Natural Gas Futures: Recovery has further legs to go

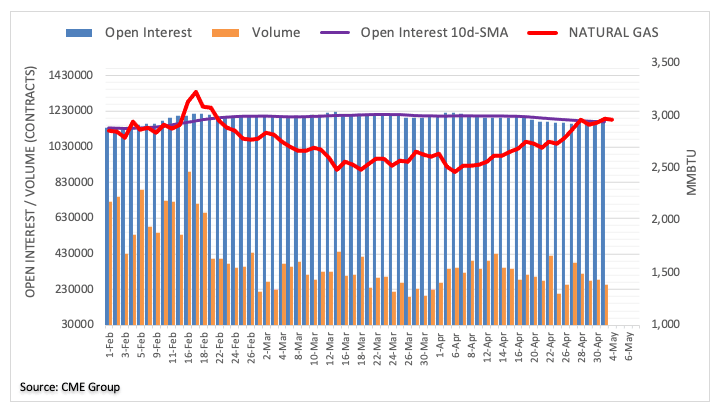

In light of advanced readings for Natural Gas futures markets from CME Group, open interest rose for the fourth straight session on Monday, this time by around 7.6K contracts. On the other hand, volume resumed the downtrend and shrunk by around 25.4K contracts.

Natural Gas faces extra gains above $3.00

Natural Gas added to recent gains and closed Monday’s session just below the key $3.00 mark per MMBtu. The daily uptick was on the back of rising open interest, leaving the door open for further gains once the $3.00 barrier is cleared in the short-term horizon.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.