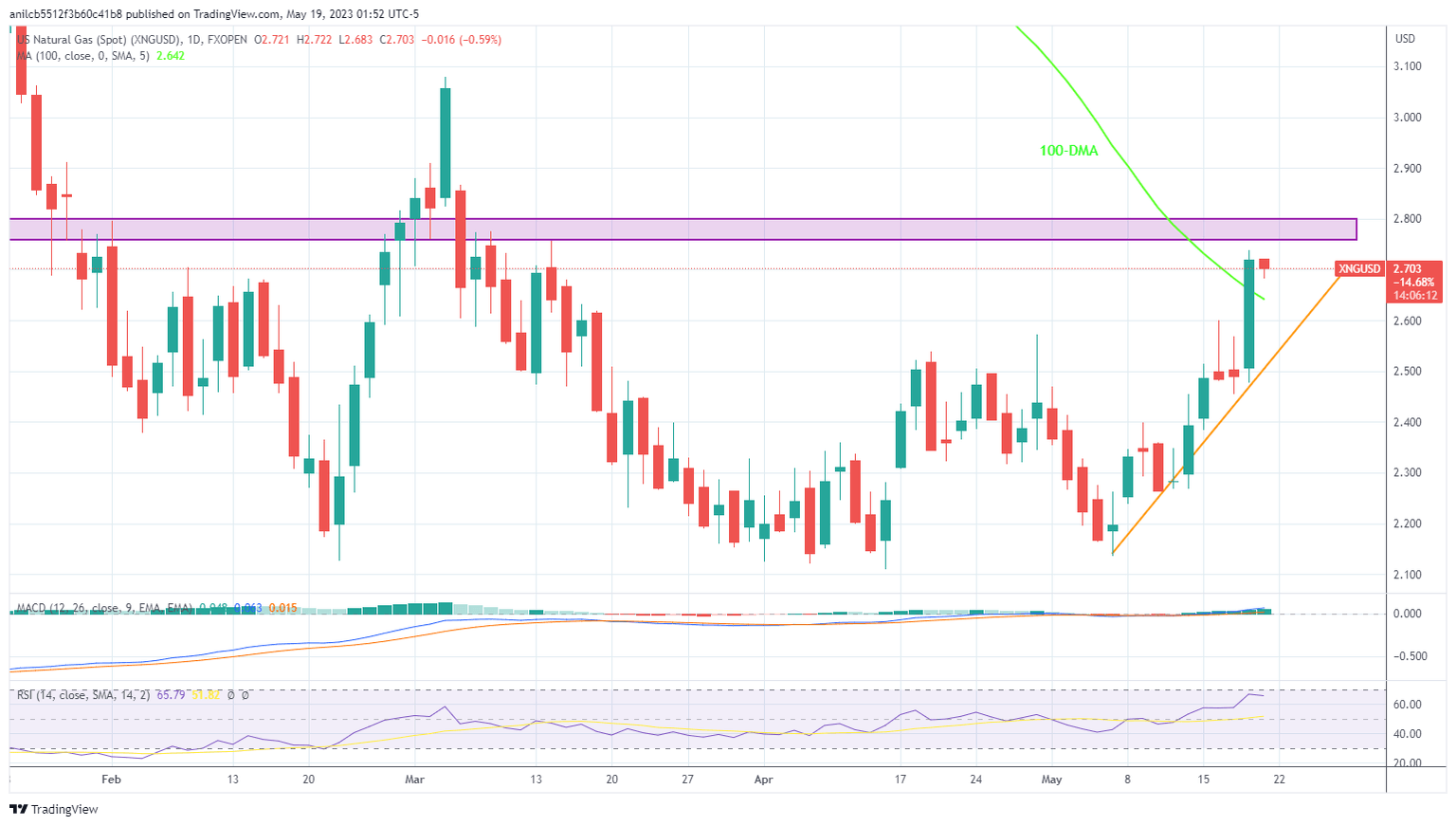

Natural Gas Price Analysis: Overbought RSI prods XNG/USD bulls below $2.80 key hurdle

- Natural Gas price retreats from the highest levels in five weeks, pares the biggest daily jump in seven months.

- Overbought RSI, 4.5-month-old horizontal area challenge XNG/USD bulls.

- 100-DMA, April’s top can restrict pullback moves, Natural Gas buyers remain hopeful beyond $2.50.

Natural Gas (XNG/USD) price remains mildly offered near $2.71 as it pares the biggest daily gains since October 2022 amid early Friday in Europe. In doing so, the energy instrument eases from a five-week high amid the overbought RSI (14) conditions.

However, the XNG/USD’s ability to stay beyond the 100-DMA support, around $2.64 by the press time, keeps the buyers hopeful.

Even if the Natural Gas price drops below $2.64 DMA support, April’s top surrounding $2.57 and multiple levels marked since March, close to $2.50, could challenge the commodity bears before giving them control. It should be noted that a two-week-old ascending support line near $2.51 acts as an extra filter towards the south.

In that case, a quick fall towards the early May’s swing high of near $2.39 can’t be ruled out.

On the flip side, a nearly four-month-old horizontal resistance area surrounding $2.75-80 appears a tough nut to crack for Natural Gas buyers.

Though, a daily closing beyond $2.80 won’t hesitate to prod the March month high of $3.08. That said, the $3.00 psychological magnet may act as an intermediate halt between $2.80 and $3.08.

Overall, the Natural Gas price remains on the bull’s radar despite the latest retreat.

Natural Gas Price: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.