Nio Stock Forecast: NIO looks to extend correction amid negative US stock futures

- NYSE: NIO extended its slump on Monday despite a better stocks' performance.

- Nio debuted in Singapore to a major boost as shares jumped 20%.

- Nio is also establishing a research facility in Singapore.

Update: NIO extended its correction from two-week highs of $17.60 into Monday, starting off a new week on the wrong footing. NIO stock price dropped 2.68% on the day, settling the day at $16, as it recovered from its daily low of $15.24. Investors ignored the rebound in the Wall Street indices amid hawkish Fedspeak. The stock failed to capitalize on NIO’s announcement that that it will be included in the Hang Seng TECH Index as a constituent stock, starting from June 13, 2022. Looking ahead, the corrective decline in the EV maker could likely extend, as the US stock futures tumbled after Snap (SNAP) crashed 30% after warning that its second-quarter revenue would be below its low end of guidance.

NIO dropped 5.3% to $15.57 one hour into Monday's session. Earlier in the session the stock traded as low as $15.24 even as the tech-heavy Nasdaq Composite trades up 0.6%. Chinese competitor Xpeng (XPEV) is down 6.3% after its Q1 earnings release early Monday. XPeng beat consensus estimates for both profit and sales but is trading lower due to poor Q2 guidance that forecast vehicle deliveries would fall below the approximately 34,500 delivered in Q1. As NIO's deliveries dropped off more in April due to covid lockdowns than XPeng's did, the read-across is making traders believe that NIO might have an even worse Q2 in its future.

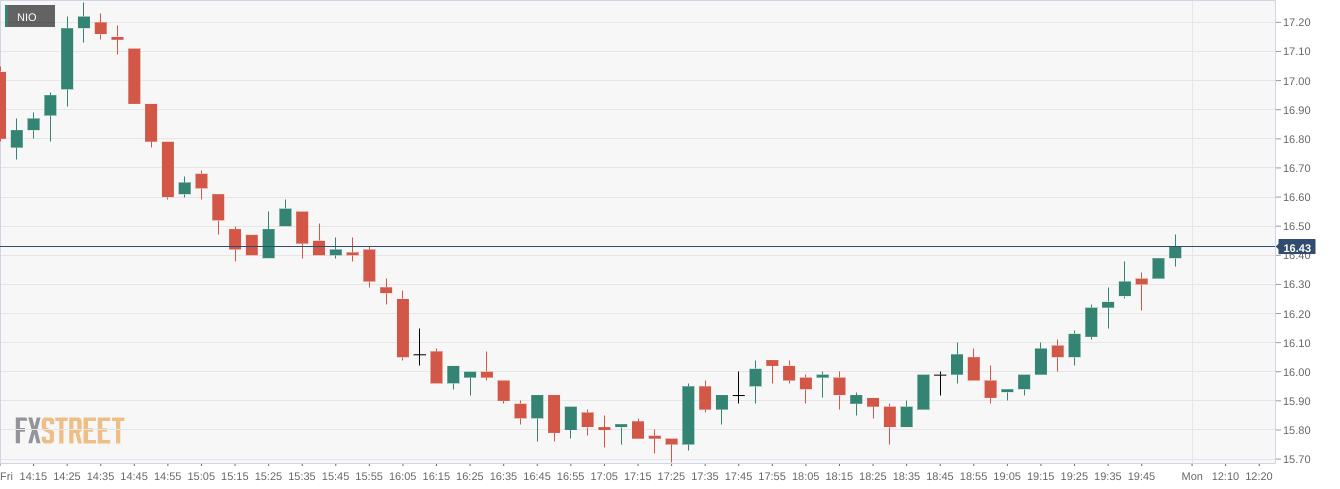

NYSE:NIO had a whipsaw session to close the week after seeing early momentum from its debut on the Singapore Exchange. On Friday, shares of Nio dipped lower by 1.32% and closed the trading week at $16.44. Despite the loss, Nio’s stock still managed to post an 11.4% gain this week which far outpaced the broader markets.

Stay up to speed with hot stocks' news!

It was another wild day for US markets as the session started in the green before dropping into the red, only to close the day out slightly higher. The Dow Jones managed to post an 8 basis point gain, while the S&P 500 rose by 0.01% after falling briefly into bear market territory. The NASDAQ was the only index to close in the red, as it dipped by 0.30% to close the session.

Nio successfully debuted its stock on the Singapore Exchange on Friday before the US markets opened for trading. The move marks the third exchange that Nio is trading on which includes the New York Stock Exchange and also in Hong Kong. The stock got out to a hot start climbing by as much as 20% during intraday trading before closing out the day with a 2.4% gain.

NIO stock price

Nio CEO William Li also announced that Singapore would be the homebase of a brand new, state of the art research facility for the company. The R&D center will focus on further advancing Nio’s artificial intelligence and autonomous driving technology, and will work to collaborate with local companies and institutions. It seems like Singapore is going to be one of the hubs that Nio is expanding to, despite rumors that it would be establishing its next headquarters in the US.

Previous updates

Update: NIO ended Monday down 2.74%, at $15.99 per share. The slide had nothing to do with sentiment, as Wall Street posted solid gains. The Dow Jones Industrial Average advanced 618 points, while the S&P 500 and the Nasdaq Composite added over 1.5% each. Market players welcomed words from US President Joe Biden, who said to be studying cutting tariffs on Chinese imports, which could save up to $80 billion in taxes for the country. Biden also called on OPEC to raise oil production, in the hopes it would help to cool down inflationary pressures. Meanwhile, European Central Bank President Christine Lagarde made some hawkish comments, hinting at a July rate hike. Central bankers and politicians, in general, maintain the focus on taming inflation and boosting economic growth.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet