Mexican Peso recovers following Banxico official's comments

- The Mexican Peso has recovered some lost ground after comments from a Banxico official on Wednesday.

- MXN has lost ground after the IMF revised down their economic growth forecasts for Mexico.

- Banxico's Deputy Governor Heath says Q1 will be stronger than expected and normalising interest rates could take time.

The Mexican Peso (MXN) is recovering lost ground on Wednesday after comments from Banxico Deputy Governor Jonathan Heath suggested it would be a long wait before the bank could normalise historically high interest rates.

The expectation that interest rates may remain higher for longer – they are already at 11.00% – supports the Mexican Peso because higher interest rates tend to attract greater inflows of foriegn capital.

Mexican Peso gains a boost from Deputy Governor Heath's comments

The Mexican Peso gained a bump on Wednesday after the Deputy Governor of the Banxico suggested interest rates might need to remain high in Mexico in order to combat persistent inflation. He further added that Q1 2024 growth would likely be higher than the 0.1% growth seen in Q4.

Up until Heath made his views known the Mexican Peso had been trending lower in the majority of its most heavily traded pairs. This was due to a combination of factors, including the decision by the International Monetary Fund (IMF) to downgrade its economic growth forecasts for Mexico in 2024-2025, as well as fading Oil prices – a key export for the country.

The impact of stubbornly high inflation in the US and recent remarks from the Chairman of the Federal Reserve (Fed), Jerome Powell, that suggest the Fed may not cut interest rates until September (from previous expectations of June), were further factors posited as influencing the Mexican Peso’s reversal in fortunes.

Technical Analysis: USD/MXN reverses trend in the short-term

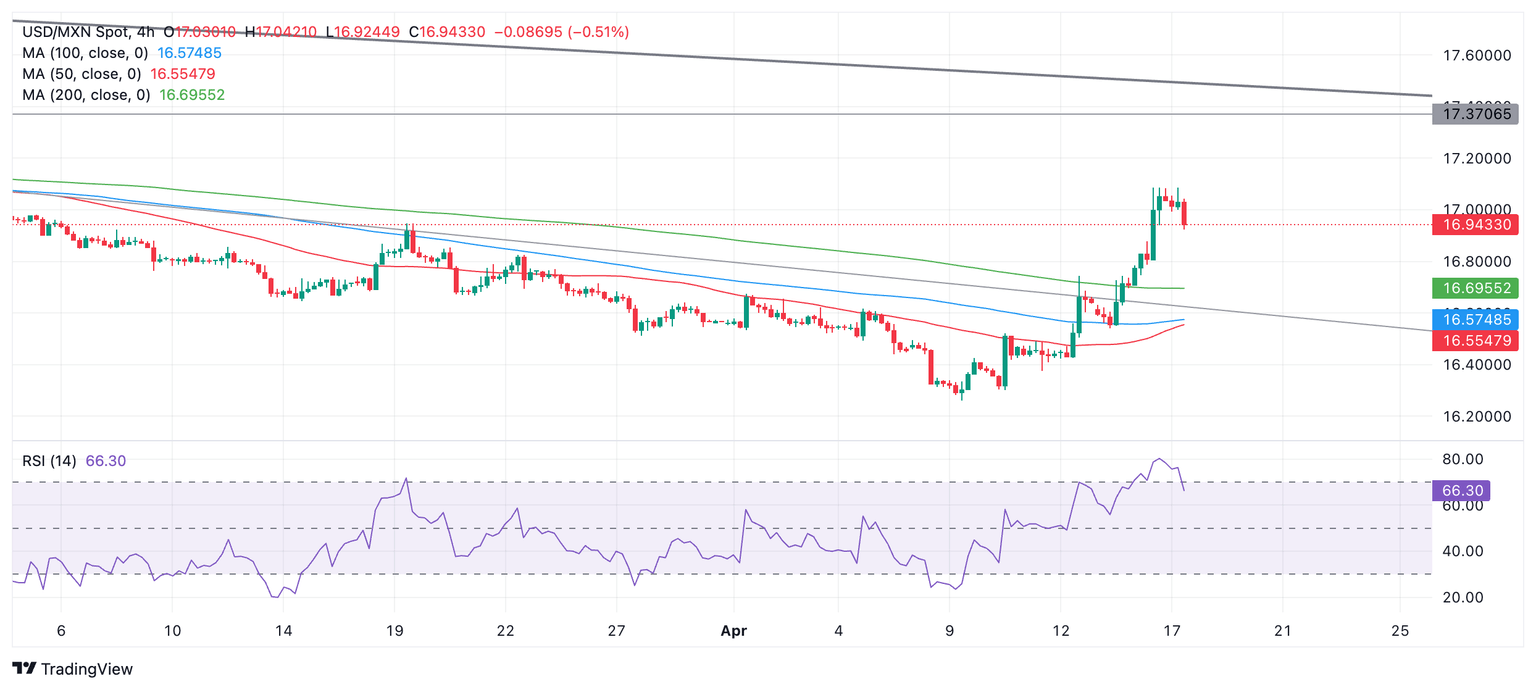

USD/MXN – the value of one US Dollar in Mexican Pesos – has probably reversed its short-term downtrend.

The peaks and troughs of price are rising on the 4-hour chart used by many analysts to assess the short-term trend. This suggests the pair is now in an uptrend, favoring bulls.

USD/MXN 4-hour Chart

One caveat to the bullish outlook is that the Relative Strength Index (RSI) is pulling back from overbought into neutral territory. Given price is also declining, the two taken together could be signaling the start of a correction. When the RSI moves out of overbought territory it is a signal for short-term time horizon traders to close long positions and open short trades.

The pair has now almost pulled back to the 50-day Simple Moving Average (SMA) at 16.82, and it is likely to encounter solid support there. Given the dominance of the short-term uptrend there is still the chance price could eventually recover and start going higher again.

A break above Tuesday’s high at 17.09 would indicate a continuation of the uptrend to the next target, possibly located at 17.17 where the 200-day SMA is situated, followed by resistance from a long-term trendline and resistance level at around 17.37.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.