Mullen Automotive Stock News: MULN CEO talks bullishly, says large company order imminent

- Mullen Automotive (MULN) stock spikes strongly again on Wednesday.

- MULN CEO David Michery appears at the Benzinga Listmaker EV event.

- Mullen CEO says a large company will be buying Mullen vans soon.

Mullen Automotive stock (MULN) managed to buck the trend seen in other meme stocks on Wednesday as it powered higher on the back of some positive news flow. MULN stock closed the regular session with a gain of 28.9% to reach $3.03. Other notable names in the meme space like AMC and GME fell sharply, while EV names Lucid (LCID) and Rivian (RIVN) were also lower by about 3% on Wednesday. MULN stock then was a strong outperformer, but why?

Mullen Automotive Stock News: CEO talks the talk

The reason for the pop in MULN stock on Wednesday was down to an interview given by Mullen CEO David Michel. He appeared on Benzinga's Listmaker electric vehicle (EV) event and was positive about the outlook for Mullen. He said the company had ensured they were not going to have any delays shortly. We assume this is referring to production as many EV makers are struggling with raw materials and supply chain issues.

Probably what grabbed the traders' attention though was this comment from him: "A fairly large company will be buying the company's van vehicles in the close future."

That certainly was positive, and traders rushed into the stock, sending it spiking higher. The CEO also mentioned that it was a Fortune 500 company, according to social media and some other news sources. Other sites are also reporting the deal is due to be announced in Q2. MULN stock has maintained the momentum and is ahead by another 8% in Thursday's premarket.

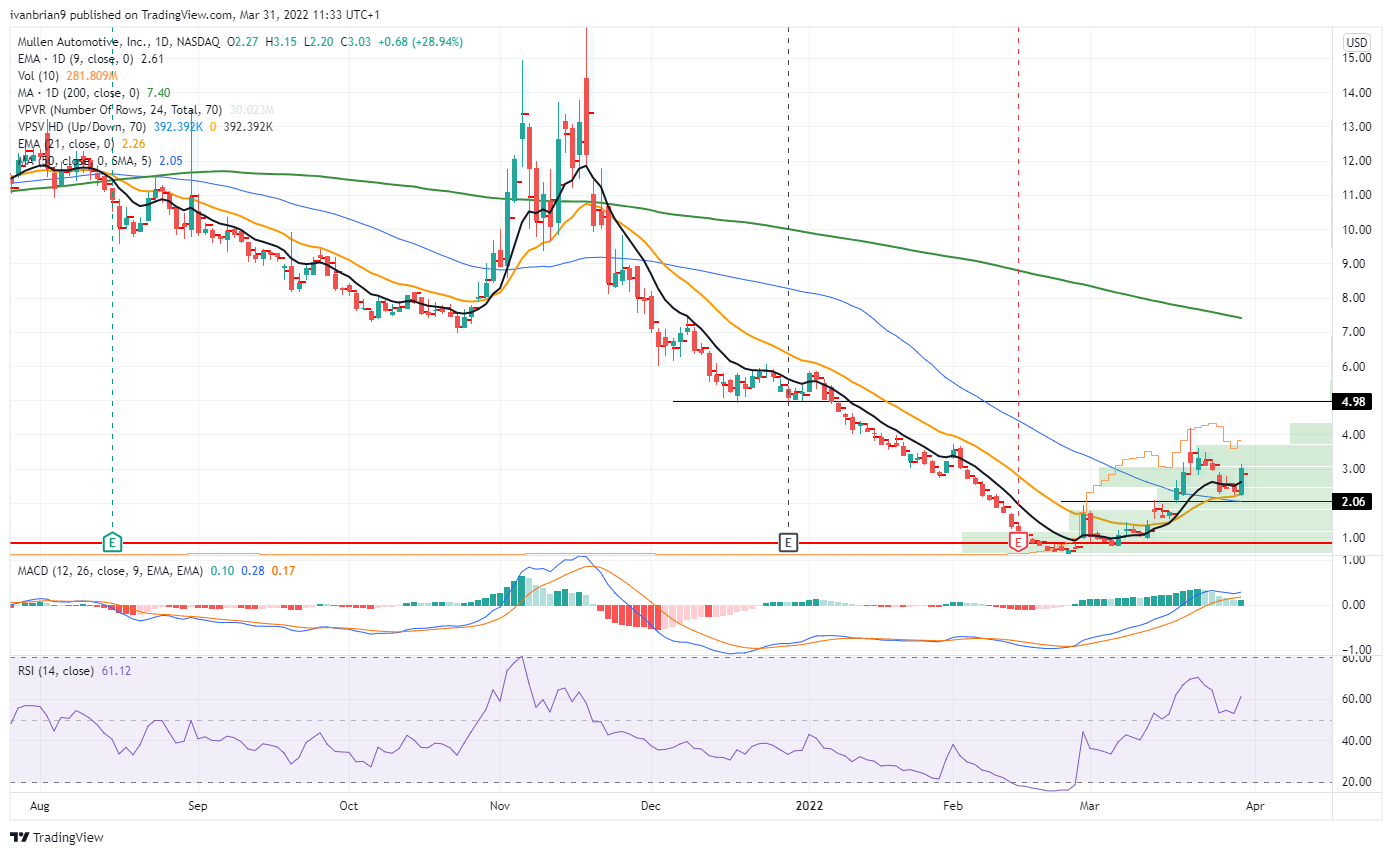

Mullen Automotive Stock Forecast: $2 must hold to test $4.98

We are not massive fans of technical analysis on something so volatile, but we can identify some key levels. The breakout took place once MULN stock broke above $2. So we need to hold above that level to maintain the momentum in the medium term. That could then set MULN up for a test of $4.98.

MULN stock chart, daily

On the short-term intraday chart below, $2.90 is the key pivot. All the volume on Wednesday was at this level and above. Breaking below probably means a sharp move to $2.60.

MULN stock chart, 15-minute

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.