Greenidge Generation Holdings (GREE), Support.com (SPRT) Stock News and Forecast: Why is GREE down?

- GREE shares continue to collapse after the merger deal with Support.com (SPRT).

- GREE stock falls over 20% on Monday.

- Equity markets suffer, but retail names really fall as volatility is high.

GREE shares continue to make a name for themselves for all the wrong reasons as the calamitous fall continues on Monday. Things were already bleak for those long from the old SPRT ticker, but since GREE took over things have gone from bad to worse. GREE fell another 22% on Monday to close just over $30. GREE peaked at $60 last week and so had lost half of its value in just four trading sessions. What investors and traders must be wondering is how much more pain is to come?

GREE stock news

Just as a back story, GREE was formed as Greenidge Generation Holdings took over Support.com. Support.com had traded under the ticker SPRT and was a meme stock favourite with a large retail following enthusiastically discussing the stock on social media. SPRT stock had exhibited huge price swings just as with a lot of other retail or meme names. Back in March of this year is when things started to get interesting and when retail traders started to really notice the stock. The deal with Greenidge was announced in March. Support.com was a good fit for retail traders as it was a facilitator of remote working solutions, which grew in popularity during the pandemic. However, Support.com is a much smaller entity despite having a public listing.

After the merger, Support.com became a small part or subsidiary of Greenidge. SPRT shares spiked on the announcement of this deal back in March but went quiet again until retail interest appeared to pick up in August. SPRT stock was circulating around various social media chat sites as the short interest was high, meaning the retail traders decided to try and instigate a short squeeze. This has obviously worked well in other meme names such as GME and AMC, but SPRT was not exactly in the same situation. SPRT stock was to become a much smaller piece of the overall GREE company. There have also been valuation concerns that the SPRT spike had put a much too high valuation on the combined GREE company. Investors sold as a result. Usually in a merger or takeover, positions in the old ticker are rolled into the new one.

GREE stock forecast

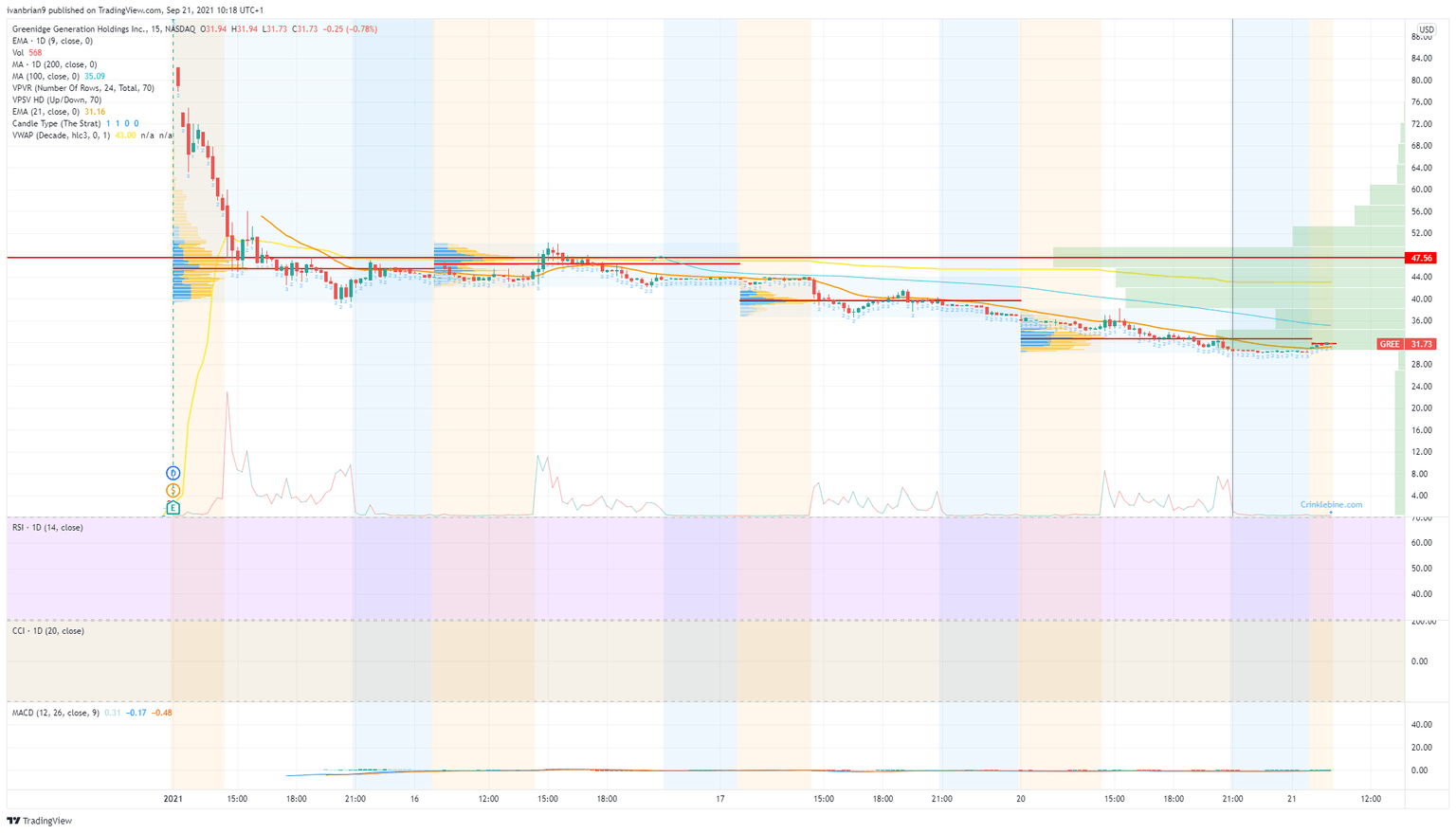

As we can see from the chart below, the point of control since GREE launched is at $47.56 with the Volume Weighted Average Price (VWAP) just below at $43. This is a volume resistance then as most of the volume has been here. There is not much historical data to look through for the chart otherwise, and the volatility makes any analysis rather difficult. Please use risk control in all names, but particularily one as volatile as this.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.