Natural Gas back to flat with markets looking for direction

- Natural Gas prices show sensitivity towards the situation in the Middle East.

- Markets see sanctions being issued out of US and Europe on Iran.

- The US Dollar Index pops back above 106.00 though faces some selling pressure.

Natural Gas (XNG/USD) prices are getting nervous and torn between two main forces. On one hand the geopolitical risk for a surge in Gas prices is not to be overlooked with the Israel War Cabinet convening at time of writing on which steps Israel will take to retaliate against Iran after the attacks over the weekend. Meanwhile several Federal Reserve officials are confirming rates steady for longer, which could mean a slowdown in demand at hand for the coming months until that first rate cut taking place.

With risks of an escalating war still on the cards, the DXY US Dollar Index is thriving as the main safe haven for investors to park their funds. As if that is not enough, the overall market narrative about US interest rates is changing, with investors pricing in that rates will either stay steady for longer or even rise further even as Federal Reserve (Fed) officials are still seeing a reason to cut this year. The gap between market expectations and the Fed is substantially big, and could mean more US Dollar strength to come should Fed Chairman Jerome Powell this evening admit that cuts will be postponed.

Natural Gas is trading at $1.89 per MMBtu at the time of writing.

Natural Gas news and market movers: Contradictions from EU and US on keeping calm

- US Treasury Secretary Janet Yellen is preparing fresh sanctions on Iran on the back of its unprecedented attacks on Israel over the weekend.

- The Israel War Cabinet is set to meet on Tuesday to discuss responses to Iran, Israeli officials said to Bloomberg.

- Despite several attempts from US Secretary of State Antony Blinken and several G7 heads of state, Israel is planning to advance with another attack on Iran in retaliation for the drone attacks over the weekend, several sources such as Reuters and Bloomberg report.

- European Gas prices are jumping higher as well on the back of Monday’s headline events out of Israel and Iran.

- Unplanned works at Norway’s Nyhamna and Dvalin facilities are expected to take place for the rest of the week, seeing a lower than average Gas flow from Norway into Europe.

- Swiss MET Group has expanded its LNG trading business with long-term capacities in Germany, Spain and Croatia. This further proves the massive international interest in the European Gas market.

Natural Gas Technical Analysis: Israel decision key for direction

Natural Gas prices are at risk of jumping higher with this tit for tat headline risk. Despite several diplomatic calls for Israel to keep its head calm and be the bigger person in the room, Israel said it has all rights to retaliate. This means more tensions will arise in the region, while attention is diverted away from Gaza, and could see supply disruptions in Gas flows with possible key pipelines being sabotaged.

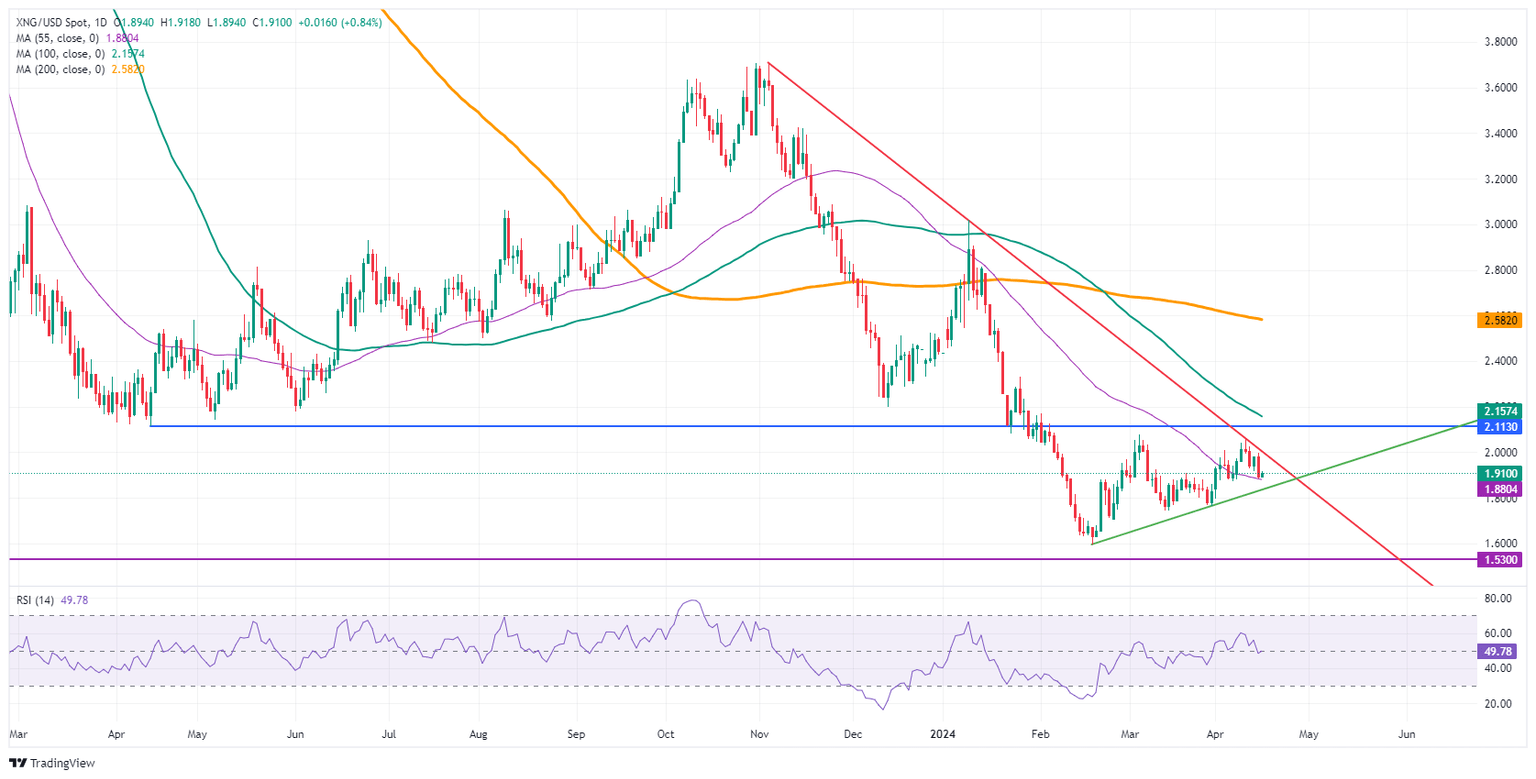

On the upside, the red descending trend line at $1.99-$2.00 looks ready for another test. Should Gas prices snap above it, a quick rally to $2.11 could be seen. Not that far off, $2.15 in the form of the 100-day Simple Moving Average (SMA) becomes the main resistance level.

On the downside, the 55-day SMA around $1.88 should be a safety net. Next, the green ascending trend line near $1.83 should support the rally since mid-February. Should even that level break, a dive to $1.60 and $1.53 would not be impossible.

Natural Gas: Daily Chart

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.