- NYSE: NIO is heading for a third consecutive day of gains after falling the previous week.

- Investors are dismissing fears that the potential delisting of Chinese firms would impact Nio Inc.

- Hopes for a US stimulus deal are boosting broader stock markets.

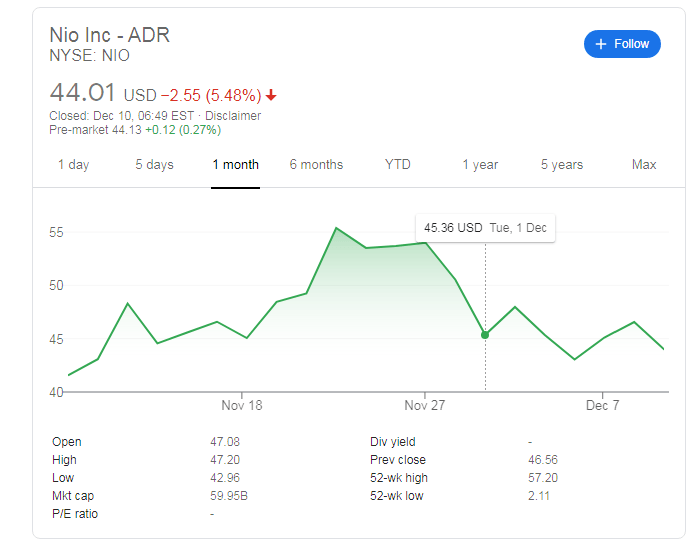

Update: NYSE: NIO shares are falling on Friday following the carmaker's announcement to offer no fewer than 60 million American depositary shares. Premarket trading is pointing to a drop of 5.53% or $2.50, more than erasing a 2.75% gain recorded on Thursday. Nio Inc is not the only firm trying to take advantage of sizzling hot markets – Elon Musk's Tesla is set to float some $5 billion of stock and shares similarly lost value. The moves follow successful IPOs by AirBnB and DoorDash, which saw elevated demand and post-listing surges.

These fluctuations could eventually make way for examining Nio's fundamentals, which look upbeat after its latest shipments of vehicles last month. Investors await data for December for the next fundamental – and not knee-jerk – move. In the bigger scheme of things, YSE: NIO is trading in a narrowing range at this is set to make way for a more directional move. More Where next for the Fed, fiscal stimulus and Trump

NYSE: NIO is changing hands at a minor gain of 0.30% or $0.13 in Thursday's premarket trading after rapidly reversing its gains on Wednesday and ending 5.4% in the red. The chart shows that Tuesday's peak is below the previous swing high – a bearish sign, but that Wednesday's low is above the trough. This narrowing wedge reflects lower volatility and according to technical textbooks, a significant explosion is likely.

Where will Nio's shares move to? The main reason for Thursday's fall came from a lawsuit against Facebook, alleging abusive monopoly powers. The broad NASDAQ index dropped amid fears of further regulatory and level action. However, stocks, especially those at the cutting edge such as in the electric vehicle sector, are finding fresh demand on Thursday. Moreover, the focus on Facebook drives attention away from worries about the potential delisting of Chinese firms described below.

What comes down must go up – perhaps not fast, but shares of Nio Inc (NYSE: NIO) are bouncing from the lows as bargain-seekers have jumped in. The Shanghai-based electric vehicle firm's shares are on course to rise by 1% on Wednesday, hitting $47.

That would complete a near $4 and close to 10% from the low of 43.04 recorded on Friday. Shares are still below the peak of $455.38 recorded on November 23 and under the 52-week high of $57.20.

What is behind the recent recovery?

NIO stock news

NYSE: NIO's advance is mostly related to a rethink of the fall – Shares of the carmaker dropped after Congress advanced a bill that requires Chinese firms to align themselves with American accounting standards or face delisting from US stock exchanges. While the legislation is still in the works and would only come into full effect in 2023, the move could shutter Nio's access to capital markets. Growth in the EV sector requires substantial investment.

Nevertheless, the considerable downfall triggered second thoughts – is the firm close to delisting? The answer is probably not. Despite bipartisan support for the bill, it could still be watered down – and conversely, Nio could adjust its books.

Moreover, the EV-maker may not need additional funds, as its car deliveries are thriving. The reason for the previous advance of NYSE: NIO shares came from an upbeat report on vehicle sales, a factor that is bringing cash to the company.

Another factor that is aiding the recovery comes from stimulus hopes in the US. Democrats and Republicans are not only uniting against China but for a relief package that would inject funds into the economy. Hopes for a fresh shot in the arm – alongside the FDA's upcoming greenlight for the Pfizer/BioNTech vaccine – are boosting markets. Nio's cars accelerate well and shares could rise in response – regardless of the origin of the manufacturer.

More:

- NIO Gets crushed again amidst investor concerns and rival downgrades

- NIO Stock Price and Forecast – Potential buy opportunity as shares fall despite strong earnings

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.