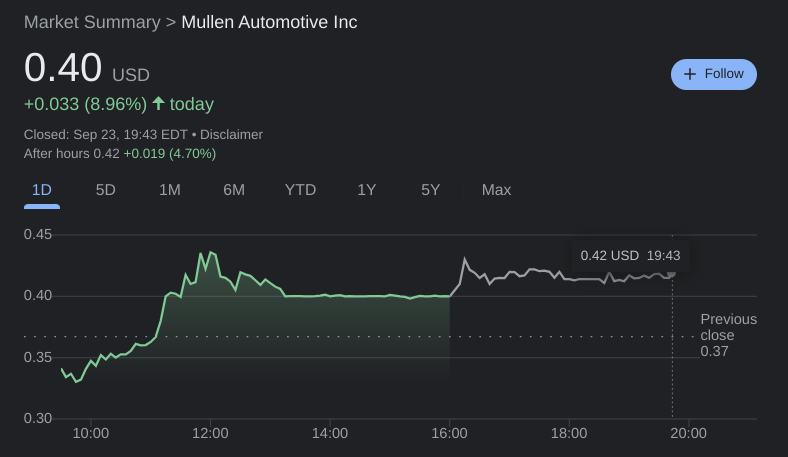

- NASDAQ:MULN gained 8.96% during Friday’s trading session.

- Mullen’s first specifications and details on the FIVE EV are impressive.

- EV stocks extend losses on Friday during broader market sell off.

NASDAQ:MULN snapped its recent losing streak and managed to close out the week on a positive note. On Friday, shares of MULN gained 8.96% and closed the trading session at a price of $0.40. All three major averages tumbled on Friday as stocks continued to sell off following September’s 75 basis point rate hike on Wednesday. It also marked the fourth consecutive losing session on Wall Street and the fifth losing week out of the past six. Overall, the Dow Jones hit a new 2022 low after losing 486 basis points, the S&P 500 fell by 1.72%, and the NASDAQ dropped lower by 1.80% during the session.

Stay up to speed with hot stocks' news!

Mullen did recently unveil some specifications for its long-awaited FIVE crossover EV model. While the nationwide tour will begin next month for Mullen, it did provide some preliminary figures for the powerful FIVE RS edition. These numbers include a top speed of 200 miles per hour, 1,000 horsepower in the engine, and acceleration of 0-60 miles per hour in just 1.9 seconds. These are some pretty powerful figures for the vehicles but one noticeably absent number so far is the price of the model. The FIVE RS will join the second leg of Mullen’s tour in 2023.

Mullen stock price

Electric vehicle stocks extended their declines on Friday and overall the sector put together a very weak and volatile week of trading. Industry leader Tesla (NASDAQ:TSLA) sank a further 4.59% as the fallout from its recent recall continued. Other EV stocks in the red included Lucid (NASDAQ:LCID) and Nio (NYSE:NIO), while Rivian (NASDAQ:RIVN) eked out a positive day of trading alongside Mullen.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.