Interactive brokers: Interactive, but not attractive

Interactive Brokers (NASDAQ: IBKR) is the largest electronic trading firm in the US by total daily average revenue trades. It offers numerous asset classes, margin trading, research, and numerous other features. The stock price of the company surged during COVID-19 but has pulled back slightly ever since. Right now, we are apprehensive about the future growth potential of the company considering its current price.

Stay Home and Trade

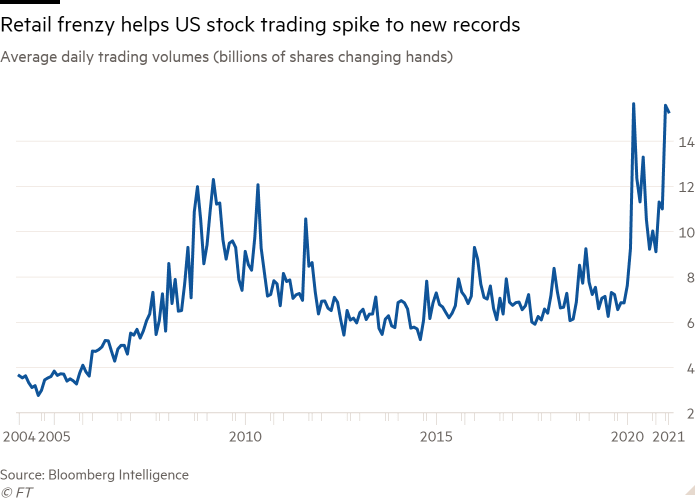

Average trading volume has skyrocketed in 2020 and 2021, with retail investors using online brokerages to invest their savings and stimulus checks.

With people being stuck at home during COVID-19, many turned to online trading. While the influx of retail investors often resulted in turmoil in the markets, one industry was sure to profit from this: Brokerages.

Interactive Brokers claims to be a zero-commission trading platform. This means that it does not charge its clients a fee. However, this is only true for certain types of trades and certain types of accounts. On many trades, Interactive charges its clients a fee, which is its primary way of generating revenue. The company also allows its clients to trade forex and other assets on margin and earns revenue through the interest rates on the loans they write.

During COVID-19, Interactive Brokers experienced an increase in activity the likes of which it had never seen. The platform went offline during December 2020, owing to an insane amount of activity overloading their servers. Despite that, the company is helped by its reputation and intense marketing campaign, which has led to a massive spike in total trade volume during FY21. By November 2020, the company had 1 million active accounts, over 50% more than it had the same time in 2019. The platform was also executing over twice the trades compared to the previous year.

As such, it is no surprise that consensus estimates show the company generating a revenue of over $2.7 billion for FY21, compared to just over $2.2 billion in FY20.

This is Where the Good Times End

While it is clear the company is doing exceptionally well compared to previous years, one fact makes us apprehensive: We believe that all of it has already been priced in the stock. On April 1, 2020, the company was trading at $41. At the time of writing, it’s trading at $63 and change. Because the company has grown by roughly 50% and the stock price has experienced a similar rise, we are doubtful whether the company can continue on this growth trajectory.

The thing is that many of the new clients that began using Interactive Brokers did so because they had nothing to do during the pandemic. In fact, many brokerages referred to the increase in investments on their platform as ‘play money’, indicating that the new retail investors were not focused on the long-term. The brokerages themselves understand this and are struggling to retain clients as market volatility subsides.

Indeed, consensus estimates show a decline in revenue in FY22 of over $100 million, indicating that new traders will have less time to engage in trades once we adequately recover from the pandemic. Operating and net profit are also expected to be down in FY22. We have reason to believe that the estimates are accurate.

What the Future Holds

We think that the company is not well-positioned in the case of a market downturn. Right now, we are in a booming stock market, with indexes crossing all-time highs once every few months or so. The rising market also encourages new retail investors to trade, expecting to make a quick profit. However, we are unsure how Interactive would perform during a bear market, especially considering that many new users may quit the platform after losing money (as we saw in the dot-com crash).

Companies like Robinhood threaten Interactive’s position as a top brokerage.

We must also point out the increase in competition that Interactive now faces. With companies like Robinhood (NASDAQ: HOOD) picking up steam due to their ease of access, it will be tough for companies like Interactive to compete for new investors. Robinhood offers a much simpler platform. While that may not be good enough for professional traders executing advanced trading strategies, it is suitable for new investors looking for an easy-to-use app. Robinhood recently went through an IPO, and young, energetic startups like them are bound to be a problem for older firms like Interactive.

Basically, it is doubtful that the company gains new users at the same rate it gained them in 2020. As such, it is challenging to recommend Interactive Brokers at this point. The company would be an attractive buy at a lower price, but the stock seems at worse overpriced and at best adequately priced right now.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Baruch Silvermann

The Smart Investor

Baruch Silvermann is a personal finance expert, investor for more than 15 years, digital marketer and founder of The Smart Investor.