- MVIS shares rally on Friday as risk on switches to overdrive as no jobs are being created!

- MVIS is the newest stock to capture the Reddit, retail focus.

- MVIS volumes ahve increased dramatically as retial gets hold.

Update: Another day another flight to quality!! Microvision (MVIS) sees a nice bounce on Friday as everything and anything seems to catch a bounce post the terrible jobs report. The Fed will be forced to keep zero rates forever if this keeps up and equities are loving it! MVIS shares are trading at $14.37, up 2.5%.

Microvision is a Washington-based technology company making sensors and microdisplays. The primary business is developing laser beam scanning technology. The company has a market cap of $3.2 billion and a high short interest of 20%. Sound familiar? Yes, it is the standard r/WallStreetBets model. As they say, "If it ain't broke, don't fix it."

Stay up to speed with hot stocks' news!

MVIS has been the top trending stock on r/WallStreetBets this week, and with price swings like this, it is easy to see why. MVIS shares are up 274% in 2021. MVIS is up 94% in the last week, 726% in the last 6 months and, wait for it, 7,909% in the last year.

MVIS has overtaken GameStop on r/WallStreetBets this week with 2,451 mentions against GameStop's 918, according to data from Quiver Quantitative.

MVIS stock price after hours

MVIS shares put in a decent shift on Wednesday, rising 4% but failing to recapture the high from Tuesday. Generally, a bearish sign, but MVIS shares do have some hope in that they report results after the close on Thursday. This may prove a catalyst or it may prove a disappointment and allow bears to take back control of the narrative.

Given how poorly MVIS performs, not having turned a profit in the last five years and counting, it is unlikely anything extremely bullish will be released. Earnings per share (EPS) are expected to be a loss of $0.02 for the first quarter of 2021, and revenue is expected to be $600,000, fairly small numbers when you consider MVIS has a market cap now of $3.3 billion.

MVIS stock news

MVIS shares pushed higher on Wednesday after the company announced its lidar sensor demonstration was complete. Microvision said, "A version of this lidar sensor could be available for sale, in initial quantities, in the third or fourth quarter of 2021."

This was enough to send social media buzzing once again over MVIS. A look at Microvision and financials would not give too much confidence in the sales process though as revenue has steadily been decreasing over the last five years, according to Refinitiv data.

| Year | 2020 | 2019 | 2018 | 2017 | 2016 |

| Revenue | 3.09m | 8.89m | 17.61m | 9.63m | 14.76m |

| Operating Income | -13.62m | -26.47m | -27.22m | -25.48m | -16.46m |

This is clearly not a Buffet-style, long-term investment. But then not many of the current retail meme stocks are. This one is highly volatile, which is what the short-term players want.

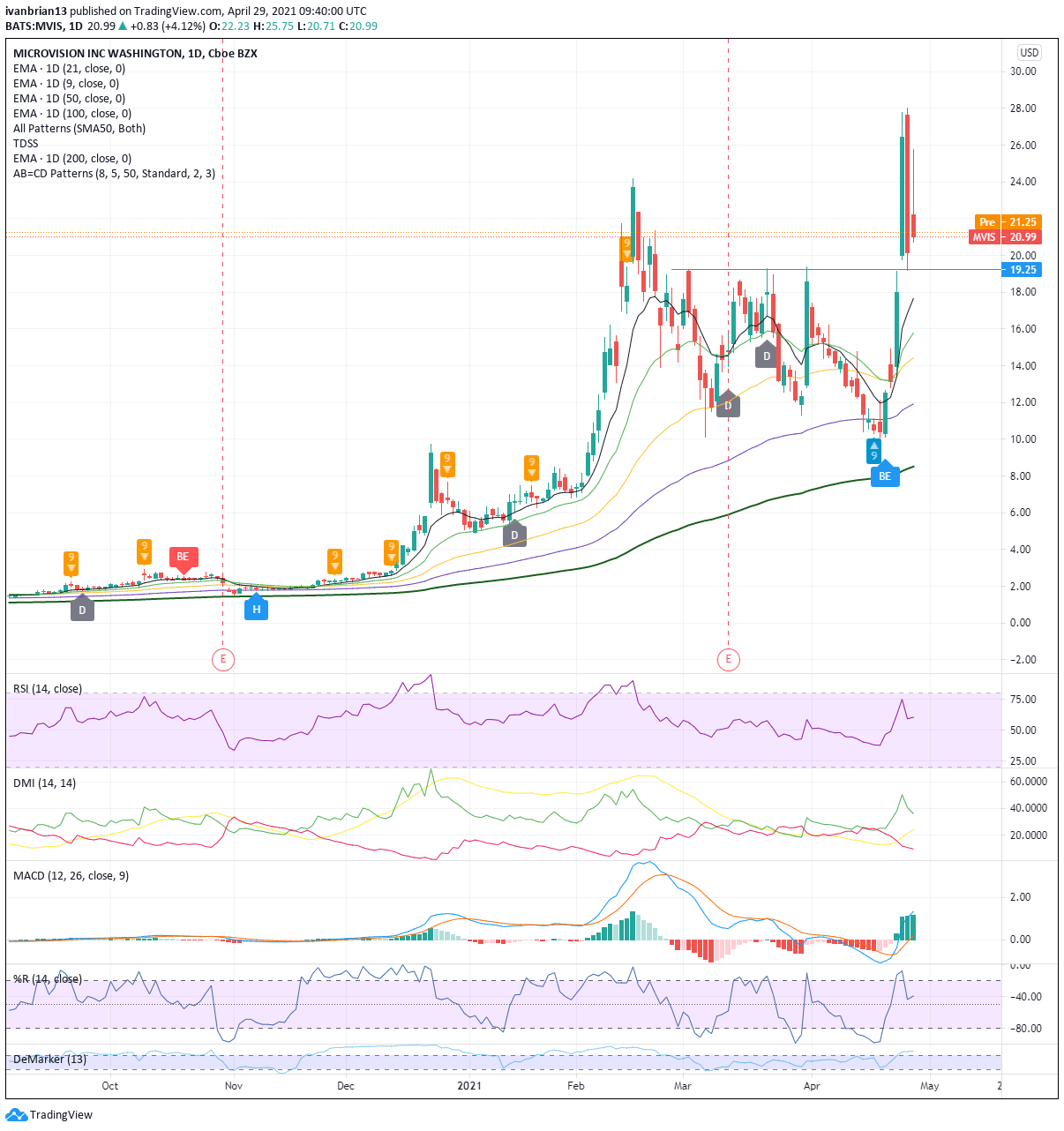

To stay bullish, MVIS really needs to stay above $19.25 where MVIS broke out from, as we can see in the chart below. Remaining above this level would see a buy-the-dips strategy with tight stops to help counter the volatile price movements. The 9 and 21-day moving averages are also key to the short-term trends and can be used as buy levels.

The picture will become a bit clearer after the results and the conference call after the market closes on Thursday. The conference call starts at 1700 EST on Thursday, details here.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.