Moderna Inc (MRNA) Stock Forecast: Surge gives investors a shot in the arm as it prepares to deliver 1 billion doses in 2021

-

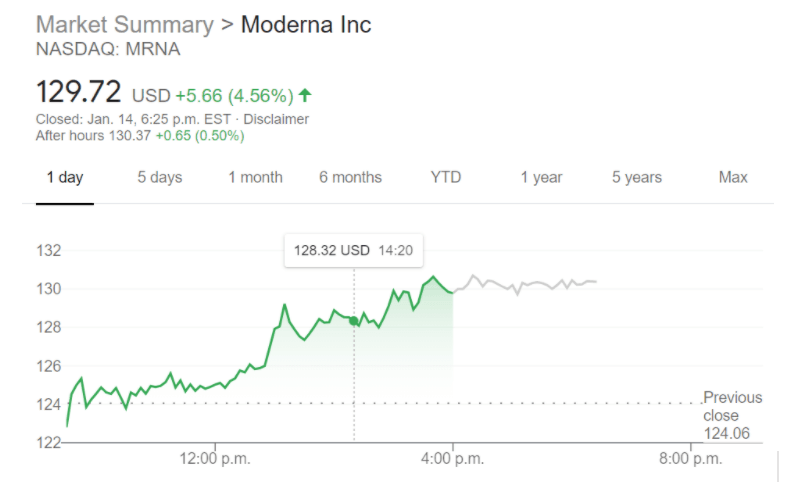

NASDAQ:MRNA gains 4.56% as broader markets rally on Biden’s stimulus optimism.

-

The Swiss government becomes the latest country to order the COVID-19 vaccine from Moderna.

-

Moderna announces three new vaccines for the seasonal flu, Nipah virus, and HIV.

NASDAQ:MRNA is riding high after CEO Stephane Bancel announced that the company is slated to distribute over 1 billion doses of its COVID-19 vaccine candidate by the end of 2021. Investors embraced the news as shares of Moderna rose by 4.56% on Thursday to close the trading session at $129.72 as it continues to climb back from the late year beat down it took as new strains of the novel coronavirus started to emerge. The stock price dipped close to $100 on December 31st, but has rebounded nicely in the first couple trading weeks of 2021.

Switzerland announced it is the latest Moderna client as the European nation ordered 7.5 million doses of mRNA-1273, as the country battles through a surge of the virus at the end of 2020. In other Swiss news, drugmaker Lonza is awaiting approval to begin making active ingredients for mRNA-1273 which could boost Moderna’s supply chain in Europe, which remains one of the hardest hit regions in the world.

MRNA stock price

Moderna also announced that it has three new non COVID-19 vaccines coming down their pipelines for HIV, the seasonal flu, and Nipah virus, which should be ready to enter Phase 1 of the clinical trials at some point in 2021. The vaccines are said to include components that will help fight against SARS-CoV-2 as well, which is the virus strain that results in COVID-19. Perhaps word of Moderna’s success is spreading as a recent poll in the United States shows growing support in receiving the vaccine after initially it was met with skepticism by Americans.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet