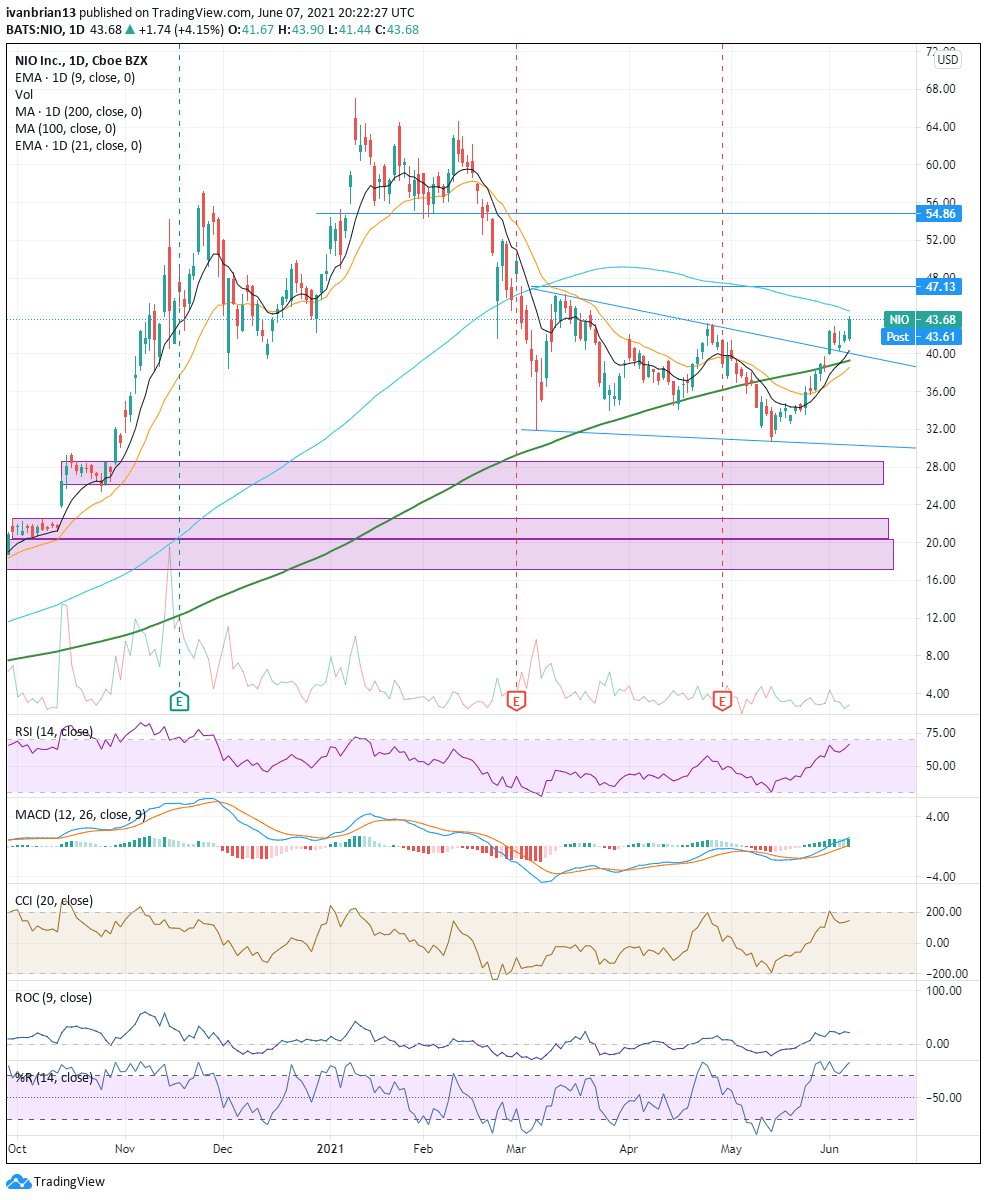

NIO Stock News and Forecast: Bullish wedge breakout targets $54.86 as Citi counts on 50% upside

- NIO breaks out of wedge formation in a strongly bullish move.

- Delivery data from NIO and peers remains strong.

- Citi says there could be 50% upside to the stock.

NIO continues to gain momentum following its breakout of the wedge formation. A stellar appreciation in 2020 (over 1,000%) has worried investors as to whether the hype and gains could be lived up to. However, a string of positive delivery announcements from NIO, LiAuto (LI), XPeng (XPEV), and others have kept Chinese electric vehicle manufacturers strongly supported by investors with the sector seeing major gains on Monday. Last week's strong delivery data saw NIO catch a very bullish upgrade from Citi. The investment bank said it sees the potential for 50% upside in the shares and that it expects "a strong demand recovery from late Apr-21 in China [...] and NIO's monthly new order volumes in May-Jun to be 20-30% higher than the average monthly level in 4Q20 peak season." Xpeng CEO Brian Gu said last week after his company's strong delivery numbers, “We are on track to meet or exceed Q2 delivery numbers, which I think means Chinese EV demand is still very strong.” Li Auto was not to be denied and also posted further strong sales numbers again on Wednesday. Deliveries of the company's Li ONE car rose by 101% YoY, and NIO closed up 4% at $43.68.

NIO stock forecast

Breaking out of the wedge formation is a bullish move and was backed up by the 9 and 21-day moving averages being broken also. Even more, momentum was given by the break of the long-term 200-day moving average. The first test will be resistance at $47.13 with $54.86 being the target of the wedge breakout. Support comes just under the $40 level from the top of the wedge formation. Obviously, breaking this level ends the bullish argument.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.