NIO Stock News and Forecast: Hurt by China’s crackdown, battles $50

- NIO extends decline after failing at a critical resistance level.

- NIO delivery data was strong as was data from peers Li Auto, Tesla and XPEV.

- Shares under pressure as Chinese stocks fall.

Update July 7: NIO shares tracked the downbeat mood across the Wall Street indices and fell on Tuesday, modestly in the red. In post-market hours, NIO stock dropped another 0.68% to finish the day below the $50 mark. Delta covid variant concerns and China’s technology sector crackdown dampened investors’ sentiment, dragging the NIO shares lower. NIO maintained its corrective pullback from four-month tops of $53.84, as the shares kicked off July on the wrong footing.

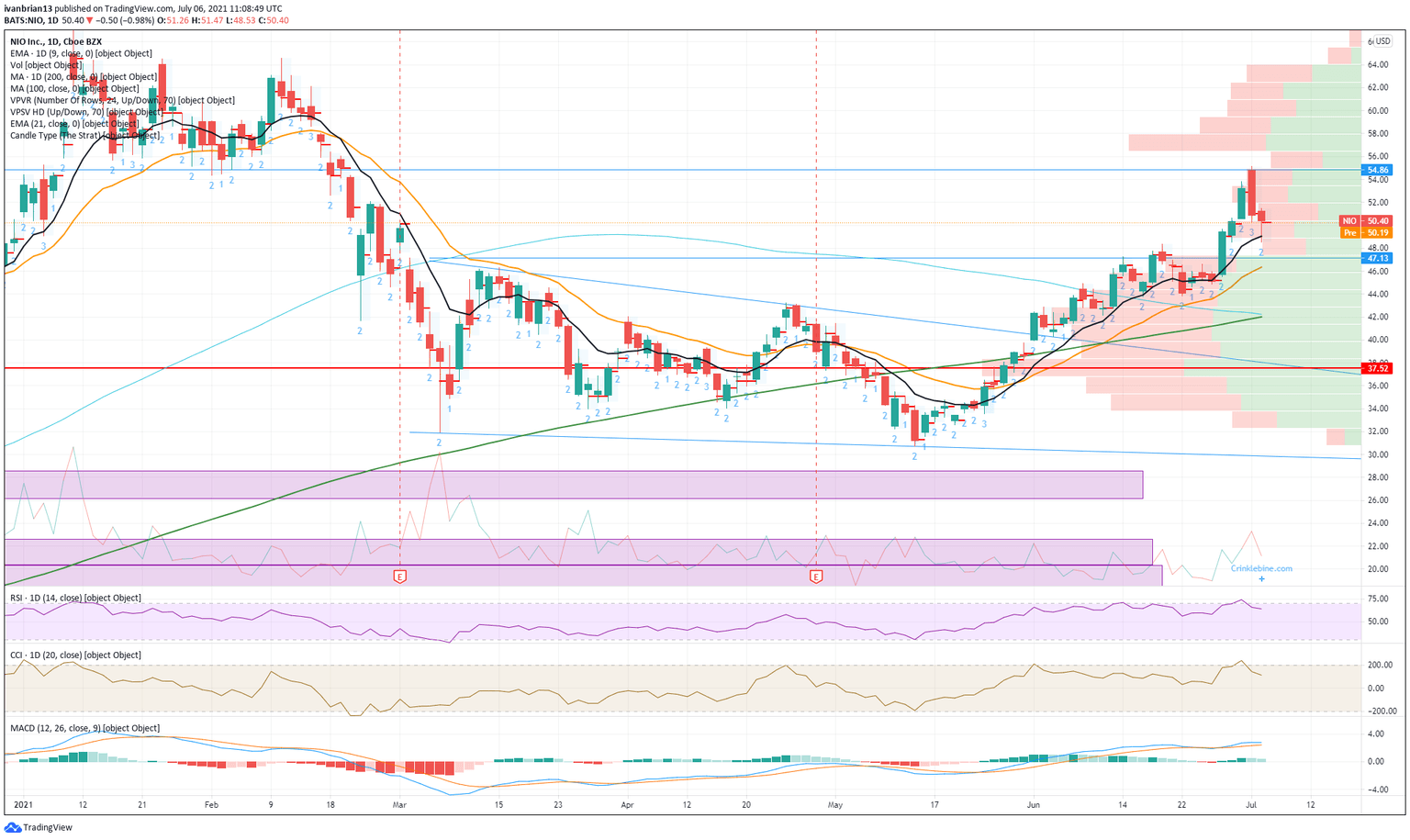

NIO shares just touched off our $54.86 resistance on Thursday before retracing back slightly to close just on the short-term 9-day moving average on Friday ahead of the long weekend. Over the weekend, however, some headwinds have emerged for Chinese-listed companies with the news surrounding DIDI (see more) and the Chinese crackdown. While NIO is a completely different sector, investors may still be uneasy about Chinese names as DIDI is down 20% in Tuesday's premarket.

NIO had been steadily appreciating since dropping to nearly $30 in May. Since then the shares gradually appreciated in line with most sector peers as Tesla in particular put in a solid June. NIO shares are up over 23% in the last month, so the setback has to be taken into context. Recent delivery numbers from all Chinese electric vehicle manufacturers were strong. LiAuto (LI) posted record June deliveries, up 166% YoY, XPeng (XPEV) posted a 439% yearly gain in deliveries, while NIO itself posted a yearly gain of nearly 116%. BYD (BYDDF), the Warren Buffet-backed Chinese electric vehicle maker, saw its June sales rise 102% YoY. Tesla (TSLA) also produced record deliveries of over 200,000 vehicles for the first quarter of 2021. So all electric vehicle manufacturers seem to be hitting record numbers despite global semiconductor chip issues.

