Gores Guggenheim Stock News and Forecast: Polestar stock remains hot after Superbowl ad

- Gores Guggenheim remains on top of the charts for social media searches.

- Polestar stock is also in vogue as GGPI is taking Polestar public via SPAC deal.

- Polestar shares see a massive spike in interest after the Superbowl ad.

Gores Guggenheim SPAC, the future Polestar stock, remains one of the most trending names on the various social media sites after its Superbowl ad on Sunday. Investors' love for EV stocks may have waned in 2022, but the sector is not dead and buried. Yesterday proved that fact with some strong rallies from Tesla (TSLA) stock, +5%, Rivian (RIVN) stock, +6%, NIO, +8%, and Lucid Group (LCID), +5%. This was a strong outperformance versus the NASDAQ, which closed up by 2.5%. Gores Guggenheim (GGPI) stock closed Tuesday just under 4% higher at $11.49.

Polestar debuted an ad during the Superbowl poking fun at Tesla and Volkswagen. Gores Guggenheim is taking Polestar public via a SPAC deal that is due for completion in the first half of 2022. Polestar is backed by Volvo and Geely of China. It produces Scandanavian inspired sleek electric vehicles akin to Volvo.

Gores Guggenheim Stock News

Polestar stock still does not have a ticker as far as we are aware, but GGPI remains in the news. The Superbowl ad promised no dieselgate and no conquering Mars. A dig at rival VW and Tesla. Tesla CEO Elon Musk appeared to take it in his stride and responded with a laughing emoji tweet. Apart from that though, recent news flow has been light.

One piece of news this morning says that Polestar will debut a bonded aluminum platform for the latest Polestar 5 GT in 2024. According to InsideEVs.com, "Exclusive to Polestar, the brand-new, bespoke platform has been developed in-house by over 280 engineers from the company’s UK R&D team based in Coventry, England. This team previously worked on projects such as Formula 1 race cars, low-volume vehicles and sports cars. Polestar has chosen bonded aluminum, because it is lightweight and rigid."

So far, Polestar is relatively rare in the US but is more widespread in Europe and the UK. The link with Volvo gives Polestar a huge advantage over new entrants Lucid (LCID) and Rivian (RIVN). It appears from the commentary that Polestar will piggyback on Volvo's delivery and sales network and does not have to build these up from scratch. Also, it will likely use Volvo's service network, again another huge advantage.

Gores Guggenheim Stock Forecast

$10 is obvious support. SPACs nearly always have a $10 cash floor, which is returned to investors in the event of a target failure. We can see that in the chart with $10 showing the largest amount of volume. Straying too far away is always risky. When investing in a SPAC, look to get in as close to $10 as possible as that lessons your downside. Recent super spikes in other SPAC deals have driven up return expectations to unrealistic levels. Witness Lucid Group also going public via SPAC and trading up to near $60. Crazy stuff, and at the time it was hard to argue with the enthusiasm and momentum.

Now markets have returned to some form of reality, meaning more analysis must be done. Trading on pure momentum can be profitable if done correctly, but knowing when that momentum has stalled is key. In the case of EV stocks, the macroeconomic backdrop has turned against them. For at least the next quarter, the sector is likely to struggle.

That does not mean some strong momentum rallies cannot happen. We witnessed one yesterday. It is important to recognize the signs. For us, we look to safety assets: the dollar, gold, bonds. If all three are rallying, then it pushes the risk-reward for high-risk growth stocks to negative. Yesterday we saw a relief rally, so getting in quick can reap some tidy profits.

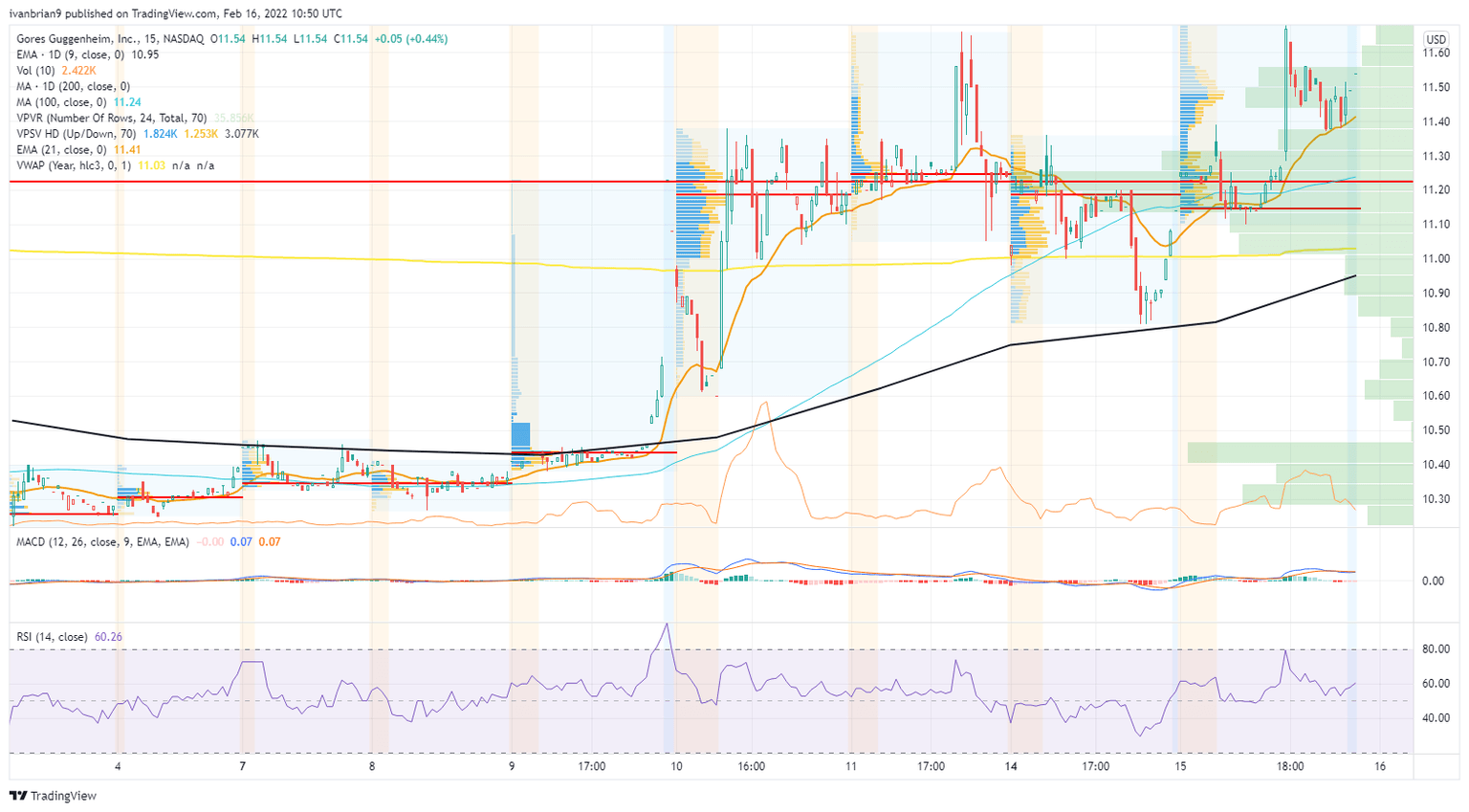

For GGPI, look at the 15-minute chart. The recent volume has been just above $11. There is a volume gap below $11, so beware. Prices can move quickly through low-volume areas. What is obvious is that volume picks up again near $10, the cash level.

GGPI chart, 15 minute

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.