Mullen Automotive: The good news, the bad and the ugly outlook

-

Mullen Automotive released the results of the shareholder vote.

-

All measures were passed, the market moved higher.

-

The news is good but the outlook is still ugly and may keep the volatility high.

-

5 stocks we like better than Mullen Automotive

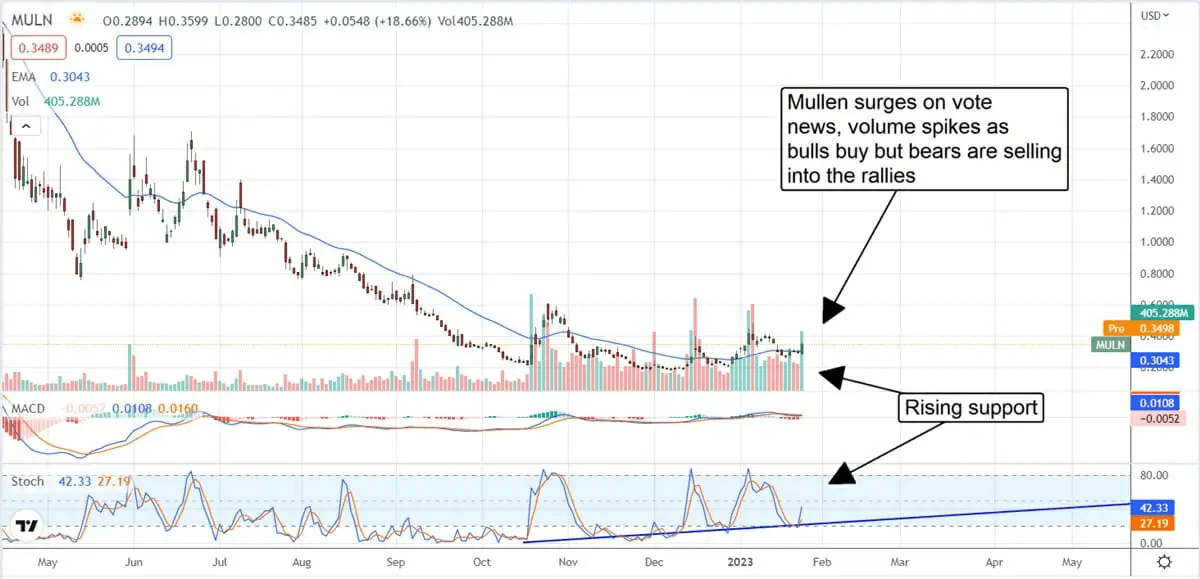

Mullen Automotive’s (NASDAQ: MULN) price action is heating up again, and the charts look as good as ever. The caveat is that short-selling and bearish activity is just as hot as ever and will likely keep the action volatile, if nothing else. The latest news from the company is the results of the shareholder vote which include approvals for all measures.

What this means for investors is a bucketful of possibilities that promise to keep the news interesting.

Mullen Automotive: The good news

Mullen Automotive announced the results of the shareholder meeting and vote, and the market cheered. The company has approved the reverse split and the increase in share count, which were the 2 most important actions on the roster. The reverse split may not even happen, but it is in place if the company can not get its share price back above $1.

Mullen has until March 6, 2023, to get the share back above the threshold and a potential extension that could push the date back until early September.

The hope is that increasing the share count will enable the company to raise money, capitalize production and begin producing cars before the deadlines are reached. In this scenario, the stock should be able to get above $1 on its own, and there are other potential catalysts.

Mullen’s I-Go is in Europe now, and the first sales are expected to be announced anytime soon. This won’t supply all the money the company needs but will put revenue on the books and act as a positive catalyst for share prices.

Mullen Automotive: The bad news

The bad news is that Mullen Automotive approved the increase in the share count. This boosts available shares from 1.75 billion to 5 billion, an increase of nearly 200%. As mentioned, this is good news because the company has an avenue to raise capital that is not linked to the debt market but is bad news from the shareholder perspective, as is the case with volatile penny stocks.

The increase in share count opens the door to significant dilution of value should the company sell even half of the new shares. At last look, there were 1.70 billion shares out so company sales of shares should be expected to begin in the “nowish” to “pretty soon” time period.

Mullen Automotive: The ugly outlook

As good as the story has been to date, Mullen faces its toughest time. It has to start production and deliver cars in the face of mounting oppression. The bears are selling into each and every rally and have increased volume steadily as the months go by. With the company on track to sell shares, the combined weight of short-selling and company sales could keep the price action capped if not moving lower in the near-to-short-term.

Marketbeat.com has the short interest listed at 13.83% via official channels, with volume up 30% from the prior month. Fintel lists the short interest at 14.8% (official), but the off-exchange short interest runs near 50%. That’s an incredibly high figure, and this is being done in dark pools, and why the recent shareholder petition to combat illegal short-selling was given to CEO David Michery.

The technical outlook: The bulls are gaining ground

As fierce as the battle is, the Mullen Automotive bulls are gaining ground. Support is rising in both the price action and the stochastic indicator, which shows a firm bottom has formed. This bottom is near the $0.20 level, so there is a high potential for near-term downside.

The upshot is that institutions, analysts and private investors are likely buyers at this level. Longer-term, it will come down to the news. The right “good news” will send the bears packing and let this stock shoot back up to where it should be trading which is in the low-single-digit dollars like other EV startups.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.