The issues in relation to DIDI appear to stem from data privacy and collection fears, so NIO and related Chinese auto stocks should not see a direct read through here. Indirectly, however, Chinese stocks may see investors shun them until more clarity hits. Investors are still wary after the ANT Group IPO was pulled with shares in parent Alibaba (BABA) still well below their peak.

NIO statistics

| Market Cap | $79 billion |

| Price/Earnings | -83 last 12 months |

| Price/Sales | 25 |

| Price/Book | 19 |

| Enterprise Value | $56 billion |

| Gross Margin | 16% |

| Net Margin | |

| Average Wall Street Rating and Price Target | Buy $54.89 |

NIO stock forecast

A buy the dip opportunity? Perhaps this can work since the stock tested the $54.89 resistance and failed. Now NIO has retraced to the 9-day moving average, but this zone is not a particularly strong support zone due to the lack of volume. I would prefer to wait for low $40s, as we can clearly see the volume profile here on the right of the chart gives greater volume-based support. The 200-day moving average also sits at $42, adding to the strength of this zone. Volume means more haggling over price, more participants buying and selling so more stability in this zone. Even a break of $54.86 is not that clearcut a move as again the volume profile shows a spike in volume above here. Any gains will be more difficult.

Holding the 9-day moving average keeps the bullish trend intact, but the risk reward is neutral in this author's opinion. If long, use a trailing stop to at least book some profits in the event of a retracement.

Previous updates

Update July 7: NIO ended Tuesday at $50.29, down 0.22% on the day. The NYSE Composite Index shed roughly 134 points as investors moved away from high-yielding assets following soft US data, suggesting slowing economic growth. Chinese macroeconomic figures published at the beginning of the week also failed to impress, adding pressure on the share. Nevertheless, the retracement so far seems corrective after NIO added over 37% in July.

Update: NIO stock is pretty calm on Tuesday, relatively good news as other Chinese names get hit from the DIDI situation. Tesla the EV kingpin is lower but NIO is holding steady with a gain of just 0.5% at $50.79. The stock has retraced to support at the 9-day moving average. A break here and it is likely to test $45 as the next support region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.