NIO Stock News and Forecast: Why did NIO stock pop 12% on Wednesday? Can it keep going?

- NIO stock rallies sharply on Wednesday to close at $20.17, up 12%.

- Nio was brought about by the fall in oil prices as the risk was back on.

- NIO still struggling for momentum and may not hold those gains.

Nio (NIO) finally had a positive day on Wednesday as the stock rallied by just over 12% to get above the key $20 level. The stock has been well beaten down this year, and despite yesterday's strong gains, NIO still finds itself down over 36% for 2022 and down 47% for the last three months. The stock took several knocks. First, the Chinese regulatory crackdown hit many Chinese stocks, even those that were not involved. Nio also suffered from the rising interest rate cycle as high-growth stocks struggled.

NIO Stock News

Thursday marks the start of trading in NIO shares on the Hong Kong exchange. This should at least allay some fears investors may have had over US delisting. This befell investors in Didi and was another negative sentiment indicator for many Chinese names. Yesterday's rally was in some way counter-intuitive. Soaring oil prices should boost the transformation to electric cars and, therefore, boost the EV stock sector. However, the overall bearishness affecting the stock market has overpowered that narrative and led to steep falls for many EV makers. The problem is that many of them have extremely high valuations and so are being targeted by investors in a rising yield environment.

Credit Suisse recently said they expect NIO to reach a sales volume of 150,000 in 2022. The last data from February disappointed investors, but February was a three-week month due to the Chinese New Year. Deliveries are still growing stronger every year. Nio stock opened for trading on its first day in Hong Kong at 160 Hong Kong dollars on Thursday. NIO shares quickly gained about 6% but fell away at the close to finish their first Hong Kong session at 158.90 Hong Kong dollars.

