- MULN stocks resumes decline and shed 7.14% on Tuesday.

- Mullen Automotive stock has a large short interest so could there be a squeeze coming?

- MULN stock still has not replied to accusations in the Hindenburg report.

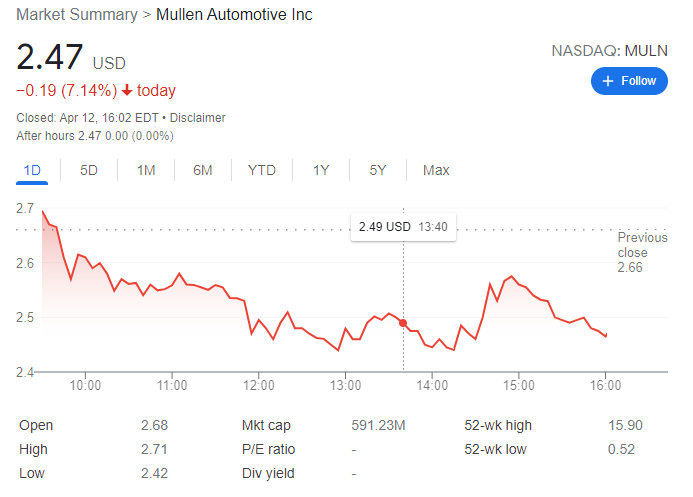

Update: MULN stock ended Tuesday at $2.47 per share, down 7.14% on the day. Wall Street kick-started the day with gains as US March inflation figures were less concerning than anticipated by the White House. The Consumer Price Index soared to 8.5% YoY, higher than the 8.4% expected and above the previous 7.9%. Likewise, the core reading printed at 6.5% YoY, slightly above the February reading at 6.4%. However, US indexes were unable to hold on to gains and closed the day with modest losses. The Dow Jones Industrial Average lost 87 points, while the S&P ended 14 points lower. The Nasdaq Composite shed 0.30%.

Additionally, government bond yields soared ahead of the opening, but eased after the release of US inflation data, stabilizing around their opening levels. The yield on the 10-year Treasury note currently stands at around 2.72%, after peaking at 2.836%. On the Russian-Ukraine crisis, news were discouraging. Russian President Vladimir Putin said that talks with Ukraine are in a dead-end, claiming that the latter has deviated from the agreements achieved at talks in Istanbul, Turkey.

Previous update: MULN stock keeps going through its rollercoaster ride inside a wide trading range on Tuesday. After rallying almost 6% on Monday, Mullen Automotive shares are down nearly 5% after the first hour of regular trading on Tuesday. Despite a relief rally on most equity indices after the US Consumer Price Index numbers came out missing the worse estimations, the electric-vehicle meme stock is going the opposite way in today's trading, down to $2.54 at the time of updating this post (14.43 GMT). Mullen Automotive is a penny stock and has been one of the favourite stocks of the retail-trading crowd in the past few weeks as they look for a short-squeeze, so expect volatility to continue.

Prior Update: MULN stock opens with its (by now) customary volatility on Tuesday. MULN shares opened at $2.68 before moving higher to trade up to $2.71 within the first two minutes of trading. MULN stock is searching for some form of stability and direction after the recent sell-off following Hindenburg Research's negative report. Some investors still hold out hope while others may be looking for a short squeeze in this small-cap name where the short interest does appear to be increasing. While the US CPI report just out does not directly impact MULN stock it does affect equity risk appetites. These have been solely focused on defensive names in advance of the upcoming Fed rate decision. Tuesday's CPI number was high but investors had expected as much and equities are currently on a relief rally. This should help the risker side of the market and may benefit MULN stock indirectly. At the time of writing MULN stock is now at $2.67 up 0.38%

MULN stock recovered quite a lot of ground on Monday as it closed up nearly 6% at $2.66. MULN shares had been under extreme pressure following the release of a report by noted short-seller Hindenburg Research last week. Mullen Automotive stock cratered but recovered some ground on Monday, here's why.

See the latest GGPI and Tesla (TSLA) stock news here

MULN stock news: Keeps rallying despite battery doubts

A Youtube interview circulating on Monday attempted to clarify some of the claims made in the Hindenburg report, especially those relating to the performance of its battery technology and potential range. To recap from the Hindenburg report: "We never would have said that. We never did say it and certainly wouldn’t have said it based on the results of testing that battery," according to the CEO who carried out the battery test, quoted by Hindenburg.

On Monday, however, the aforementioned Youtube video appeared to clarify those comments. Bitnile (NILE) CEO Milton Todd said in a Youtube Risk On interview that Bitnile had invested privately in MULN and remains invested in the company. He also addressed concerns over Mullen's electric battery range which Hindenburg aimed at. Biennale CEO Milton Todd Ault III interviewed EV Grid CEO, Tom Gage. EV Grid reportedly carried out Mullens battery test.

In the interview, Gage reportedly said that “the 600-mile number [is] a number that depends on how big the car is, how big the battery is and how efficient the drivetrain and aerodynamics are. So it’s quite possible to do it. Until it’s done under observed conditions you don’t know what you’re talking about. But if you put enough battery in a car, it can go 600 miles.” This does not exactly assuage any of our concerns over this issue. If you put enough battery in a car it can go 600 mils sounds dubious, to say the least. But Gage also said the battery was “very large in physical size" making one wonder if it is indeed practical for use in an EV although he did say the "capacity is legit." So more confusion then, rather than clarity.

Regardless, it was enough to send MULN stock higher and this move has carried on on Tuesday with another 2% added in the premarket. We should point out that the latest reports show Mullen Automotive has a large and growing short interest, reportedly at over 20%. There is the potential for a short squeeze which may also be behind some of the recent MULN stock recoveries.

MULN stock forecast: Breaking points to the current range at $2.06 and $4.21

$2.06 and $4.21 have been the key levels for MULN stock. $2.06 is the breakout level and where the recent spike to $4.21 began. Below there Mullen Automotive shares would be going back to sub $1. Breaking above $4.21 will see more momentum traders enter and the move could accelerate.

There is much more uncertainty surrounding this stock than is usual. It is highly volatile and the Hindenburg report carries serious questions that need to be clarified. So please manage your risk carefully. Speaking personally, I would not be tempted to enter either way. While the Hindenburg report may make some interesting points and tempt some to go short the volatility and ease with which one can get stopped out are too high here. MULN stock has a growing short float and has traded considerably higher in the past. This is a penny stock, a small-cap company so be warned.

MULN stock daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.