NIO Stock Price and News: Shares rise as JP Morgan analyst sees upside in earnings

- NIO has been one of the hot retail meme stocks for 2021.

- NIO announced results on Monday covering Q4 2020.

- NIO shares peaked at $66.99 in January, closed Monday at $49.76.

Update March 4: Nio Inc (NYSE: NIO) has been rising on Thursday, up some 0.5% to $41.75 at the time of writing. The China-based electric vehicle maker is responding positively to bullish comments from Nick Lai, an analyst at JP Morgan. Lai offered a new narrative to Nio's earnings, pointing to the upside in elevated sales and manufacturing. It is also essential to note that while NIO's earnings were not as stunning as Li Auto's, it shines against Tesla with its bloated valuation and Lucid Motors, which entered the market via CCIV stock.

See latest electric vehicle sector news

NIO is a Chinese electric vehicle (EV) manufacturer designing manufacturing and selling smart EV's. NIO is also involved in the autonomous driving sector.

Stay up to speed with hot stocks' news!

NIO Stock forecast

NIO announced results on Monday after the market closed for Q4 2020. EPS was -$0.16 versus an estimate of -$0.07 according to Refinitiv. Revenue came in slightly ahead of expectations at $1.03 billion versus $1.01 billion. This is a rise of 133% from a year earlier.

Overall NIO had a very good 2020 with revenue more than doubling, deliveries in Q4 were 17,353 versus 8,224 in Q4 2019. Total 2020 vehicle deliveries were 43,728 as against 20,565 in 2019.

For Q1 2021, the Company expects: "Deliveries of the vehicles to be between 20,000 and 20,500 vehicles, representing an increase of approximately 421% to 434% from the same quarter of 2020, and an increase of approximately 15% to 18% from the fourth quarter of 2020.

Total revenues to be between RMB7,382.3 million (US$1,131.4 million) and RMB7,557.2 million (US$1,158.2 million), representing an increase of approximately 438.1% to 450.8% from the same quarter of 2020, and an increase of approximately 11.2% to 13.8% from the fourth quarter of 2020".

On the earnings conference call, NIO said it will enter the European market and has researched entering the US market according to Reuters.

The delivery targets for Q1 2021 disappointed investors who had been hoping for a continued strong pace of growth. Q3 to Q4 2020 delivery growth was over 40%. But battery issues and the well-flagged semiconductor problems were mentioned by CEO William Li on the analyst call.

"For the first half of this year, we would like to be more conservative," "For the second half of this year, we are quite confident about the demand, but we do not have the full visibility yet," he said.

NIO Stock Price

NIO shares are currently trading at $47.30 during Tuesday's pre-market, a loss of nearly 5%.

NIO Technical analysis

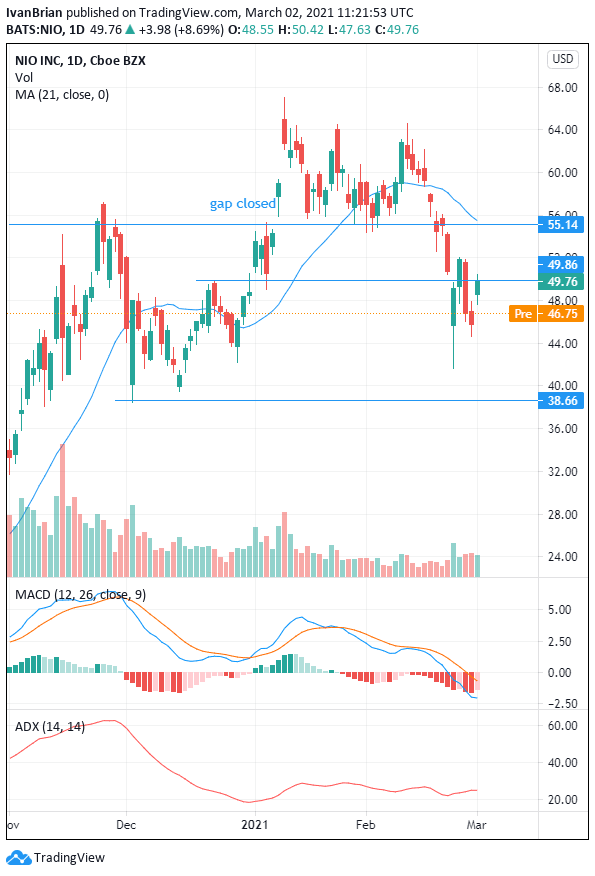

NIO will continue its bearish trend once the candle for today's Tuesday goes live. A declining series of lower highs sees support come at $38.66 with weaker support at $41.92. To retake a bullish theme NIO shares would need to break above $52.

Previous updates

Update March 4: Nio Inc (NYSE: NIO) has suffered another day of losses on Wednesday, falling by another 4% to close at $41.53, getting further away from its 52-week high of $66.99 in an extended response to weak earnings. Thursday's premarket trade is pointing to an additional slide to $41.03. However, JP Morgan Analyst Nick Lai sees an upside in the recent report. One of the reasons the Chinese EV-maker lost more money than expected comes from foreign exchange calculations. However, its production forecasts and harnessing of JAC to ramp up output is encouraging. All in all, Lai says NIO is a buy – will investors jump on the stock?

Update March 3: Not up to speed – Nio Inc (NYSE: NIO) reported earnings that fell short of market expectations, especially in comparison to rival Li Auto. The two Chinese electric vehicle upstarts are competing in different niches and Li's success created elevated expectations for Nio. However, after the 13% crash on Tuesday, shares of the Shanghai-based company are set to rise on Wednesday. Premarket data is pointing to an increase of 1.59% to $43.98. Broader markets are relatively calm.

Update, March 2: After starting the day deep in the negative territory on Tuesday, Nio Inc (NYSE: NIO) extended its slide and was last seen losing 11.4% on the day at $44.10. Earlier in the day, the company said it sees electric vehicle deliveries slowing down in the current quarter. Consequently, JP Morgan announced that it lowered its price target for NIO to $70 from $75. Meanwhile, the S&P 500 Index, which started the day virtually unchanged, is losing 0.2% at 3,893, reflecting an indecisive market mood following Monday's impressive rally that saw the index post its largest daily percentage gain since June.

Update: Nio Inc (NYSE: NIO) has kicked off Tuesday's trading session with a 7% dive – a response to its unimpressive earnings results. The Shanghai-based electric vehicle maker reported results late on Monday and investors to seem unconvinced. While not all the figures (described below) are shocking, growth expectations are elevated for the sector.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.