Mullen Automotive Stock News: MULN falls an unlucky 13% on Thursday

- Mullen Automotive falls 13% on Thursday to close at $1.24.

- MULN stock had risen earlier in the week on positive test results for its electric battery.

- MULN stock remains one to avoid in our opinion, but momentum players may be tempted.

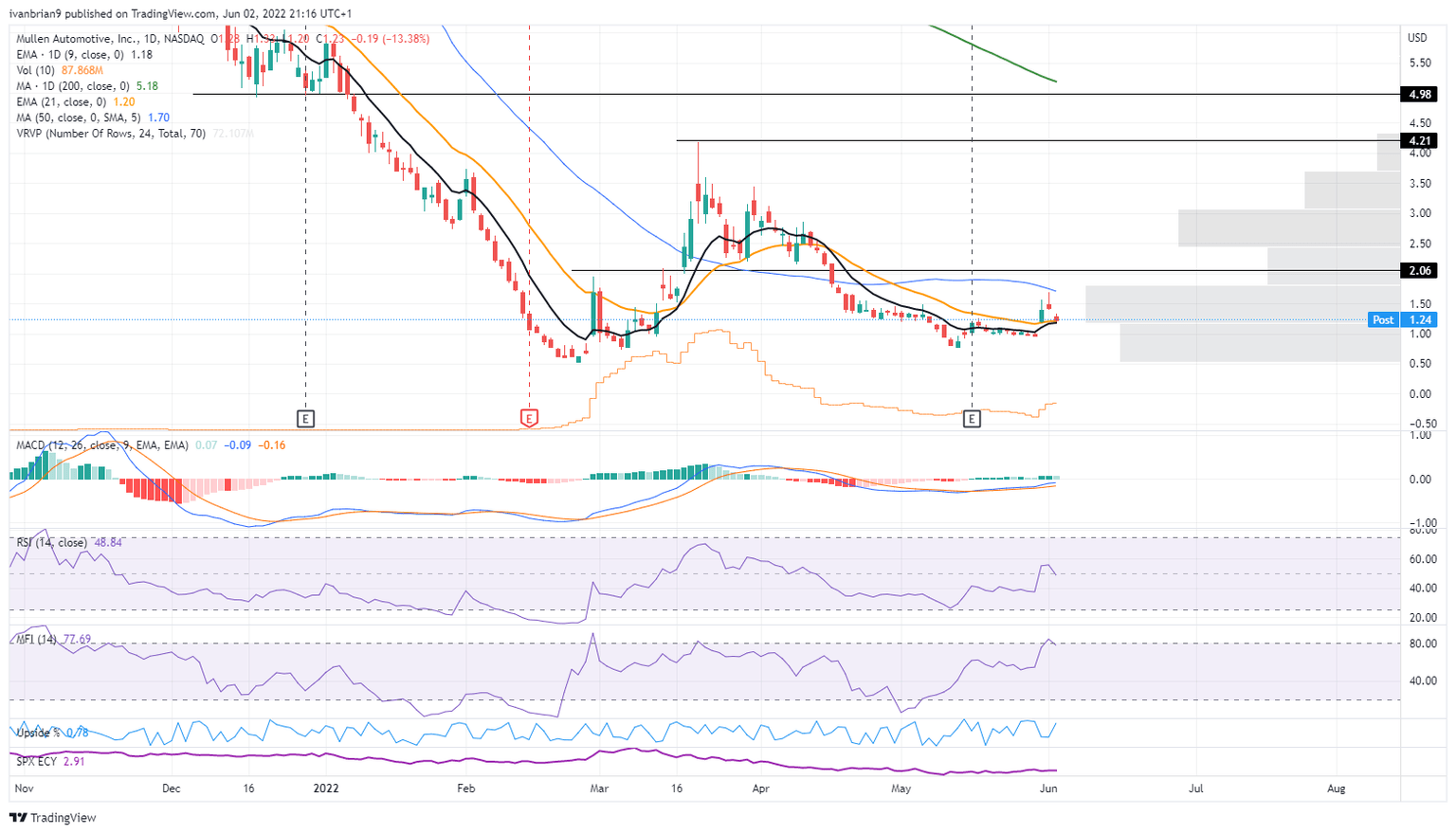

Mullen Automotive (MULN) stock has once again performed its usual party trick: the pump followed by the dump. MULN stock rose sharply earlier this week, moving from $1 to a high of $1.68 on Wednesday. We witnessed a few concerning signals late in the day on Wednesday that caused us to issue our strong warning: "The strong trend is over in our view, and it is time to take some risk off the table...Time to get out and stay out." We really could not have been more clear. Thursday saw MULN stock close at $1.24, and so while it remains above where it started the week we still have one day left that is not likely to be a positive one.

MULN Stock News: This one loves the pump and dump

Our negative bias toward this stock is well-established, and we cannot apologize for this. Fundamentally, the stock is on extremely shaky ground, and we doubt it will be in existence much beyond 2023. The company has been massively diluting shareholders and does not make any money. Automotive startups need hoards of cash, and cash is proving more expensive to come by. The share count has moved up over tenfold in the last few months. So this one is a pure momentum play, and knowing when to get in and out is key. This is not for the long term. There are many other EV makers out there, and many may also fail as credit conditions tighten. Those that survive are likely to have strong cash flow or already have manufacturing capabilities in place.

MULN Stock Forecast: More losses to come for Mullen

The move pushed higher on the back of a positive battery testing announcement. This indeed looks positive, but it is very early stage. Moving into the production phase means a lot more than a battery is required. Capital expenditure (capex) on a massive scale is needed for auto manufacturing. The short-term momentum has now dried up. This is a pattern with MULN stock. A few days of hype and a strong rally followed by a full 100% retracement and an actual move below the original catalyst price level. We expect more declines on Friday.

We have been generating quite a bit of comment for our strongly negative outlook on the stock. "Haters" is the most common moniker in the feedback! We always advise emotion is not your friend in trading. If you are emotionally attached to your position, then that is usually not a good sign. The name of the game is profits, plain and simple. Us being negative on the stock is not a personal insult, merely an educated opinion.

MULN chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.