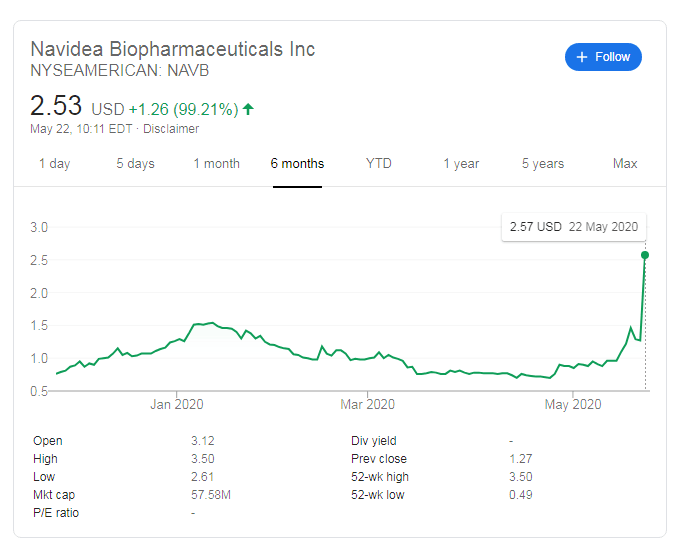

NAVB Stock Price: Navidea Biopharmaceuticals doubles in value, not coronavirus related

- NYSEAMERICAN: NAVB is trading at double its price on Thursday.

- Navidea Biopharmaceuticals Inc reported encouraging results on its rheumatoid arthritis treatment.

- Pharma firms are in the spotlight, even if their drugs are unrelated to coronavirus.

Navidea Biopharmaceuticals, Inc, a biotechnological company that has offices in both Dublin Ireland and Ohio, in the US, is enjoying its time in the sun. NAVB reported promising results for its treatment for rheumatoid arthritis. While those are preliminary results, the second interim analysis, Phase 2B, of the company´s NAV3'31 study shows that Tc99m tilmanocept imaging can help supply robust and qualitative health controls.

RA affects the joints and usually results in pain, swelling up, a feeling of warmth and stiffness. The autoimmune disorder affects the hands and wrists. Genetic and environmental factors are believe to be involved. It reaches between 0.5% and 1% of the population in the developed world and causes dozens of thousands of deaths per year.

Rheumatoid Arthritis (RA) is unrelated to the coronavirus outbreak gripping the headlines and the world's attention. Broader stock markets have been rising and falling in response to hopes for a vaccine for COVID-19, and NAVB may have been under the radar. The change in its stock price may make place it in the spotlight.

Navidea Biopharmaceuticals Inc Stock

At the time of writing, NAVB is trading at around $2.53, up 99% – or around double its value on the previous day. The shares are still below the 52-week high of $3.50 but five times more than the 52-week low.

Hong Kong is in the spotlight for investors, as China aims to tighten its grip while the US is protesting yet probably without taking action.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.