NIO Stock Forecast

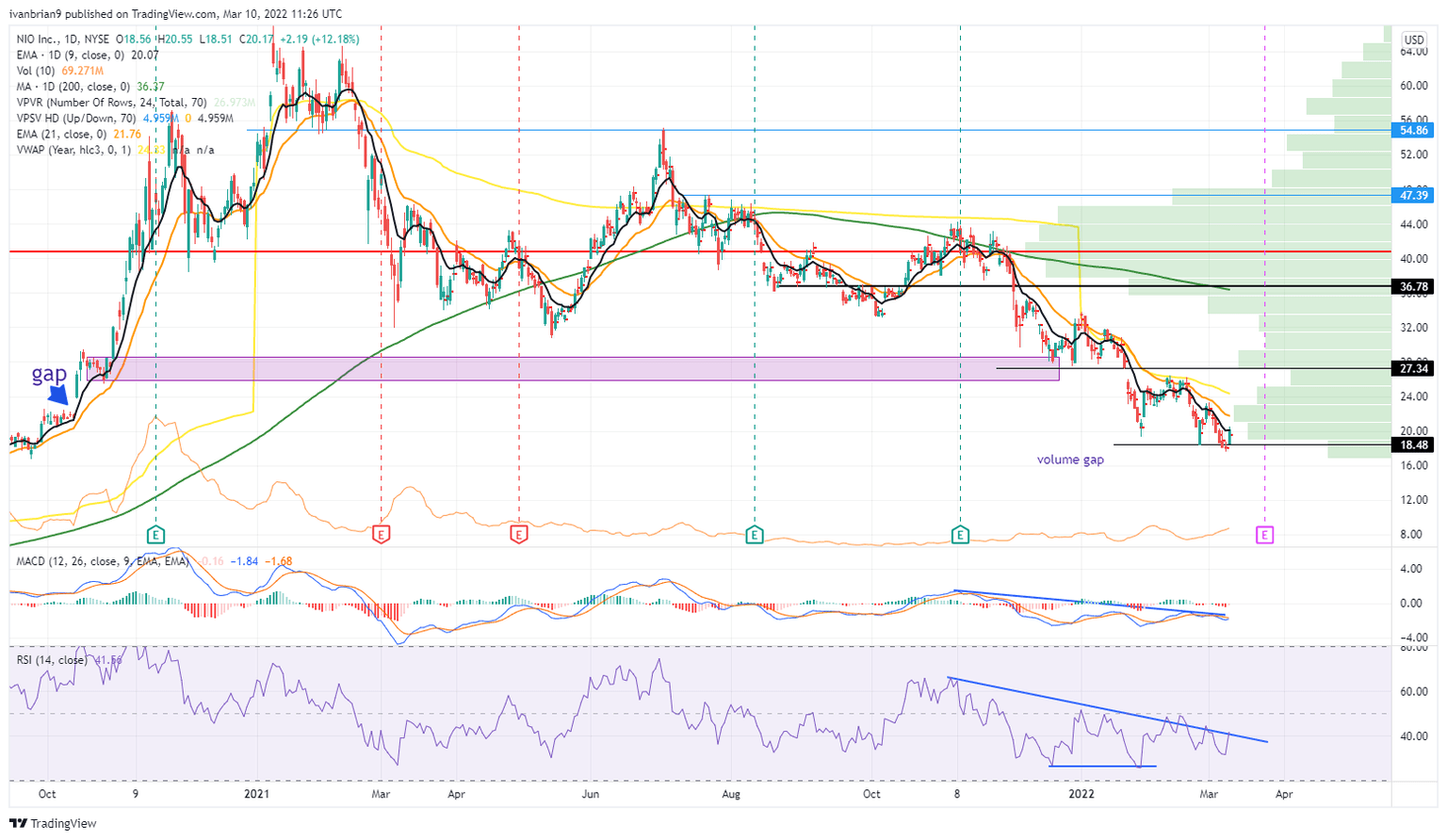

The move yesterday was impressive but highlights the extent of NIO's decline. The move did not even get back up to the 9-day moving average. NIO is still bearish on the chart with a declining Relative Strength Index (RSI) and Moving Average Convergence Divergernce (MACD). Nio is trading below all major moving averages, both short and long term.

NIO stock chart, daily

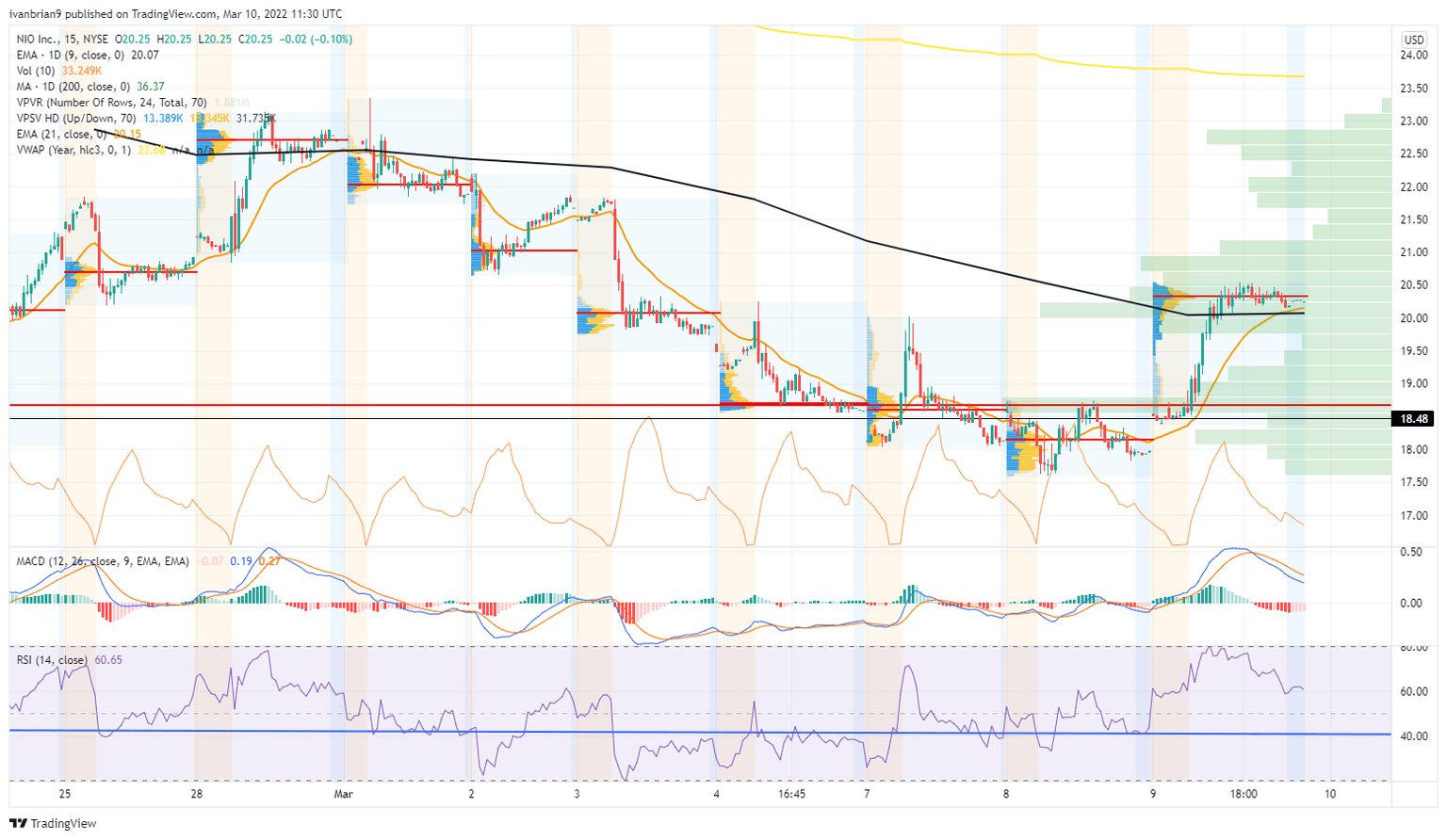

From the NIO 15-minute chart below, we can see most of the volume on Wednesday took place at the higher end of the range, which is positive in the short term. NIO, therefore, needs to hold the lower end of this volume at $19.75 to push ahead further on Thursday. Below and a move back to $19 is highly likely. Again $18.48 is key with a huge volume profile down there giving strong support. A break is strongly bearish.

NIO chart, 15-minute

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.