Tapestry, Inc. (formerly: Coach, Inc.) is a multinational luxury fashion holding company based in New York City, USA. The parent company owns three brands: Coach New York, Kate Spade New York and Stuart Weitzman. The stock of the company being a component of the S&P500 index can be traded under ticker $TPR at NYSE. Currently, we see cotton turning higher. Also, other soft commodities are moving up. Therefore, Tapestry being a heavy weight in the textile market should be a great opportunity for investors to diversify their portfolio by indirect investement in the rising prices of particularly soft commodities.

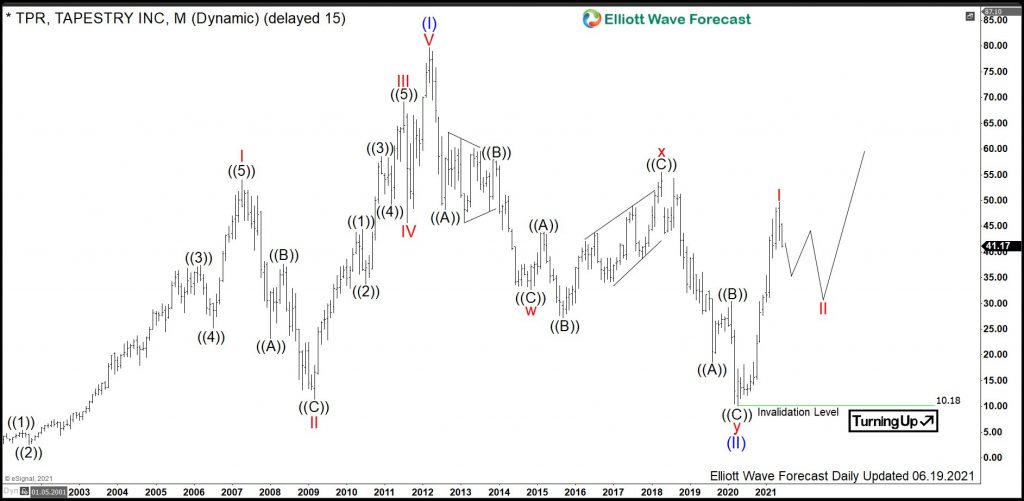

Tapestry monthly Elliott Wave analysis 07.03.2021

The Monthly chart below shows the Tapestry shares $TPR traded at NYSE. First, the stock price has developed a leading diagonal higher in blue wave (I) of super cycle degree. It has printed the all- time highs in March of 2012 at 79.70. From the highs, a correction lower in blue wave (II) has unfolded as an Elliott wave double three pattern. It has printed an important bottom in April of 2020 at 10.18. As a matter of fact, the stock price has lost 87% of its value in only 8 years.

From 2020 lows, a new cycle in wave (III) has already started and should extend towards 79.70 highs and beyond. Then, the target for wave (III) will be towards 89.90-139.21 area and even higher.

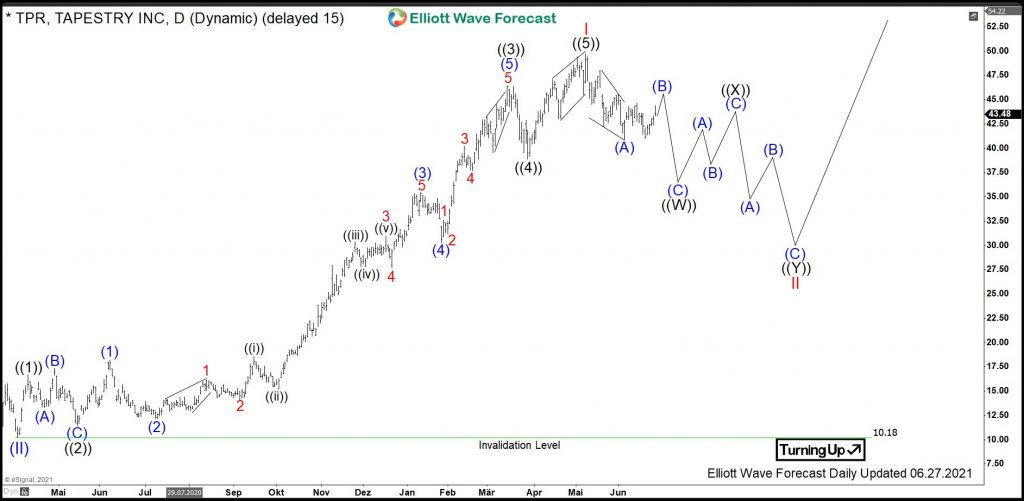

Tapestry daily Elliott Wave analysis 07.03.2021

The daily chart below shows the early stages of the blue wave (III). From April 2020 lows, $TPR has developed a textbook impulse higher in red wave I. It has ended in May 2021 at 49.66. From the highs, consolidation in wave II might have just started. Investors and traders can be looking to buy the pullback in 3, 7 or 11 swings against 10.18 lows targeting 89.90-139.21 area and even higher in the long run.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.