- Inovio Pharmaceuticals Inc. (NASDAQ: INO) partially fades Tuesday’s advance.

- NASDAQ: INO faces the next resistance at $25.00.

Following Tuesday’s strong advance, shares of Inovio Pharmaceuticals Inc. (NASDAQ: INO) are now shedding part of that move and return to the sub-$24.00 area during the premarket trading hours on Wednesday.

Further out, and despite Tuesday’s uptick, NASDAQ: INO still remains in the negative territory this month following gains of around 82% during June. The biotech company is expected to start the Phase 2/3 of its study for a COVID-19 vaccine (INO-4800) this summer (pending FDA approval).

In the meantime, the broader US reference stock indices – DowJones, NASDAQ and S&P500 – are posting modest gains ahead of the opening bell in Wall St, always gauging the ongoing economic recovery against the relentless surge of infected cases of coronavirus in the US economy and fresh outbreaks around the world.

INO Stock Quote

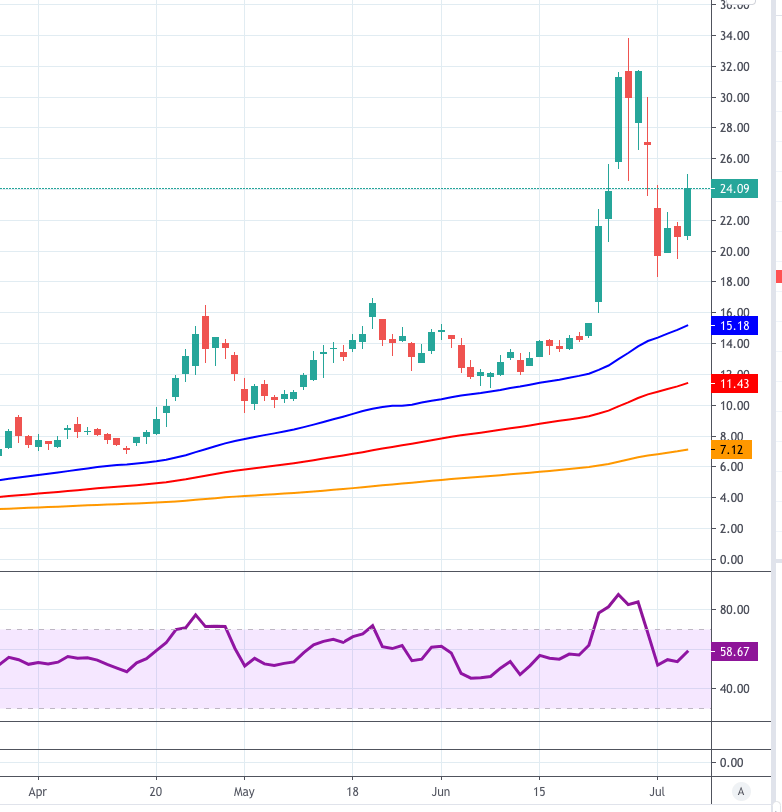

As of writing NASDAQ: INO is losing 3.69% at $23.20 and faces the next support at $16.92 (monthly high May 20) seconded by $15.18 (55-day SMA) and finally $11.13 (monthly high Jun.8). On the upside, a surpass of $24.99 (weekly high Jul.7) would expose $33.79 (monthly high Jun.23) and then $40.00 (high September 2000).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.