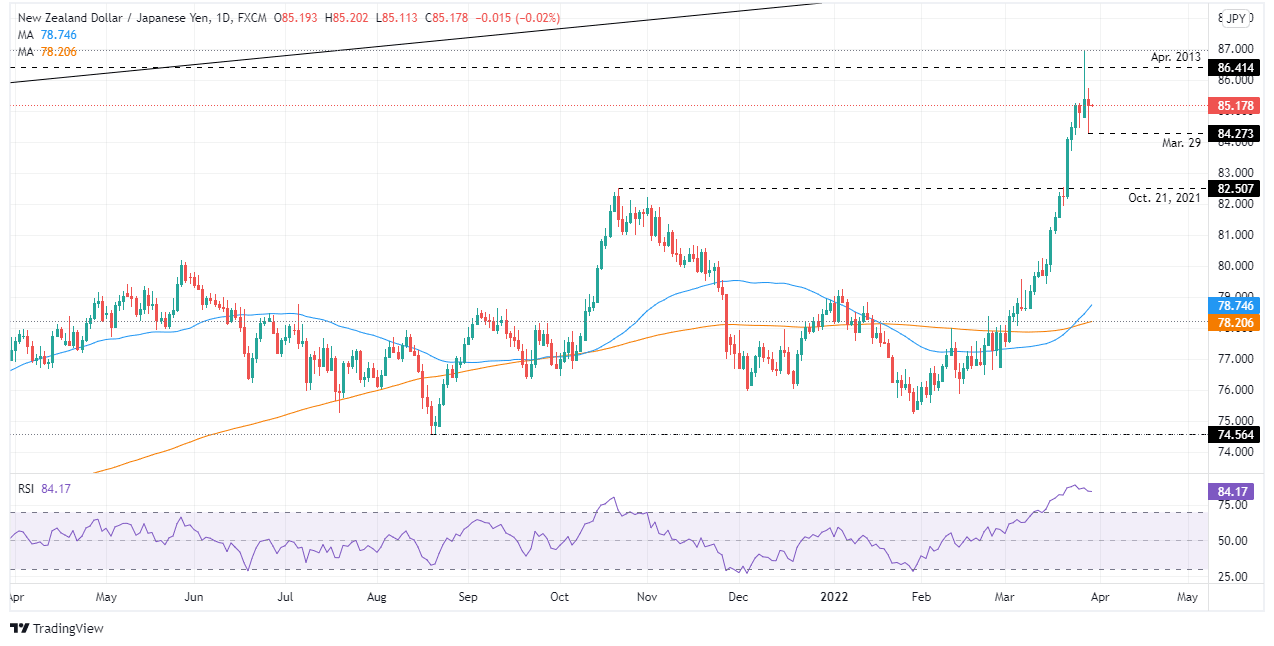

The NZD/JPY printed an inverted hammer after a steeper upward move towards 87.00, followed by a regular hammer, but on a lower note, as the close is above the open. Those two candlesticks themselves signal that the upward bias could shift to consolidation, despite that the daily moving averages (DMAs) reside below the spot price.

With that said, the NZD/JPY first resistance would be 85.73. Breach of the latter would expose 86.00, followed by April 2013 high at 86.41, and then the multi-year-high reached on Monday at 86.95.

On the flip side, the NZD/JPY first support would be 85.00. A sustained break could lead towards March 29 low at 84.27, followed by the 84.00 mark, and then October 21, 2021, daily high at 82.50.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.